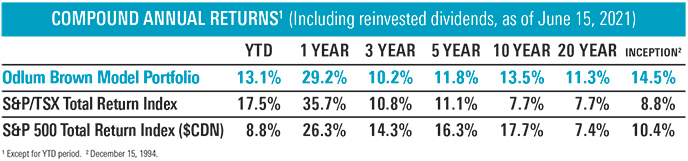

Equities have had a great first half of the year, with the Canadian and U.S. benchmarks registering gains of 17.5% and 8.8%, respectively, through to June 15, 2021. The Odlum Brown Model Portfolio* has benefited from the rising tide, advancing 13.1% over the same period.

Stocks are doing well because the economic outlook is bright. With increasing vaccination rates, economies are gradually reopening. That has stimulated impressive economic growth in the first half of 2021, and we expect the momentum to continue. There is tremendous pent-up spending potential in Canada and the U.S. due to the combination of above-trend personal income growth (thanks to government relief payments) and below-trend spending this past year (due to lockdowns). Moreover, the unprecedented levels of fiscal and monetary stimulus should help keep the world economy robust well into 2022. Economic stimulus typically takes 12 to 18 months to work its way through the economic system.

Indeed, the outlook is so bright that investors are starting to worry about higher inflation, which would put upward pressure on interest rates. While the reopening of economies has created supply bottlenecks and near-term pricing pressure in certain industries, we think the inflationary impulses will prove to be temporary. The still high level of unemployment, global competition and the deflationary influence of technology should keep inflation in check in the medium and long run.

Nonetheless, we are monitoring the rate of economic growth and inflationary pressures closely as these factors have a meaningful influence on the rate of corporate earnings growth and valuation multiples. We hedge the risk of higher inflation by owning high-quality businesses with pricing power and the ability to pass higher costs on to customers.

Popular, fast-growing firms are theoretically the most sensitive to rising inflation and interest rates, and we therefore limit our growth stock investments to those that we believe have reasonable valuations relative to their growth prospects. We tend to avoid the most speculative, highest valuation growth businesses, as we think they are the most vulnerable. We also have a good complement of attractively priced value-type stocks that have performed well in recent months as the outlook has improved. Companies that pay good dividends, in particular, have become more fashionable, and we believe that will continue because dividend yields are currently higher than bond yields.

We have made modest yet meaningful shifts in our positioning this year to take advantage of the brighter economic outlook and also to hedge against the risk of higher inflation.

We sold our position in Markel Corporation and added to our Royal Bank and Bank of Montreal holdings. With brighter economic prospects on the horizon and interest rates on the rise, the Canadian banks should experience a meaningful improvement in earnings. Moreover, we believe a sizeable amount of loan loss reserves will be added back to current earnings in future quarters as they are ultimately rendered unnecessary. That will make dividend increases and stock buybacks more likely. If we are correct about these developments, the odds are good that shares of Canadian banks will perform better than the general market.

Bank stocks are also a good hedge against higher interest rates. In general, higher interest rates exert downward pressure on stock valuations as fixed income alternatives become more competitive with stocks. However, banks’ net interest margins benefit from rising interest rates. This means that their improved earnings power in this type of environment normally more than offsets the negative influence of higher interest rates on valuations.

With Canadian energy businesses trading at steep discounts relative to their American counterparts, we sold our two U.S. energy holdings – Cabot Oil & Gas and EOG Resources – and added three Canadian firms – Tourmaline Oil Corporation, Canadian Natural Resources and Cenovus Energy.

We sold our entire stakes in SPDR Gold Shares and Amgen, and reduced our positions in Berkshire Hathaway, Alphabet and CP Rail to make room for five new companies: Vertiv Holdings, Netflix, Saputo, LendingTree and Thermo Fisher Scientific.

Vertiv has a strong position in an attractive industry, selling and servicing equipment for data centres and communication networks. Its products are essential to customers’ operations as they prevent costly disruptions caused by overheating and/or power outages. Management is highly regarded, and there is ample opportunity for the company to grow sales and expand margins, which should produce very attractive long-term earnings growth.

Vertiv has a strong position in an attractive industry, selling and servicing equipment for data centres and communication networks. Its products are essential to customers’ operations as they prevent costly disruptions caused by overheating and/or power outages. Management is highly regarded, and there is ample opportunity for the company to grow sales and expand margins, which should produce very attractive long-term earnings growth.

Netflix came on the scene in 2007 and changed the way we consume entertainment. In 2013, the company began making its own original content in addition to licensing from others. Quality content is key to attracting and retaining subscribers, and Netflix expects to spend over $17 billion on content creation this year. Disney is the only other peer with such scale and global reach. Looking forward, the runway for new subscribers is long.

Netflix came on the scene in 2007 and changed the way we consume entertainment. In 2013, the company began making its own original content in addition to licensing from others. Quality content is key to attracting and retaining subscribers, and Netflix expects to spend over $17 billion on content creation this year. Disney is the only other peer with such scale and global reach. Looking forward, the runway for new subscribers is long.

Saputo sells a variety of dairy products, including cheese and milk, under brands such as Armstrong, Dairyland, Bari and Neilson. Management is superb and very focused on ongoing productivity gains, which in turn has made the company an industry leader in profitability.

Saputo sells a variety of dairy products, including cheese and milk, under brands such as Armstrong, Dairyland, Bari and Neilson. Management is superb and very focused on ongoing productivity gains, which in turn has made the company an industry leader in profitability.

While growth prospects for the dairy industry are relatively modest, Saputo bolsters its growth by deploying its strong cash flow toward acquisitions. Management is patient and often able to improve the operations of newly acquired companies. Successful acquisitions have helped drive double-digit average annual earnings per share growth since Saputo became a public company in 1997.

LendingTree is the leading online marketplace for financial services in the United States, enabling consumers to comparison shop for loans and other financial services the same way they would for travel. The company generates referral revenue from its extensive network of financial institution partners. Management and the business model are impressive; the company has consistently gained market share and done very well with acquisitions. From 2013 to 2019, revenue increased eight-fold, with margins expanding along the way. In addition, the company has reached an inflection point with My LendingTree, a service that helps consumers monitor their financial health while identifying relevant offers from financial institutions. As revenue contribution from My LendingTree grows over time, the company can expect longer-lasting consumer relationships, more efficient marketing spend and higher margins.

LendingTree is the leading online marketplace for financial services in the United States, enabling consumers to comparison shop for loans and other financial services the same way they would for travel. The company generates referral revenue from its extensive network of financial institution partners. Management and the business model are impressive; the company has consistently gained market share and done very well with acquisitions. From 2013 to 2019, revenue increased eight-fold, with margins expanding along the way. In addition, the company has reached an inflection point with My LendingTree, a service that helps consumers monitor their financial health while identifying relevant offers from financial institutions. As revenue contribution from My LendingTree grows over time, the company can expect longer-lasting consumer relationships, more efficient marketing spend and higher margins.

Thermo Fisher Scientific

Thermo Fisher Scientific sells critical instruments and equipment such as pipettes, vials and specimen containers, as well as cold storage, water purification systems and centrifuges. It also provides disinfectants and chemical reagents used in the research and testing of new vaccines and medical treatments. With involvement in more than 50% of worldwide COVID-19 testing, the company played a significant role in responding to the pandemic. Accordingly, Thermo had a record year in 2020. Due to this remarkable “pull forward” in demand, performance expectations for the next two years are modest. Still, we believe the company will continue to be a leader and maintain its proven growth model.

Please read our Odlum Brown Limited Disclaimer and Disclosure - It is important!

* The Odlum Brown Model Portfolio is an all-equity portfolio that was established by the Odlum Brown Equity Research Department on December 15, 1994, with a hypothetical investment of $250,000. It showcases how we believe individual security recommendations may be used within the context of a client portfolio. The Model also provides a basis with which to measure the quality of our advice and the effectiveness of our disciplined investment strategy. Trades are made using the closing price on the day a change is announced. Performance figures do not include any allowance for fees. Past performance is not indicative of future performance.

Odlum Brown Limited is an independent, full-service investment firm focused on providing professional investment advice and objective research. We respect your right to be informed of relationships with the issuers or strategies referred to in this report which might reasonably be expected to indicate potential conflicts of interest with respect to the securities or any investment strategies discussed or recommended in this report. We do not act as a market maker in any securities and do not provide investment banking or advisory services to, or hold positions in, the issuers covered by our research. Analysts and their associates may, from time to time, hold securities of issuers discussed or recommended in this report because they personally have the conviction to follow their own research, but we have implemented internal policies that impose restrictions on when and how an Analyst may buy or sell securities they cover and any such interest will be disclosed in our report in accordance with regulatory policy. Our Analysts receive no direct compensation based on revenue from investment banking services. We describe our research policies in greater detail, including a description of our rating system and how we disseminate our research here.

This report has been prepared by Odlum Brown Limited and is intended only for persons resident and located in all the provinces and territories of Canada, where Odlum Brown Limited's services and products may lawfully be offered for sale, and therein only to clients of Odlum Brown Limited. This report is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Odlum Brown Limited to any registration requirement within such jurisdiction or country. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this report, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed or recommended in this report.

This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information's accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice.

Please note that, as at the date of this report, the Research Analyst responsible for the recommendations herein, associates of such Analyst and/or other individuals directly involved in the preparation of this report hold securities of some of the issuer(s) referred to directly or through derivatives.

No part of this publication may be reproduced without the express written consent of Odlum Brown Limited. Odlum Brown Limited is a Member-Canadian Investor Protection Fund.