What does it take to be an Olympian?

by Shelly Appleton-Benko | December 10, 2013

On Sunday, we had the good fortune of hearing Lynn Kanuka-Williams speak at the BC Sports Hall of Fame.

Lynn spoke about her Olympic experience in the 1984 Olympic Games in Los Angeles where she secured a bronze medal for Canada. It is amazing to hear how a small town girl from Saskatchewan pursued her dream, running one mile at a time, and is now giving back to our Lower Mainland community, teaching people of all ages to do the same.

Whether you are a runner or an investor, the same principles apply… never lose sight of your goal and enjoy the run along the way.

Thanks Lynn for the inspiration.

(+ click the image to enlarge)

Money Muscle

by Shelly Appleton-Benko | December 5, 2013

In 2014, consider upping the ante and increasing your money muscle. Challenge yourself like never before and make taking control of your finances a priority. Don’t wait until the clock strikes 12 on December 31st to make the change. Here is a list of some of the changes that can increase your investment power.

1) Contribute your maximum RRSP contribution in 2013 and maximize that tax deduction!

2) Make those lump-sum mortgage payments and pay off any mortgage that does not have tax deductible interest.

3) Share your financial plans with your professional advisory team (which may include an accountant and financial advisors) and possibly your family. Let them know you are ramping up your game plan. Ask them for ideas on how to assist you in achieving your goal.

4) Consider your current investments. Are they meeting your objectives?

5) Reduce the amount of money you spend on “stuff” and start building your wealth. Consider investing in quality companies that return dividends back to your accounts and pay yourself first.

2013 has been a fabulous year! Odlum Brown Limited has a rich 90-year history of serving clients and continues to be one of B.C.’s most respected investment firms. If you would like to learn more about our investment philosophy, please give me a call. If someone you know may be interested, please pass along my information.

Mom, where are the keys?

by Shelly Appleton-Benko | November 26, 2013

Where did you pick up your financial savvy? Was it from a family member? At school? Or was someone influential in your life?

November is Financial Literacy Month, and I would like to highlight Junior Achievement of Canada, one of the largest youth financial educators in the country.

Over the next two weeks, it will be my turn to give back to the next generation as I work with Junior Achievement of Canada to donate part of my work day to teaching Grade 6 and 7 students the basics of business finance. This week, I am working with 30 students who are interested in starting their own businesses, such as lawn mowing or babysitting. I will help them learn about what it takes to make it happen.

If you are an educator or a parent of children who you think could benefit from some financial insights at a young age, visit Junior Achievement of Canada. Educating our youth about financial literacy takes time and patience, but it really is the ‘key’ to lifelong financial success.

Top Five Tips for Year-End Financial Planning

by Shelly Appleton-Benko | November 14, 2013

1. Topping up your TFSAs – Tax-Free Savings Accounts are available for any resident 18 years1 or older in Canada and provide the opportunity to invest $5,500 per year. The account grows tax-free regardless of whether the growth comes from capital gains, interest and/or dividend income!

2. Crystallize capital losses – End the love affair with that stock tip you received from your brother’s dentist. If your ship didn’t come in and you wouldn’t buy the stock again today, it is time to sell. The loss can be carried forward indefinitely on your tax return so all is not lost. The last day for tax-loss selling in Canada is December 24th, 2013.

3. Pay it forward – Make a donation to a registered Canadian charity before December 31st and maximize your tax credits. The more you give, the bigger your tax credit. Cumulative donations of more than $200 are eligible for a combined federal and BC tax credit of 43.7% (provincial rates vary). If this is your first time donating, you may be eligible for the First-Time Donor’s Super Credit! Remember, donating stocks with a capital gain means that you avoid paying the tax on capital gains and the maximum donation is up to 100% of your net income.

4. Maximize the benefits of compound interest by contributing to your child’s RESP account now. Take full advantage of the Canadian Education Savings Grant as well as the tax-deferred growth of investments held within these plans. The annual contribution of $2,500 yields an instant 20% return by way of the government grant. Don’t forget that if your child turns 17 this year, this would be their final year to be eligible for the grant.

5. Will you turn 71 this year? This is the year to convert your Registered Retirement Savings Plan (RRSP) to a Retirement Income Fund (RIF). If you have unused contribution room, be sure to make a final contribution to your RRSP account by December 31st, 2013.

Shelly

1 The accumulation of contribution room for a TFSA will start at age 18. However, the age of majority is 19 for residents of British Columbia which may delay the opening of a TFSA.

The Flintstones or The Jetsons?

by Shelly Appleton-Benko | November 5, 2013

Both were great shows, carrying out the same day-to-day routines using humour. The Flintstones was set in the Stone Age; the Jetsons in the Space Age. Someone recently asked – which one are you? Do you e-mail? Are you on Facebook, Instagram, LinkedIn? Or, is it just not for you?

The way the world is communicating is changing. If we exclude ourselves from the technological revolution that is currently underway, we may miss important opportunities to communicate with each other and our kids, learn about cultural shifts and generally stay in touch with the next generation.

We invite you to visit Odlum Brown’s Community Facebook page which keeps you up-to-date with the firm’s commitment to programs and events around our community.

We invite you to visit Odlum Brown’s Community Facebook page which keeps you up-to-date with the firm’s commitment to programs and events around our community.

As well, the firm has just launched its Twitter page at @Odlum_Brown.

As well, the firm has just launched its Twitter page at @Odlum_Brown.

Check them out!

Shelly

P.S. I am LinkedIn! If we have not already connected, let’s link: Visit my LinkedIn Profile

Tying the Knot

by Shelly Appleton-Benko | October 31, 2013

Are you getting married? Maybe you or someone in your life is finally ready to tie the knot?

Recently, I met with a couple who are at a crossroads in their life. They are moving ahead with their relationship and need to consolidate their finances.

There are some definite steps to take with regards to your finances. Firstly, be honest with each other about all the assets and liabilities that you both have. List out all the investments and the credit card bills, and decide how to close the gap, if any, between the accounts.

If one of you is carrying credit card debt and paying 20 per cent interest, and the other is saving at one per cent in interest, there is a disconnect. Have the conversation about your “team” strategy. All household members need to be on the same page with regards to the strategy and savings/spending plan. Everyone should feel like they are a part of the plan and working towards financial security.

Lastly, consider the process of building a plan as a slow, methodical train. Understanding the financial components of your new life together is essential to keeping the train moving and accelerating towards your goals. If you are overwhelmed with the process, call us and let us assist you in getting on the right path.

Inspired

by Shelly Appleton-Benko | October 23, 2013

Giving back to our community has always been a part of our business philosophy. As parents, it is important for us to involve our children in making a difference too. We support a number of local, regional and international efforts, both with our time and charitable contributions. (There are so many worthy causes, it’s difficult to select only a few!)

Our team, together with our children, had the opportunity to attend We Day on October 18. This initiative is put on by Free the Children, an international charity that educates and engages youth to become agents of change. We Day is a celebration of those efforts. Hearing from the likes of Martin Luther King III, Spencer West and Molly Burke – we were inspired by their stories of generosity and the will of the human spirit.

As some of you may know, in March, I will be travelling with my family to Kenya to assist in building a school in Bogani. We are looking forward to experiencing firsthand how our efforts can assist others and inspire the next generation.

We are fortunate to live where we live, and thankful for the opportunity to work with such great clients.

Shelly P.S. On a business note; If you are interested in learning more about charitable giving as part of your estate planning efforts, give us a call.

To Spend or Not to Spend?

by Shelly Appleton-Benko | October 15, 2013

“Bucket List” was a great movie. I have seen it twice, and yes, it made me think about all the things that I would like to experience during my lifetime.

However, what’s easy to forget is that we can’t predict when we are going to leave this Earth, or how long we need to make our money last. That is why we must SAVE some of our earnings each year for the future. The magic fairy doesn’t swoop down and take us away to an all-inclusive nursing home (those places are expensive!); while staying in your own home, can sometimes be even more expensive.

So before you say, “I just need to cross this one thing off my bucket list,” make sure that you have enough savings set aside to take care of future expenses. We should all know whether we can afford to spend or not spend. If you are under 50 years of age, and you aren’t sure if you have enough in the savings department, give us a call and we can get started on planning your financial future.

Shelly

Now what, Washington?

by Shelly Appleton-Benko | October 3, 2013

There has been a lot of discussion in the last few days on the U.S. Government Shutdown. With his permission, I am passing along the recent reassuring comments on the situation from our Head of Investment Research, Murray Leith:

Government Shutdown Doesn't Alter Our Positive View

The wealthiest Americans got to where they are by owning great businesses. They don't all of a sudden react to headlines about a government shutdown and contemplate selling their great businesses. Likewise, investors should ignore short-term political developments that will likely have very little influence on the long-term returns from businesses. The outlook for the U.S. economy remains good. In our opinion, any negative effect from the government shutdown will be more than offset by the stimulative influence of lower interest rates and gasoline prices. Given the low level of interest rates and our constructive view toward the economy, we continue to believe that equities will benefit from earnings growth and valuation multiple expansion.

Bond is a Four Letter Word

by Shelly Appleton-Benko | September 25, 2013

Global economic recovery is expected to gain momentum and with the sharp increase in Government bond yields since May, bond returns are likely to be negative for 2013. Inflation looks like it is trending up slightly which typically means that we will be paying more for consumer goods in the next few months as well.

If the bond ladder you own is comprised of investment grade corporate bonds and the maturity is shorter term, the total return should be modestly positive. Longer term bonds may produce negative returns as stated above.

Our Fixed Income Strategist, Hank Cunningham, authored an article about the “State of the Bond Market” on September 4, 2013, that explains just how expensive bonds are right now. There are some very attractive equities in the market that are yielding almost 2.5 times what the bonds are yielding. If you would like to find out more about these selections, please be sure to give me a call.

A Silver Lining to Current Low Long-Term Rates

by Shelly Appleton-Benko | September 9, 2013

Have you ever been faced with a choice of taking a lump sum or steady income stream? Perhaps you participate in a Defined Benefit Pension Plan and have to exit the plan (retirement, job change, lay off, etc.) or are the beneficiary of a financial settlement that offers this choice.

The lump sum represents today’s value of the future income stream and is referred to as the commuted value. One of the factors used in the commuted value calculation is long-term interest rates. Since current long-term rates are quite low, this commuted value option maybe more appealing at present than in a different rate environment. Michael Erez of Odlum Brown Financial Services Limited has written an excellent article titled “Choosing Between a Defined Benefit Pension Plan and Commuted Value” (simply click on the link to read it).

As a client, if you are ever presented with the choice, let us know and we can assist you in making an informed decision.

Shelly

Change is a Constant

by Shelly Appleton-Benko | August 28, 2013

Whatever happened to cute little Hannah Montana? Watching the Video Music Awards with my teenager this past weekend shocked me into realization – everyone grows up and all things continually change.

September is the time of the year when I get the urge to sign up for a course or learn something new. I am travelling to Toronto at the end of October for a wealth management summit to learn more about new trends in social media, portfolio management and overall changes in the industry.

My last trip to this summit inspired me to start blogging, so I am keen to learn the next steps on how social media can improve communication with our clients and future clients at Odlum Brown.

One thing is for sure, technology is changing our business.

Celebrating 90 Years of Thinking Differently

by Shelly Appleton-Benko | August 8, 2013

“If you want to succeed you should strike out on new paths, rather than travel worn paths of accepted success.”

- John D. Rockefeller, founder of Standard Oil Company

This year, we celebrate Odlum Brown’s 90th year in business. We have a firm built on the enduring values that guide our client-focused approach and we are proud of our rich history and prominent West Coast roots. We enjoy a strong corporate culture and have a long-standing passion to be involved in our community. Yes, we are different than the bank-owned firms and other independent brokerages. Different really does make a difference.

Enjoy these vignettes showcasing Odlum Brown’s rich history as we celebrate our 90th birthday! We look forward to continually sharing our unique corporate culture with our current clients and invite new clients to experience the Odlum Brown difference.

Have a Word with Yourself

by Shelly Appleton-Benko | July 30, 2013

Walking downtown last week, I saw an advertisement for injury prevention. The tagline was, “have a word with yourself.”

There are so many times that I meet with people and wish that they would realize the benefits of sitting down and having an action plan. We often do it for education, we do it for marriage and we do it for our children. We don’t do it enough for ourselves!

Where do you want to be with regards to your finances and what does it take to get there? What sacrifices do you have to make to save the funds you need? And, what investments do you need to make to have the funds working for you?

If you don’t know the answers to these questions, then you need to have a word with yourself and then call us to discuss a plan of action.

The Money Project

by Shelly Appleton-Benko | July 23, 2013

Back in February, I asked you to consider setting some goals for the next one to three years. Did you? If not, now is the time to get that money project going. We are now half way through the year and you need to ask yourself:

- Where are you currently?

- Are you where do you need to be?

- If not, what do you need to change?

It is easy to put your projects off especially during the dog days of summer. Remember that de-cluttering your life isn’t just for your closets; it can be beneficial to look at all your financial holdings and do some consolidation. If you are not working with us already, have outgrown your advisor from when you graduated university, or perhaps need to consolidate your many brokerage accounts, allow us to kick start your money project. You will feel the weight off your shoulders and be ready to enjoy the rest of the summer.

“The days are long, the years are short.” - Gretchen Rubin author of The Happiness Project

Mid-Year Market Check-in

by Shelly Appleton-Benko | July 17, 2013

So why did the markets start correcting in the last month (June)?

Simply put, there are three main reasons why the much-needed correction transpired:

1. Threat of rising interest rates;

2. Retreat in the Canadian bond market;

3. Global markets surprised by China’s announcement of slower growth expectations.

What are we doing?

Over the past couple of years, Odlum Brown has been advocating that portfolios be diversified away from Canada and we are reaping the benefits of this approach now. We are taking some profits on the heavily-weighted, interest-sensitive stocks and continuing to add our U.S. growth stocks. It is our intention to carry on with the portfolio rebalancing throughout the summer months and look forward to a solid return on our investments in the third quarter of the year. Please do not hesitate to call us should you have any questions or concerns regarding the current state of the economy. We would be glad to discuss our strategy in detail.

Dad's Advice

by Shelly Appleton-Benko | June 19, 2013

With Father’s Day last Sunday, I recalled with admiration some of the life lessons and advice that my own father passed along to me. One that resonates so often with me is the importance of paying it forward.

Opportunities to make a positive difference in the world are everywhere; you can change lives – even if it’s in a very small way. Some of our team have participated in Soup Sisters, where we prepared soup that was then donated to homeless shelters. We’ve participated in the Cloverdale Charity Golf Classic and will be sponsoring an upcoming golf tournament that will benefit students who are interested in golf, but cannot afford it. These are a few small ways we are paying it forward.

Belated Father’s Day wishes to all of the dads, or future dads reading this blog!

Do I need an estate plan and why?

by Shelly Appleton-Benko | May 27, 2013

Let me start by saying that an estate plan is more than a Will. The basic tools of a plan may also include a Power of Attorney, Representation Agreement, Inter-vivos trust(s) as well as designations and joint ownership. Without getting too bogged down into the technical issues, an estate plan ensures the orderly management of your affairs upon your death. It ensures that your estate is distributed according to your wishes. The plan may reduce or eliminate the burden of estate fees and other taxes; arrange support and care for minor children in the event of a parent’s death; and can ensure your desires are honoured if you become incapacitated.

So who needs one? Let me ask you a few questions to see if more in-depth planning might apply to you:

- Do you own a business?

- Do you have children who are minors?

- Do you not have any children?

- Are you in a blended family?

- Are you recently divorced?

- Do you want to avoid family squabbles after you die?

If you have answered yes to any of these questions, then you should review what measures you already have in place and consider whether or not more action should be taken. More planning might be the next step.

Spending time to ensure your affairs are in order is important. I encourage you to get started or revisit yours today!

Shelly

Life is Sweet!

by Shelly Appleton-Benko | May 21, 2013

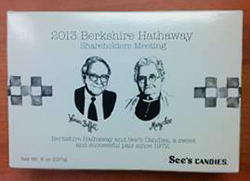

I just wanted to take a moment to say a big thank you to a couple of clients who recently returned from seeing the Oracle of Omaha, Warren Buffett at the Berkshire Hathaway Annual General Meeting and brought us back a very special box of chocolates (see photo).

What a fabulous experience it is to see and hear from Mr. Buffett, a true legend in this business. Many consider him to be the most successful investor in the 20th Century. I lean to his investment wisdom regularly - here are two of my favourite quotes.

1. “We will only do with your money what we would do with our own.” (A mantra I apply to our business here.)

2. “Price is what you pay. Value is what you get.”

What great advice and great clients to work with – life is sweet! Thanks again for the chocolates!

Hellos and Goodbyes!

by Shelly Appleton-Benko | May 14, 2013

Last May, Lisa Flett welcomed her beautiful second child, and has since been enjoying time with her young family. While away, my niece Michelle Appleton joined us to help with the many details and administrative tasks to ensure we provide our clients with the quality service that they have come to know and expect!

On May 21, we welcome Lisa back to the office. We extend our thanks and best wishes to Michelle, who will be off to pursue a career in nursing! Thank you for your help over the year.

Shelly

P.S. “Choose a job you love, and you will never have to work a day in your life.” - Confucius

Date Night

by Shelly Appleton-Benko | April 22, 2013

When I received an impromptu invite from my husband asking me on a date this Friday, I was super excited. When was the last time we went for dinner without our kids?! Then I found out the real reason we were meeting – estate planning.

While it’s not quite as glamorous as a true date night, it is probably the only way we can carve out the time needed for this important discussion.

Having been through the process before, we know that there will be some key points that we should discuss even before heading to our estate planning specialist. Specifically, we need to talk about what we want done or if we need to change anything if the worst case scenario happens:

a) I die first,

b) He dies first, or

c) We die together

We need to talk about the guardian for our children, Executor(s) for the Will, a Trustee to look after the financial aspects, and provisions for possible tax liabilities. While we will use the advice of a professional, we plan on discussing Power of Attorney as well as creating a Representation Agreement to cover medical preferences should they be required.

So now I ask you, are you due for a Date Night?

Rewriting My Estate Plan

by Shelly Appleton-Benko | April 16, 2013

Over the next few weeks, I will be rewriting my estate plan and chronicling my experience to illustrate how the process unfolds. With the assistance of our experts here at Odlum Brown and others in our professional network, I plan to take this seemingly overwhelming task, and break it down into manageable parts to demonstrate just how simple the process can be.

Pre-work – Where are we now?

Before I could even think about pulling out our Will, my husband and I took some time to list all of our assets and liabilities on a spreadsheet. We also identified all of our income sources, beneficiaries and any specific savings plans like TFSAs or RESPs for our kids. Yes, it’s a relatively daunting task to do this, but it saves us time and energy throughout the process to have these numbers on hand.

Our First Step – What if?

Armed with the information, I met with Rita Ager from Odlum Brown Financial Services Limited to talk about insurance coverage. Why? Because what happens to our income flow if one of us gets hit by a bus and loses the ability to work? Or, what if one of us became seriously ill? And yes, even the dreaded question, what if one of us dies unexpectedly? There is a lot of information to take in – but it is definitely worth the effort!

With an insurance needs analysis, Rita made it easy to discuss the kinds of coverage that we should consider. Now the hard decisions will come if we decide to get additional coverage on what we have already. I am so glad that I bought a life insurance policy when I first got married (thanks Dad!) too bad I didn’t buy more!

Join me in my challenge to get my estate plan in check. Start today by calling us to set up a complimentary appointment* with Rita - trust me, she makes insurance easy to understand. Check in next week to see where we go from here with our Will preparation.

Shelly

*available exclusively to Odlum Brown clients.

Are you using super tax credits?

by Shelly Appleton-Benko | April 2, 2013

To encourage Canadians to give to charity, the Federal Budget proposes to introduce a temporary First-Time Donor’s Super Credit (FDSC). You will receive an additional 25 per cent non-refundable tax credit for donations up to $1,000 for first time donors! Per the March 21, 2013 Federal Budget, if you haven’t claimed a donation credit since 2007 on your tax return, now is the time to score big. As a first time donor, you would be entitled to a 40 per cent Federal credit for donations of $200 or less and a 54 per cent credit for donations between $200 - 1,000. Only cash donations will be considered and not in-kind donations. This new credit can only be claimed once and for any year between 2013 and 2017. This is a great incentive to give to your favourite charity and save some tax dollars!

“Be Prepared” – The Girl Guide Motto

by Shelly Appleton-Benko | March 18, 2013

It’s time to talk about it. No one likes to think about or even plan for the possibility of a disability, critical illness or death, but any of these events can seriously impact your life.

Your overall financial health should include some form of insurance coverage. Many individuals, families and business owners go unprotected against risks that can be mitigated or reduced by the use of insurance products. Did you know that as a client, you have access to Odlum Brown Financial Services Limited (OBFSL)? The OBFSL team helps you assess your personal situation and provides unbiased advice that makes sense for you. Our team is on your team. Protect your financial future and be prepared. Give us a call to set up a meeting with our Insurance Specialist at OBFSL.

The Good, the Bad and the Ugly of Interest Rates

by Shelly Appleton-Benko | March 11, 2013

Yes, that’s right, that’s how I feel about buying most interest bearing instruments these days. The Canadian Minister of Finance, Jim Flaherty, announced Wednesday, March 6, 2013, that interest rates are going to stay low for the foreseeable future. Couple that necessary announcement with tough budget decisions in the United States, and, you guessed it, the return on interest bearing products will continue to be low and maybe even negative in some cases.

However, don’t despair; there are plenty of places to invest your money these days that are producing great returns. Blue-chip dividend paying stocks in North America are yielding an average of 3.1 per cent (S&P/TSX Composite) and the stock market continues to look attractive relative to bonds. Some stocks have roared ahead year-to-date making most investors nervous about adding to positions. Contrarian thinkers believe that the U.S. economy is just starting to take off and the ride upwards for stock prices should continue for some time. Now is the time to add to those equity positions that pay great dividends as well as add value and growth over the long term. We recognize that you have many choices in North America for investments, but today, in this environment, it seems like stocks are more attractive than bonds, and deserve a little more attention than they are receiving.

A Little Nugget – New Beginnings

by Shelly Appleton-Benko | March 4, 2013

A wise friend always reminds me that you can learn something from everyone. It could be something life changing, it could be something not to do, or it could simply be a nugget that may spark another idea. Last week, I was at an event and was mingling with a group, and by chance or by fate, whatever you choose to call it, I had the good fortune of meeting a woman and we engaged in some small talk. She was telling me how her husband was winding down his work and they would be moving to their place on the Sunshine Coast. When I asked her about her retirement plans she quickly added, “at our house, we don’t call it retirement, we call it new beginnings.” What a refreshing perspective! For those of you embarking upon your new beginnings, feel free to share this nugget.

Best of Both Worlds – the “Easy Button”

by Shelly Appleton-Benko | February 26, 2013

Perhaps one of the most frequently asked questions I receive is should I make an RRSP contribution or should I pay down my mortgage? There is no easy answer and there are some factors to consider, such as what your marginal tax rate is before you make your RRSP contribution. However, the decision to pay yourself first instead of the taxman makes sense.

Here’s how you can have the best of both worlds: pay yourself first and maximize your RRSP contributions*. Your net worth stays the same (your RRSP belongs in your asset pile) and the contributions to the plan are tax deductible. You lower the amount of income that the government taxes you on, and as such, lower the amount of taxes owing, which may result in a tax refund.

With a tax refund in hand, be disciplined and take the funds to pay down your mortgage. Success! You will save more, pay less tax, and have your mortgage paid down quicker. Press the “easy button” NOW.

Best,

Shelly

*Remember the deadline is March 1, 2013. In 2012, you can contribute 18 per cent of earned income to a maximum of $22,970 – unless you have carry-forward contribution room. Check your Notice of Assessment from the CRA for your contribution limit.

What is with the market?

by Shelly Appleton-Benko | February 13, 2013

Year-to-date returns (as of February 12, 2013) for the S&P/TSX and Dow indices are 3.42 per cent and 7.23 per cent respectively. It has been a while since we have had a start to the New Year like this one. How long can this last? Should we be taking money off the table? Will the uptick continue? No one can predict with 100 per cent accuracy, but our research department continues to be bullish on U.S. equities and believe that there can be some remarkable growth in the U.S. economy. The recovery has just begun and it is a great time to get onboard with some U.S. positions if you haven’t already done so. We are still seeing great value in some of the consumer discretionary and staple markets, and surprisingly the U.S. financials are adding some great growth as well.

Remember: Diversification is an important part of portfolio planning. Send me an email if you’d like to learn more about your portfolio’s diversification.

Best,

Shelly

Lessons from Oprah

by Shelly Appleton-Benko | February 6, 2013

On January 24, I had the good fortune of attending “An Evening with Oprah” with a close friend of mine. How amazing was it to sit 25 rows away from one of the most successful women in America! I have to admit to being a bit star struck at first. Then, I started asking myself how I could apply her approach to my business and my client’s investing strategies.

Here is one “aha!” moment that I believe is worth sharing: Goal Setting is Paramount.

For those of you without a strategic investment plan, let’s get started. There is no better time than now to set your goals for the next one to three years. Creating a plan will guide you on your wealth planning journey.

I recognize that the journey may sometimes seem painful, i.e. taking your tax refund to pay down your mortgage or making an RRSP contribution instead of splurging on those Louboutins (shoes). However, especially when it comes to your RRSPs, you might be overjoyed to realize that after just 12 short months, you would be able to add to your nest egg as well as reduce your overall tax payable.

While on this journey, there may be setbacks. It is important to stay the course, but be open to modifications to get you to your destination. Be sure to listen to that inner voice about what you really need. The sacrifices will be easier to make when you start to see the results.

I leave you with this quote from Oprah Winfrey: “You become what you believe.”

Best,

Shelly

Winner of the contest

by Shelly Appleton-Benko | February 6, 2013

Thank you to everyone who entered our First Anniversary contest. We appreciate your feedback and look forward to incorporating your suggestions.

Congratulations to Anne M, the winner of the wine collection!

Lunch & Learn Wednesday, January 30, 2013

by Shelly Appleton-Benko

We continue our Lunch and Learn series on January 30, 2013 with An Accountant's Perspective: What you need to know about buying or owning U.S. real estate.

With the strength of the Canadian dollar and the current state of the U.S. housing market, purchasing U.S. property may be an appealing investment. But is it?

Learn about noteworthy tax implications and estate considerations from experienced accountants:

- Kim LaBreche, CA, Saklas & Co. Chartered Accountants

- Kevin Stickle, CPA, MS‐Tax, Partner, Larson Gross PLLC

Fiscal Cliff Averted

by Shelly Appleton-Benko | January 9, 2013

Although there are still many details to be confirmed, the deal that the White House and Senate have reached will avert the “Fiscal Cliff.”

Highlights of the proposed deal include:

– Permanently increased tax rates for U.S. individuals with income above $400,000, or a household income above $450,000.

– Capital gains and dividends will be set at 20 per cent for those with similar income levels and 15 per cent for everyone below that.

– Estate tax will be set at 40 per cent with a $5 million exemption.

The market initially responded quite positively on January 2 with what the news anchors called the “Dow Dance,” an uptick of over 300 points in one day. We reiterate our thesis regarding the cliff – although these events can be scary and generate many news stories, they are just events that shouldn’t affect our investment thesis on the many corporations we own or intend to own. If you buy good quality companies at decent valuations, your investments will do well over time.

Happy New Year!

by Shelly Appleton-Benko | January 3, 2013

A year ago, I embarked on a new journey – this blog, per$pectives. Its objective is to provide insight into the financial markets and perspective on strategic wealth management issues. There is never a shortage of topics to share and I believe that the blog has been a great way to communicate with clients and friends in a timely manner.

In celebration of its first year (what’s an anniversary without a present?), I will be giving away a coveted collection of wine from the Laughing Stock Vineyard from 2007, 2008, 2009 and 2010. Four amazing years in the market, I might add!

Simply click here to complete an entry* for our draw to win this wine collection. The winner will be randomly selected from all of the entries. Contest closes January 11, 2013 but we still welcome your feedback at any time.

All the best wishes to you and yours in 2013!