When it comes to investing, we can be our own worst enemy. We are emotionally wired with instincts and biases that naturally cause us to make mistakes.

Learning about our human shortcomings in my university psychology and sociology courses was enlightening, yet losing my own hard-earned cash yielded more impactful, lasting lessons.

Learning about our human shortcomings in my university psychology and sociology courses was enlightening, yet losing my own hard-earned cash yielded more impactful, lasting lessons.

In my final year of university, I had the opportunity to make a quick buck – to turn $500 into $4,000 almost overnight – by participating in a pyramid scheme. Despite a gut instinct that it was too good to be true, and a sound understanding of why such money-making systems collapse faster than most expect, I let envy, greed and the fear of missing out (FOMO) get the best of me – and my wallet.

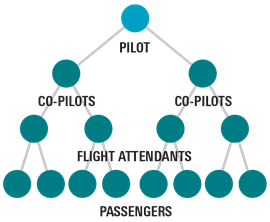

The get-rich-quick scheme was called the airplane game. For $500, you joined an “airplane” as a “passenger” at the bottom rung. Already on the airplane were four “flight attendants,” two “co-pilots” and a “pilot.” Once the pilot collected $4,000 from all eight passengers, they would retire, and the group would split equally into two airplanes, with each co-pilot becoming the pilot of the new airplane and promoting everyone up a level – thus looking for eight new passengers to join for $500 each. The goal was to become a pilot oneself, collecting the $4,000, an eight-fold return on investment.

Pyramid schemes ultimately fail because they require an ever-increasing number of participants to keep going. And unlike interest or dividends on an investment, the numbers compound against the odds of success in an exponential manner. In the airplane game, the first iteration requires one airplane and eight passengers, then two airplanes and 16 new passengers, then four airplanes and 64 new passengers, and so on such that 33 million new passengers are needed by the 23rd iteration of the game. That was more than the entire population of Canada back when I played, and thus the reason for my doubt and hesitancy to do so.

Pyramid schemes ultimately fail because they require an ever-increasing number of participants to keep going. And unlike interest or dividends on an investment, the numbers compound against the odds of success in an exponential manner. In the airplane game, the first iteration requires one airplane and eight passengers, then two airplanes and 16 new passengers, then four airplanes and 64 new passengers, and so on such that 33 million new passengers are needed by the 23rd iteration of the game. That was more than the entire population of Canada back when I played, and thus the reason for my doubt and hesitancy to do so.

Nonetheless, watching so many others make easy money made me envious. I didn’t want to miss out. So, I parted with my $500 just as the game lost momentum. It was a hard lesson, as $500 was a significant amount of money for me to lose at the time. This lesson about human nature has been top of mind lately, as uber-accommodative government and central bank policies have fuelled a highly speculative market environment. Everyone seems to have a neighbour, relative or friend with a “hot” investment idea that has the prospect for supersized gains.

While we don’t think there is a general stock market bubble waiting to burst, we do think there is a bubble in speculation. What worries us most are the expensive and popular stocks, sectors and themes: Tesla, clean energy, Bitcoin, funds with returns of more than 100% in 2020, IPOs that double in price on their first day of trading, and so on. I can’t help but wonder what will happen to the speculative activity if, and more likely when, governments and central banks throttle back their extraordinary support for the economy. Will there be enough money and investors to support lofty valuations?

Much like the technology mania in the late 1990s, many of today’s best-performing stocks have a lot of future potential but little or no current earnings. We are not saying that there aren’t exciting businesses and powerful new secular trends. There absolutely are. But the level of speculation in the market is getting a little extreme. Perhaps a lot extreme. If history is a guide, the hot and popular stocks and themes will remain so for some time, maybe much longer than we think. But in the fullness of time, the odds are not good that this pricey bunch will provide decent returns. Don’t let envy, greed and FOMO override sound judgement and an appreciation that investments have risks.

Please read our Odlum Brown Limited Disclaimer and Disclosure - It is important!

Odlum Brown Limited is an independent, full-service investment firm focused on providing professional investment advice and objective research. We respect your right to be informed of relationships with the issuers or strategies referred to in this report which might reasonably be expected to indicate potential conflicts of interest with respect to the securities or any investment strategies discussed or recommended in this report. We do not act as a market maker in any securities and do not provide investment banking or advisory services to, or hold positions in, the issuers covered by our research. Analysts and their associates may, from time to time, hold securities of issuers discussed or recommended in this report because they personally have the conviction to follow their own research, but we have implemented internal policies that impose restrictions on when and how an Analyst may buy or sell securities they cover and any such interest will be disclosed in our report in accordance with regulatory policy. Our Analysts receive no direct compensation based on revenue from investment banking services. We describe our research policies in greater detail, including a description of our rating system and how we disseminate our research here.

This report has been prepared by Odlum Brown Limited and is intended only for persons resident and located in all the provinces and territories of Canada, where Odlum Brown Limited's services and products may lawfully be offered for sale, and therein only to clients of Odlum Brown Limited. This report is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Odlum Brown Limited to any registration requirement within such jurisdiction or country. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this report, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed or recommended in this report.

This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information's accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice.

Please note that, as at the date of this report, the Research Analyst responsible for the recommendations herein, associates of such Analyst and/or other individuals directly involved in the preparation of this report hold securities of some of the issuer(s) referred to directly or through derivatives.

No part of this publication may be reproduced without the express written consent of Odlum Brown Limited. Odlum Brown Limited is a Member-Canadian Investor Protection Fund.