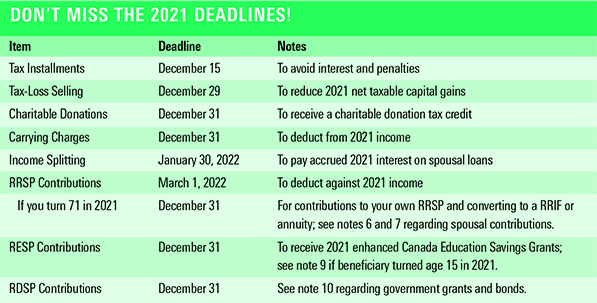

With December upon us, here are a number of tax considerations and deadlines to remember for the 2021 tax year. Please note that December 31 is a Friday this year.

Payments, Expenses and Other Transactions

1. Tax-Loss Selling

Tax-loss selling entails selling investments with unrealized capital losses before year-end to offset capital gains realized during the year. To ensure that your capital losses can be reported in the 2021 tax year, trades on Canadian securities exchanges must be placed no later than December 29, 2021, as trades typically take two business days to settle. Different dates may apply to foreign exchanges.

Beware of “superficial loss” rules. The capital loss on an investment will be denied if you buy an identical investment during the period that begins 30 days before and ends 30 days after the sale settlement date and you still own that investment at the end of the period. These rules also apply if the identical investment is purchased by or transferred to your RRSP, RRIF, TFSA, spouse, or a company controlled by you or your spouse.

If you are caught by the superficial loss rules, the denied loss amount is generally added to the adjusted cost base of the identical investment purchased, in essence deferring the loss until the ultimate year of disposition.

Any unused capital losses in 2021 can be carried over to offset capital gains from the three preceding years (i.e., 2020, 2019 and 2018) or in any future year. While this strategy may be advantageous from a tax perspective, ensure that tax-loss selling makes sense from an investment perspective as well.

2. Charitable Donations

The first $200 of annual donations are eligible for a 15% federal tax credit, plus applicable provincial credit (5.06% in BC). The federal donation tax credit increases to 33% to the extent that the individual has taxable income in the highest tax bracket. For example, any portion of donations over $200 that were made from income over $216,511 (federally) and $222,420 (provincially) for a BC taxpayer in 2021 can receive combined tax credits of 53.5%. Otherwise, donations in excess of $200 are eligible for a 29% federal tax credit which, when combined with the applicable provincial tax credit, can result in tax credits worth between 43.5% and 50.0%.

Charitable donations can be made “in kind” by donating eligible securities. Capital gains arising on donations of eligible securities are non-taxable, and the donor still receives a donation tax credit for the market value of the donated securities.

3. Carrying Charges

Investment-related expenses, such as fees to manage non-registered accounts and charges and interest paid on money borrowed for most investment purposes (other than in registered accounts) must be paid by December 31 to be deductible in 2021.

4. Income Splitting

The deadline to pay 2021 interest on spousal loans is January 30, 2022. This should not be confused with pension income splitting rules, which allow recipients of eligible pension income to allocate up to 50% of such income to a spouse or common-law partner for tax purposes. Eligible pension income includes payments from a registered retirement income fund (RRIF) and life income fund (LIF) where the account holder is 65 years of age or older at the end of the year. It also includes life annuity payments from a registered pension plan at any age.

5. Capital Gains

If the capital gains inclusion rate is raised from 50% to 75%, as has been speculated for a number of years, this could impact investors such as those holding securities in non-registered accounts. While realizing capital gains in 2021 could reduce exposure to potentially higher future inclusion rates, ignoring potential transitional provisions such as grandfathering gains accrued to a certain valuation date, deferring capital gains and the resulting taxes to a future year may be appropriate for clients with longer investment horizons.

To learn more about factors to consider when deciding whether or not to take any pre-emptive actions in your portfolio, a recorded presentation is available on our website.

Contributions to Registered Plans

6. Registered Retirement Savings Plans (RRSPs)

The maximum RRSP contribution limit for 2021 is $27,830. If you contribute to a spousal RRSP, making a 2021 contribution by December 31 reduces the income attribution period for that contribution by one calendar year, versus waiting until 2022. If you have a considerable amount of contribution room or if you expect to be in a higher tax bracket in the near future, consider making the maximum contribution this year, but deduct the contribution over multiple years, depending on your expected taxable income and credits.

7. RRSP Contributions After Age 71

Although you can no longer contribute to your own RRSP after December 31 of the year in which you turn 71, you can contribute to a spousal RRSP if you still have contribution room and your spouse or common-law partner is not older than 71 in the year of contribution.

8. Tax-Free Savings Accounts (TFSAs)

There is no deadline for TFSA contributions. You must reach the age of majority (19 in BC) to open an account; however, the accumulation of contribution room starts at age 18. Unused contribution room is carried forward to future years.

If you were eligible for a TFSA in every year since 2009 but have never contributed to one, you may have up to $75,500 in TFSA contribution room available for 2021.

If you plan to withdraw from TFSAs in the near future, consider making the withdrawal in December 2021, rather than in 2022. Since TFSA withdrawals increase your contribution room the following calendar year, this will enable an early re-contribution, as early as January 1, 2022, rather than having to wait until 2023.

9. Registered Education Savings Plans (RESPs)

The federal government provides a 20% Canada Education Savings Grant (CESG) of up to $500 annually ($1,000 annually, if catching-up past unused CESG room) for beneficiaries age 17 or younger at the end of the calendar year, up to a lifetime limit of $7,200 per beneficiary.

If your child turned 15 in 2021 and you have not contributed a minimum of $2,000 or at least $100 per year in any four years to the RESP, then December 31, 2021, is your last chance to contribute enough funds to maintain CESG eligibility on future contributions in 2022 and 2023 (ages 16-17).

The enhanced CESG (eCESG) is available to moderate-income families on the first $500 of annual contributions. Since eCESGs cannot be carried forward, contribute by December 31, if eligible.

10. Registered Disability Savings Plans (RDSPs)

RDSPs are tax-deferred savings plans that you can use to help provide long-term savings for an individual who is eligible for the disability tax credit. Lifetime contributions of up to $200,000 can be made by anyone until the beneficiary turns 59, but the contributions are not tax deductible.

The federal government provides assistance in the form of Canada Disability Savings Grants (CDSGs) and Bonds (CDSBs) until December 31 of the year in which the beneficiary turns 49:

- CDSGs up to $70,000 are provided on a matching basis, based on the contribution amount and the beneficiary’s family income, subject to annual limits.

- CDSBs up to a lifetime limit of $20,000 are provided to low-income beneficiaries. No contributions are required to receive the bond, subject to annual limits.

Interested persons should consider opening/contributing to an RDSP by December 31 in order to receive government assistance for the current year and up to 10 previous calendar years, particularly if the beneficiary is age 49 by December 31, 2021.