That’s a Wrap – 98.3 Roundhouse Radio Segment

by Shelly Appleton-Benko | December 23, 2016

This week, I had the opportunity to chat with Minelle Mahtani on her radio show, “Sense of Place” on Roundhouse Radio, where we did a year-end market wrap up and discussed some considerations for your financial “To-Dos” for next year.

This week, I had the opportunity to chat with Minelle Mahtani on her radio show, “Sense of Place” on Roundhouse Radio, where we did a year-end market wrap up and discussed some considerations for your financial “To-Dos” for next year.

If are interested in listening, I have included the link here. You can also hear me weekdays in the mornings at 7:34 AM and 8:35 AM for market updates.

From All of Us

by Shelly Appleton-Benko | December 12, 2016

Coming Soon! New Annual Reports for Clients

by Shelly Appleton-Benko | December 7, 2016

In January 2017, clients will receive a new Annual Reports package in addition to regular Client Account Statements.

In January 2017, clients will receive a new Annual Reports package in addition to regular Client Account Statements.

Part of an industry-wide initiative called the Client Relationship Model (CRM2), these new reports are designed to provide clients with more details on the performance of their investment account(s) and the fees and compensation they have paid in the past year.

At Odlum Brown Limited, we have always been committed to providing clear and complete information and to delivering a full-service experience. We hope that our clients will find these new Annual Reports helpful.

Top Five Tips for Year-End Financial Planning

by Shelly Appleton-Benko | November 21, 2016

1. Topping up your TFSAs – Tax-Free Savings Accounts are available for any resident 18 years* or older in Canada and provide the opportunity to invest $5,500 per year. The account grows tax-free regardless of whether the growth comes from capital gains, interest and/or dividend income!

1. Topping up your TFSAs – Tax-Free Savings Accounts are available for any resident 18 years* or older in Canada and provide the opportunity to invest $5,500 per year. The account grows tax-free regardless of whether the growth comes from capital gains, interest and/or dividend income!

2. Crystallize capital losses – End the love affair with that stock tip you received from your brother’s dentist. If your ship didn’t come in and you wouldn’t buy the stock again today, it is time to sell. The loss can be carried forward indefinitely on your tax return so all is not lost. The last day for tax-loss selling in Canada is December 23, 2016.

3. Pay it forward – Make a donation to a registered Canadian charity before December 31, 2016 and maximize your tax credits. The more you give, the bigger your tax credit. Cumulative donations of more than $200 are eligible for a combined federal and BC tax credit of between 43.7% and 47.7%, depending on your taxable income for the year (provincial rates vary). If this is your first time donating, you may be eligible for the First-Time Donor’s Super Credit! Remember, donating stocks with a capital gain means that you avoid paying the tax on capital gains and the maximum donation is up to 100% of your net income.

4. Maximize the benefits of compound interest by contributing to your child’s RESP account now. Take full advantage of the Canadian Education Savings Grant as well as the tax-deferred growth of investments held within these plans. The annual contribution of $2,500 yields an instant 20% return by way of the government grant. Contact us for further details regarding eligibility.

5. Will you turn 71 this year? This is the year to convert your Registered Retirement Savings Plan (RRSP) to a Retirement Income Fund (RIF). If you have unused contribution room, be sure to make a final contribution to your RRSP account by December 31, 2016.

*The accumulation of contribution room for a TFSA will start at age 18. However, the age of majority is 19 for residents of British Columbia which may delay the opening of a TFSA.

The Slobberknocker is Over!

by Shelly Appleton-Benko | November 15, 2016

Here is a new word for some of you:

slobberknocker noun

1. a hard hit or punch.

2. a blowout in a competitive sport.

origin: professional wrestling.

The election is over and, yes, it was a slobberknocker. The aftershock was quite positive for the markets, at least for the first couple of days, but we ask ourselves: where do we go now?

Today we learned that U.S. Federal Reserve Chair Janet Yellen will remain in the position until her term is up in 2018. This provides us with some comfort that the “same old, same old” fiscal policy will remain for at least the next 12 months. There may be some points where we are shocked by the new administration in the United States, but it is our prediction that common sense will prevail. Raising interest rates or cutting off trade deals with trading partners are not things that can be accomplished overnight.

We continue to see opportunity in the markets, and although a correction would cause us to temporarily lose our breath (much like a punch to the stomach), we would most likely welcome some new bargains. Our investment mandate has not changed, and we look forward to seeing what the new administration south of the border will bring to the table.

Quality Matters in a Slow-growth World

by Shelly Appleton-Benko | November 7, 2016

Recently, Executive Vice President and Director of Investment Research, Murray Leith provided his sentiment on the current market outlook and our approach to investing in this slow-growth world. We’ve gathered a few of the key takeaways to share with you.

While it’s tough to be a contrarian investor in the current climate, prices although higher than before, are still justified. Quality matters. It’s easier to hold a great business through a market downturn because it’s easier to have confidence in its ability to weather the storm. Often, quality companies don’t experience the same level of volatility.

The overall message was that the time that you spend invested in the markets is more important than trying to time the market. Diversify and stay focused on the long term.

Class of 2034

by Shelly Appleton-Benko | October 31, 2016

Last week, we welcomed a new baby into our family; the newest member of the class of 2034. It seems like a regular occurrence as all our nieces and nephews are graduating, securing careers and starting their families. Yet, the excitement never dulls when a new baby arrives! As a parent of a child in university I would like share just how important it is to start contributing to a Registered Education Savings Plan (RESP).

A $2,500 annual contribution can be eligible for a 20% grant from the Federal Government through the Canadian Education Savings Grant (CESG), in addition to the BC Training and Education Savings Grant (BCTES) for certain school age children. The investment’s growth and income compound tax free until the child starts to take the funds out for tuition and other education related expenses. The withdrawal of funds is reported in the child’s name for tax purposes so the net effect of tax paid can be minimal.

The magic of compounding interest should be your motivation for starting a RESP as soon as you arrive home from the hospital. Just $2,500 a year invested at 4% with the Canadian Education Savings Grant (CESG) can provide a healthy RESP of $75,000 when your child graduates from high school. Remember, these funds can be used for more than tuition and books.

A new baby and budgets are tight? Grandparents are also eligible to open family plans for grandchildren and assist with the next generation’s education expenses. If that isn’t enough to motivate you, then consider the current tuition estimate at a university in Canada. According to the Canadian Centre for Policy Alternatives, back in 1991 tuition costs were $1,464. Today, in 2016-2017 the cost of tuition is estimated to be $7,437 per year. This doesn’t include books or student cost of living.

The class of 2034 is arriving daily, do you have a plan?

Upcoming Presentation

by Shelly Appleton-Benko | October 14, 2016

Join us for a night at the museum featuring an informative presentation by Murray Leith, who will share his thoughts on the economy and what is swaying investor sentiment.

Mr. Leith will also discuss opportunities in a slow-growth world and how Odlum Brown’s unique approach has helped generations of clients navigate the equity markets.

When: Thursday, October 27, 2016

• Museum open from 6:30 – 7:00 PM

• Presentation at 7:15 PM

• Followed by light refreshments

Where: Surrey Museum

17710 – 56A Avenue, Surrey BC

We welcome you and your guests to join us for this complimentary event to learn more about Odlum Brown and the services we offer.

Seating is limited. RSVP by October 20.

Selling your house?

by Shelly Appleton-Benko | October 6, 2016

As of October 3, 2016, you now have one more item to add to the laundry list when selling your home.

The Federal Government announced a change to how you will report the sale of your principal residence to the Canada Revenue Agency. Although you do not have to pay tax on the gain on your principal residence if you qualify for the personal residence exemption, you must report the sale. Starting with any dispositions made in the 2016 tax year, you will be required to report your acquisition price, proceeds of disposition and a description of the property on your income tax return in order to claim the full principal residence exemption.

CRA has posted an FAQ section on the topic. Click here for the link.

What is your ikigai? (eek-y-guy)

by Shelly Appleton-Benko | September 29, 2016

Many of us dream of the day when we reach retirement and experience ultimate freedom from our day-to-day work responsibilities. Recently, I met with a client who is semi-retired. When I asked how full retirement was looking, she responded immediately with, “I can’t possibly retire as I would be totally bored!” This brought to mind a Japanese term, ikigai, which I recently read about. The meaning can be translated to the reason you wake up each morning or your sense of purpose.

Many of us dream of the day when we reach retirement and experience ultimate freedom from our day-to-day work responsibilities. Recently, I met with a client who is semi-retired. When I asked how full retirement was looking, she responded immediately with, “I can’t possibly retire as I would be totally bored!” This brought to mind a Japanese term, ikigai, which I recently read about. The meaning can be translated to the reason you wake up each morning or your sense of purpose.

Typically, during your career, your ikigai is defined as the five days a week where you work and with whom you interact. It has been said that people with a sense of purpose live longer and healthier lives than those who don’t. A new term coined the “victory lap,” is essentially ‘working’ after retirement for fun and experience. Even though you planned your exit from your career well in advance and you have attained independence from commuting, office politics, meetings and sales targets, you just aren’t quite done!

Finding things to do that make you happy and possibly help you earn extra money for new experiences, such as travel and adventures, can be some of the most rewarding work that you may do in your entire life. Some of the best advice that I received was from my father when I was struggling with my career choice. He told me to find something that I loved to do and then figure out a way to get paid to do it. Working on something you are passionate about will always give you the motivation needed to make retirement fun and fulfilling. If you are thinking of retiring, make sure that your financial plan also considers your lifestyle needs and don’t forget to include your ikigai!

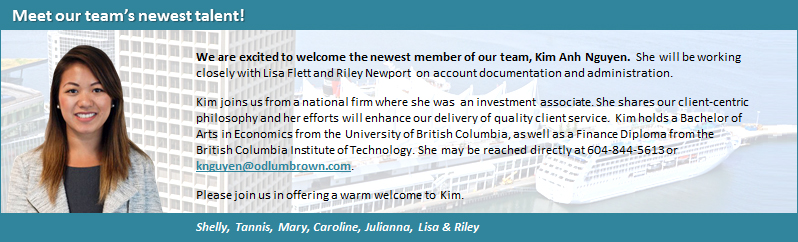

Introducing Kim Anh Nguyen

by Shelly Appleton-Benko | September 1, 2016

Summer Camp

by Shelly Appleton-Benko | August 17, 2016

Investing in your children doesn’t always mean a large financial outlay. This weekend, my youngest with seven other inspiring young ladies will head off to a leadership camp to experience the benefits of paying it forward. While she is looking forward to campfires and s’mores, she may not realize that the overall camp is based on discovering your passion, developing leadership skills and building confidence.

Investing in your children doesn’t always mean a large financial outlay. This weekend, my youngest with seven other inspiring young ladies will head off to a leadership camp to experience the benefits of paying it forward. While she is looking forward to campfires and s’mores, she may not realize that the overall camp is based on discovering your passion, developing leadership skills and building confidence.

Truly, this is travel with a purpose. Although it is not a hefty expense to send her there, I am expecting a large return on the investment when she returns.

Exploring local and global issues should be on everyone’s radar and who better to educate than our youth, whose open minds and hearts can inspire us all. Investing in the next generation today will help ensure that the future is bright and strong tomorrow.

Five Bucks, Five Bucks, Five Bucks

by Shelly Appleton-Benko | August 2, 2016

Everywhere I turn, there seems to be some sort of advertisement that claims “for only five bucks” you can get an extra this or that – a second pizza, gourmet coffee or carwash. It doesn’t seem like much at the point of sale, but those five extra dollars could really make a difference to your overall savings. David Bach, the author credited with coining the term “Latté Factor,” explains the theory of how quickly $5 a day spent on a latté could be better spent growing in your portfolio.

Everywhere I turn, there seems to be some sort of advertisement that claims “for only five bucks” you can get an extra this or that – a second pizza, gourmet coffee or carwash. It doesn’t seem like much at the point of sale, but those five extra dollars could really make a difference to your overall savings. David Bach, the author credited with coining the term “Latté Factor,” explains the theory of how quickly $5 a day spent on a latté could be better spent growing in your portfolio.

Do the math: $5 a day times 365 days per year, at an annual return rate of 5%. In one year, that extra five bucks grows to just over $1,900. Over 10 years, it climbs to over $10,500; and over a 30-year period, it accumulates to over a whopping $127,000! So yes, $5 can make a difference to your retirement plan.

For those of you still saving for retirement, when was the last time you adjusted the amount you are automatically contributing via a pre-authorized amount of monthly savings? If you don’t already contribute to a monthly automatic savings plan, consider what you are missing and start today. What if you increased your current amount by that $5 a day? Would you miss it in your day-to-day spending? Consider the possibilities.

In the Community

by

Shelly Appleton-Benko | July 25, 2016

Headlines Can Be Misleading

by

Shelly Appleton-Benko | July 12, 2016

“Be fearful when others are greedy and greedy when others are fearful.”

– Warren Buffett

The last quarter has brought much uncertainty for the equity markets in North America. We are definitely working hard to decipher the facts from the sensationalized headlines to find out what will truly affect our portfolio positions — either positively or negatively over the next few weeks.

For example, we have heard some people lament missed opportunities in the Vancouver real estate market and weigh the pros and cons of investing in it instead of a diversified investment portfolio. Let’s agree that the Vancouver real estate market is manic right now, and although it may be lucrative for some, it may be a particularly risky business for others. Comparatively, the stock market behaved this way in the late 1990s. Remember the technology bubble?

When valuations of any asset seem to be excessive, you have to ask yourself, when is the bottom going to fall out? According to BNN, during the month of June, Vancouver real estate prices grew by 32.8%. Regardless, most of us don’t consider our home as an investment. We have to live somewhere and we plan on being there for the long term and wouldn’t sell our home just because the value has appreciated so quickly. Comparing real estate to a stock portfolio is futile; in fact, to own both would be a grand idea. Historically, both stocks and real estate have reaped great returns.

The headlines of the day play on our fears and admittedly, we are in uncertain times where interest rates and economic growth are both low. Change is in the air, but it will not occur in the markets without catalysts and these can be unnerving for the average investor. People clearly want change, considering the U.K. Brexit vote and the “reality TV” election campaign in the U.S. With it comes volatility, more uncertainty and some unknown risks. This is why we strive to own companies that can adapt to change.

While avoiding risk is somewhat impossible when it comes to investing, whether it be in real estate or stocks, we can do our best to mitigate it with investments that can thrive in most economic environments and provide you with what your personal situation needs.

Remember that headlines are designed to grab your attention. We are more interested in the underlying story and the long-term value that a company can bring to your investment portfolio.

Graduation and New Beginnings

by Shelly Appleton-Benko | June 15, 2016

This past weekend was filled with tears, tears of joy but still tears. My oldest graduated from high school. As he crossed the stage, I thought of all his accomplishments thus far – all of the proud moments as a parent. Then my thoughts turned to his future as he prepares to leave home to attend university. Although I am ecstatic for him, I can’t help but think of the laundry list of items he’ll have to explore such as banking, RESP withdrawals, credit cards, insurance, car maintenance, setting up a cell phone, goal setting, not to mention the actual laundry that needs to be done! The list can be overwhelming for most adults, let alone the average 18 year-old!

This past weekend was filled with tears, tears of joy but still tears. My oldest graduated from high school. As he crossed the stage, I thought of all his accomplishments thus far – all of the proud moments as a parent. Then my thoughts turned to his future as he prepares to leave home to attend university. Although I am ecstatic for him, I can’t help but think of the laundry list of items he’ll have to explore such as banking, RESP withdrawals, credit cards, insurance, car maintenance, setting up a cell phone, goal setting, not to mention the actual laundry that needs to be done! The list can be overwhelming for most adults, let alone the average 18 year-old!

If there is a new graduate in your family, consider taking some time to sit down and create a plan and budget with him or her. There are set monthly costs that don’t vary (rent) and those that do vary (groceries). For example, ask questions like how much will it cost to live? Do you have enough money to buy pizza on Friday night? Can you afford to buy it Friday, Saturday and Sunday? It would be prudent to set aside an emergency fund too. Analyze what the monthly cost of living will be and allow for an occasional splurge if it stays within the budget.

University is challenging enough without having to worry about cash flow, so students need to start with a plan and do their best to stick to it. This is a great reminder for all of us, even if we aren’t of university age, staying aware of your expenses is an important part to experiencing financial success. What is your monthly number? Do you know? Are you living within your means?

Learning basic money management skills now will be far less painful than learning it later! It can be one of the best gifts you can give to your graduate or yourself.

Should I defer my property tax?

by Shelly Appleton-Benko | June 2, 2016

There is a low-interest rate loan program in British Columbia that allows seniors (55 and over) to defer the annual property taxes on their principal residence. We have received a lot of calls about this option as many of our clients are faced with a bi-annual bill from the city that puts a damper on their annual cash flow.

There is a low-interest rate loan program in British Columbia that allows seniors (55 and over) to defer the annual property taxes on their principal residence. We have received a lot of calls about this option as many of our clients are faced with a bi-annual bill from the city that puts a damper on their annual cash flow.

How does it work?

You must be a Canadian citizen or permanent resident who has lived in BC at least one year immediately prior to applying for the program. You qualify for the regular program if you are at least 55 years of age (only one spouse must be 55 years or older), a surviving spouse or a person with a disability as defined by the government. You must also have a minimum of 25% equity of the current assessed value of your property after deducting all outstanding mortgages, lines of credit and other charges.

Once your application is approved, your certified copy of the agreement is registered as a lien in the Land Title office and your property taxes are paid by the BC Property Tax Deferment Program. You are still personally responsible for penalties, interest, previous years’ property taxes, user fees and utility charges. The cost of the program is a rate not greater than two percent below the bank prime rate. When you eventually sell your home, the amount of deferred taxes is taken off the proceeds of the sale. The same process applies if your estate is selling your home after your death.

Why would you consider this?

You may consider this if you, for example, need to increase in your household cash flow or perhaps free up some capital to make costly renovations or other investments. The low interest rate that you are charged on the loan for property tax deferment is NOT calculated on a compound basis. We have found a comprehensive fact sheet on the province’s website for those who are interested in pursuing this as a financial strategy.

All types of financial planning are personal and should be viewed on an individual-case basis. If you feel that this might be something you would consider, please email me for more information.

6,935 Days

by Shelly Appleton-Benko | April 25, 2016

Nineteen years ago, I started my career with Odlum Brown. That was approximately 6,935 days ago. How things in this industry have changed!

Nineteen years ago, I started my career with Odlum Brown. That was approximately 6,935 days ago. How things in this industry have changed!

Today, practically everything in our lives revolves around the internet such as our banking, school calendars, communication with family members and friends, shopping, entertainment, research – you name it, it’s there. When I started at Odlum Brown, we didn’t even have personal computers on our desks!

With technological advancements come more regulation and reporting changes than ever before. While exciting, these changes force us to look at things differently and become more connected than ever.

Looking back on the changes in our business, I realize that I truly am still a “teenager.” Some say 19 can be unlucky, like in the card game of cribbage, but I feel that as a Portfolio Manager with expertise in strategic wealth management, entering my 20th year gives me a great advantage in the investment business. Investment cycles come and go but there is definitely something to be said for the experience of living through volatile markets and investing in the right places for our clients.

I am grateful to work in a firm where our independence is paramount, our research is amazing and where we put clients’ interests first, always. Going forward, I realize that I am in the best possible place in this business and fortunate to continuing working with such great clients.

Retirement. It’s here. Are you ready?

![]() by Shelly Appleton-Benko | April 8, 2016

by Shelly Appleton-Benko | April 8, 2016

The time has come and you have finally decided to sail off into retirement. Before you do, here is a list of items to consider with your personal financial plan in mind before you close the “Work” chapter of your life.

The time has come and you have finally decided to sail off into retirement. Before you do, here is a list of items to consider with your personal financial plan in mind before you close the “Work” chapter of your life.

1. Don’t take your CPP too soon.

- If you collect CPP before age 65, benefits are reduced by 0.6%/month (7.2%/year).

- If you collect CPP after age 65, benefits are increased by 0.7%/month (8.4%/year).

2. Work with your financial advisor to realign your investments so that they better reflect your risk and objectives during retirement. This doesn’t mean you have to run out and sell all of your equities!As you approach the time in your life when you need to access your account for income, the need for capital preservation increases.

3. Change your monthly budget allowances. More time off may mean more travel and unexpected expenditures. Reviewing “the needs” versus “the wants” annually helps to smooth out the expenses so that you can afford to do what you want, when you want.

4. Manage annual healthcare costs and factor in travel insurance. For those without extended health coverage, private health insurance may be an expense previously funded by your employer that does not necessarily continue in retirement. Purchasing an annual policy for travel can be a convenient and less expensive way to manage health insurance coverage while travelling outside of Canada. Some restrictions apply, so be sure to discuss your situation with an insurance professional.

5. Don’t spend too much money. Prudent cash management can make a huge difference in retirement. For those with children, we know that we all want to help out our kids. However, we need to remember that your income in retirement is now fixed and, in most cases, your ability to increase your savings is limited. Know what your monthly expenses are and stick to the plan.

6. Be fraud aware. Seniors tend to be the targets for fraudulent activity. Many may not be as tech-savvy as some generations and criminals know this. Before investing in any idea, discuss the opportunity with your financial advisor. Do your research online, ask questions of others and look up recent or related fraudulent activity online. If the security is publicly-held, you can also find more information with SEDAR. Be sure to review the resources available through the BC Securities Commission’s InvestRight website.

7. Consider taking a reduced pension. Retiring early can sometimes come at a great cost. Ensure that you consult with your financial advisor on the overall amount before you decide to retire. A reduced pension means that you are willing to accept a reduced amount for the term of your pension.

8. Be shrewd with your taxes. When receiving pension income, there are income-splitting tax savings that could apply to your annual tax filing. Ensure that your accountant is aware of your new situation and that you fully disclose your income sources in order to pay the least amount of tax as a household in retirement. You may also be eligible for some additional tax credits of which you weren’t previously aware (i.e. the home renovation tax credit for seniors). Ah, retirement has some benefits.

9. House rich and cash poor. Staying in the family home may be important; downsizing is not for everyone in retirement. If downsizing is one of the options, consider what your household would do with the extra funds and how this could make a difference in your annual retirement income. Consider deferring your annual property taxes and decreasing your annual expenditures. A financial advisor can assist you with a projection that will lay out the changes in a simple and meaningful way.

10. Work with professionals. Everyone’s situation is different so don’t hesitate to give me a call if you need clarification on any of the points above.

Stick to Your Grandparents’ Wisdom and Advice

by Shelly Appleton-Benko | March 14, 2016

Millennials seem to have it all figured out. Information, communication and gratification are instant these days, in our technological world. If you shoot me a text, I will respond right away, regardless of what I am doing or who I am with at the time.

Millennials seem to have it all figured out. Information, communication and gratification are instant these days, in our technological world. If you shoot me a text, I will respond right away, regardless of what I am doing or who I am with at the time.

Although the methods of investing may have changed, the overall strategy of prudent investing has not. According to Money Magazine’s December 8, 2015 article “Why You Should Invest Like Your Grandparents” by John Waggoner:

You’ll often hear that newbies can take more risks with stocks, especially shares of small companies, which like them are unpredictable but filled with potential…One thing Grandma may not have told you: Dividends [from large blue chip companies] have accounted for more than 40% of the S&P 500’s total return since 1926. The younger you are, the sooner you can take advantage of that by reinvesting the cash in the market and compounding your gains.

It appears that the virtue of patience is currently being tested with regard to investing. My recommendation is to stick to the knitting and trust the grandparents; they always have the best advice.

Shelly

P.S. To read the complete article, click here.

Investing in Our Future at the BC Winter Games

by Shelly Appleton-Benko | March 3, 2016

This past weekend I spent four days in Penticton at the BC Winter Games. While there, I enjoyed seeing the many volunteers, athletes and fellow parents cheering on all disciplines of sport. Each category of the Games was so very different in how the athletes prepared for training and qualifying, and even how they arrived at the Games.

We witnessed the thrill of victory and the agony of defeat, but most of all we saw that sport not only builds character, it reveals it. Young athletes from all over the province met up with new friends, faced bigger competitors and will become better people for the experience. I realized that investing in our future here in BC can mean mentoring a young person, cheering on a struggling athlete or just being a fan in the stands enjoying the game.

My thanks go to Penticton and to the hundreds of volunteers who made this fantastic experience possible and had the energy to step up and lend a hand. Congratulations on a successful Games and on leaving us fans with something to cheer about in the future.

Tactical Trading Opportunities

by Shelly Appleton-Benko | February 10, 2016

After one of the toughest markets on record in January, we can happily say that we look forward to the new year hangover to be over! Being eternal optimists, we are in a good position to take advantage of opportunities that are becoming available. Tactical trading is when we strategically identify opportunities within the portfolio and establish whether we need to make changes that we believe will add value over the longer term. This could include buying a new position to replace an existing one, if it better suits your risk tolerance and objectives. The current market volatility has helped us to once again find value in the U.S. market, as well as some new opportunities within the Canadian market.

Odlum Brown is hosting a series of annual presentations in a few weeks that will profile our firm’s research and approach for the coming year. If you haven’t already registered to attend one of the sessions, please click here for more information.

Shelly

Know a child born after January 1, 2007?

by Shelly Appleton-Benko | February 4, 2016

Any BC resident children born after January 1, 2007 and holds an RESP may be eligible to receive an additional BC Training and Education Savings grant for their RESP account in the amount of $1,200.

Any BC resident children born after January 1, 2007 and holds an RESP may be eligible to receive an additional BC Training and Education Savings grant for their RESP account in the amount of $1,200.

Here’s a link for more information for this new program that is now in effect in British Columbia: $1,200 BC Training and Education Savings grant

If your child or grandchild meets the criteria, be sure to apply for the additional grant. Feel free to contact me with any questions.

Shelly

Sports Analogy

by

Shelly Appleton-Benko | January 13, 2016

Football fans everywhere were amazed on Sunday when Russell Wilson and the Seahawks fortuitously took advantage of the Minnesota Vikings in the Wildcard Final. The Seahawks won the game as a result of two errors by the Vikings, providing amazing entertainment to the fans. The stock markets can sometimes be compared to a wild ride in the playoffs. The emotional rollercoaster on which investors travel up and down can be more than what some people can stomach.

With the S&P/TSX Composite Index down 5.85% and the Dow Jones Industrial Average down 6.85% so far this year, one has to begin thinking that the stock market is giving us a late Christmas present. That’s right I said present, as in a gift. With valuations coming down, there are a lot of opportunities that our team is looking for in this environment. We aren’t sure when the correction will end and when the right time will be to step in, but we do know that we are preparing our list of items to acquire and are ready to buy when the conditions are right.

Like a sports team, we not only work as your quarterback who will call the play that works best for your portfolio, but we will also coach you through tough markets to ensure that you are taking advantage of the opportunities as they present themselves.

Shelly