A year ago, we were feeling good yet cautious. The value of the Odlum Brown Model Portfolio1 was at a record high, having registered a gain of 23% in 2019. Despite disappointing and sluggish global growth that year – the weakest since 2009 – stocks roared higher because central banks lowered interest rates and pumped money into the financial system.

While lower interest rates were helping to keep the economic expansion alive and drive stock valuations higher, we questioned whether stocks could keep appreciating at a faster pace than the underlying economy and corporate earnings. Consequently, we titled our January 2020 Odlum Brown Report article “Tempered Expectations.” With stock valuations elevated, the risk and reward attributes of the stock market were less appealing, and we felt it was a time to moderate our return expectations and position our Model more conservatively.

Accordingly, we took profits on some winners, sold some higher-risk cyclical businesses, dumped a couple of loathed stocks and ended 2019 with an unusual 10% cash reserve. Early in the new year, we initiated a position in gold bullion via the SPDR Gold Shares ETF to further improve the diversification and overall risk and return characteristics of the Model Portfolio.

Our conservative posture hindered our relative performance early in 2020 as stocks powered higher, but being more defensive helped on the downside when the world locked down due to COVID-19.

It truly was a surreal year. The pandemic disrupted our lives and wreaked havoc on the global economy in ways that were previously unimaginable, and yet the effect on society has been uneven. There have been winners and losers, and a lot of surprises.

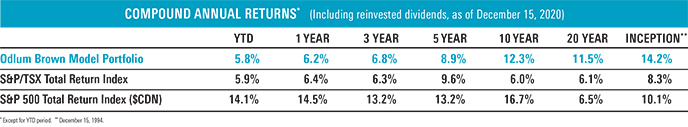

The most pleasant surprise for us and our clients is how well stocks, and U.S. stocks in particular, have performed despite the virus and the economic damage it has caused. As of mid-December 2020, the Canadian S&P/TSX Composite Index had risen more than 55% from its March low and produced a year-to-date total return of 6%. Our Model was up as much and near a record high. Amazingly, the U.S. S&P 500 Index achieved a total return of 14% over the same period, measured in Canadian dollars.

For a lot of us, it’s hard to understand how stocks can be doing so well when many people and businesses are still hurting. There are three principal reasons.

First, governments have provided a tremendous amount of support to individuals and businesses, which has helped people make ends meet and kept businesses afloat. Personal income normally declines in a recession when people are laid off, but that didn’t happen. Aggregate personal income actually went up due to government transfer payments. Consequently, overall spending in the economy has been relatively robust, although it has been distributed differently. For example, people are not spending money on travel. Instead, they are renovating their homes, buying cars, shopping online and subscribing to video streaming services, among other things. Businesses naturally are spending a lot more on technology to facilitate remote working.

The second reason stocks are doing well is that the U.S. Federal Reserve and other central banks have provided significant stimulus to the economy by lowering interest rates, committing to keep interest rates low for a long time and injecting unprecedented liquidity into the financial system by buying bonds. Credit normally gets tighter during a recession, but the opposite happened this time due to the aggressive actions of central banks. Low interest rates help important interest-sensitive sectors like housing by making it cheaper to finance purchases. And in the same way low mortgage rates push home prices higher, low interest rates push all asset prices higher, including stocks.

Vaccines are the final reason stock markets are setting new records. While the winter spike in COVID-19 cases has necessitated economic restrictions that will take some steam out of the recovery in the near term, the promise of vaccines restoring normalcy to our lives has provided reason for optimism. The stock market is always forward focused, and investors are looking over the valley and bidding up stocks based on the potential for stronger corporate profits in the latter part of 2021 and into 2022.

We are thankful that stocks have done as well as they have, and even more grateful that scientists have developed seemingly effective vaccines so quickly. We have always had faith that society would get past the pandemic and that the economy and stock market would recover. Still, the outlook has improved faster than we expected.

Governments and central banks have truly done an amazing job cushioning the economic blow from the pandemic and providing society with an economic bridge to the other side. In October, the International Monetary Fund forecast that the world economy would shrink by just 4.4% in 2020,2 a much smaller contraction than was feared earlier in the year. Moreover, the organization expects global growth to rebound by more than 5% in 2021.

The mixture of ultra-low interest rates and a stronger economy is a tonic with the potential to propel stocks higher. Still, investors would be wise to temper their return expectations as the average stock is not cheap. Many stocks are probably already discounting much of the expected improvement ahead.

Quality and diversification remain paramount. With increased debt and social unrest in the world, there is the ongoing risk of market volatility.

Excessive debt has weighed on global growth for a long time, and unfortunately individuals, businesses and governments will have a lot more debt once the world gets past the virus. Increased debt is a double-edged sword; it will help in the near term but will hurt in the long run.

Social unrest is still a major problem and potentially an ongoing impediment to global growth. While there is reason to believe there will be less divisiveness in America with Biden replacing Trump as president, the inequality that is fueling social unrest globally hasn’t been helped by the pandemic. The less advantaged took the biggest hit from the lockdowns, and many are still unemployed. Central banks’ ultra-low interest rate policies, which have been absolutely necessary, are also serving to widen the wedge between the haves and have-nots, as low interest rates inflate the value of assets that are disproportionately owned by the wealthy.

Governments have big challenges ahead as they balance the need to rein in unsustainable budget deficits against demands for policies that lessen inequality. In our view, the risk of policy mistakes is greater given the heightened social unrest in the world.

On balance, we are more upbeat regarding the outlook than we were a year ago, when a global pandemic was beyond our imagination. We are no longer handicapping the timing of the next recession and instead we are excitedly looking forward to a return to normal. While we can’t make any guarantees about the price of stocks, there is little doubt that thanks to the efforts of governments, central banks and scientists, 2021’s waters will be less troubled.

1 The Odlum Brown Model Portfolio is an all-equity portfolio that was established by the Odlum Brown Equity Research Department on December 15, 1994, with a hypothetical investment of $250,000. It showcases how we believe individual security recommendations may be used within the context of a client portfolio. The Model also provides a basis with which to measure the quality of our advice and the effectiveness of our disciplined investment strategy. Trades are made using the closing price on the day a change is announced. Performance figures do not include any allowance for fees. Past performance is not indicative of future performance.

2 https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/OEMDC/ADVEC/WEOWORLD

Please read our Odlum Brown Limited Disclaimer and Disclosure - It is important!

Odlum Brown Limited is an independent, full-service investment firm focused on providing professional investment advice and objective research. We respect your right to be informed of relationships with the issuers or strategies referred to in this report which might reasonably be expected to indicate potential conflicts of interest with respect to the securities or any investment strategies discussed or recommended in this report. We do not act as a market maker in any securities and do not provide investment banking or advisory services to, or hold positions in, the issuers covered by our research. Analysts and their associates may, from time to time, hold securities of issuers discussed or recommended in this report because they personally have the conviction to follow their own research, but we have implemented internal policies that impose restrictions on when and how an Analyst may buy or sell securities they cover and any such interest will be disclosed in our report in accordance with regulatory policy. Our Analysts receive no direct compensation based on revenue from investment banking services. We describe our research policies in greater detail, including a description of our rating system and how we disseminate our research here.

This report has been prepared by Odlum Brown Limited and is intended only for persons resident and located in all the provinces and territories of Canada, where Odlum Brown Limited's services and products may lawfully be offered for sale, and therein only to clients of Odlum Brown Limited. This report is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Odlum Brown Limited to any registration requirement within such jurisdiction or country. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this report, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed or recommended in this report.

This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information's accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice.

Please note that, as at the date of this report, the Research Analyst responsible for the recommendations herein, associates of such Analyst and/or other individuals directly involved in the preparation of this report hold securities of some of the issuer(s) referred to directly or through derivatives.

No part of this publication may be reproduced without the express written consent of Odlum Brown Limited. Odlum Brown Limited is a Member-Canadian Investor Protection Fund.