Guaranteed Income Options with Annuity Products

By Rita Ager, CFP, CLU, CHS, CPCA, FEA Insurance Specialist,

Odlum Brown Financial Services Limited

By Debbie Stuart, CLU, CHS,

Estate and Insurance Planner,

Odlum Brown Financial Services Limited

For many clients, annuities may provide a solid foundation for guaranteed retirement income. Annuities can range from the simple life annuity to a more complex variable annuity (commonly referred to as guaranteed minimum withdrawal benefit plans, or GMWB). In this article, we will exclusively discuss life annuities.

One of the most common questions we are asked is, “How much income would I receive from purchasing a life annuity?”

Several factors influence the income received from a life annuity, including the:

- Demographic of the annuitant (i.e., gender and age);

- Type of annuity purchased (i.e., single life or joint life);

- Frequency of income payments received (i.e., monthly or annually);

- Length of the purchased guaranteed payment period;

- Type of funds used to purchase the annuity (i.e., registered, non-registered or pension); and

- Other special features chosen (i.e., indexing).

One of the most important decisions to make before purchasing an annuity is finding a guarantee that suits your circumstances. Choosing a guarantee option ensures that a certain number of payments will be made, regardless of when an annuitant dies. There are many choices available, ranging from a zero guarantee (where payments stop when annuitants die), to options for guaranteed payments to age 90. If an annuitant dies during a guaranteed period, a value representing the remaining guaranteed payments is provided to the estate or beneficiary named. If the annuitant lives beyond the guaranteed period, the annuitant will still continue to receive payments for the duration of his or her life.

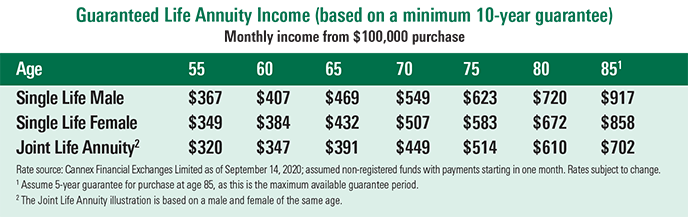

Here is an example of the lifetime monthly income you could receive from an annuity purchased with $100,000 of non-registered funds, providing a minimum 10-year guarantee.

Annuities purchased with non-registered funds have an added advantage, as only a portion of each payment is considered taxable income. As listed above, the monthly payment for a joint life annuity purchased for a male and female, aged 75, is $514. The “taxable” portion of this monthly annuity income payment would be $46, or $552 annually. Annuity income may also qualify for the annual $2,000 pension income tax credit, which can reduce or eliminate the tax otherwise payable on the annuity income.

You may wish to consider a life annuity if you seek:

- Guaranteed income for life;

- Higher monthly income than many other guaranteed income products provide;

- Guaranteed payments without exposure to market volatility; or

- A tax-advantaged income stream. Only a portion of each payment from an annuity purchased with non-registered funds is taxable, and the taxable portion remains level for life in the case of “prescribed” annuities.

To understand the many options for today’s annuity products and whether they may be suitable for your retirement income needs, please contact us through your Odlum Brown Investment Advisor or Portfolio Manager.

Odlum Brown Financial Services Limited (OBFSL) is a wholly owned subsidiary of Odlum Brown Limited offering life insurance products, retirement, estate and financial planning exclusively to Odlum Brown clients. OBFSL offers a variety of coverage options from many of Canada’s top insurance companies tailored to suit clients’ individual needs. Our licensed professionals are here to help you assess your position and then implement customized recommendations to meet your individual circumstances and needs. For more information, please contact your Odlum Brown Investment Advisor or Portfolio Manager.