Understanding your Life Insurance Options

By Rita Ager, CFP®, CLU, CHS, CPCA®, FEA

Insurance Specialist, Odlum Brown Financial Services Limited

There are many different reasons to purchase life insurance. For example, to:

There are many different reasons to purchase life insurance. For example, to:

- Provide financial security for dependents by replacing income lost due to the death of a family member.

- Cover the debts owed or shared by the insured, such as mortgages and other loans.

- Pay final expenses and legal costs upon settling an estate.

- Cover final taxes payable on capital gains arising on various assets, including non-registered investments, vacation and rental properties, and taxes on the deemed disposition of registered retirement accounts.

- Balance or equalize distributions between beneficiaries.

- Preserve or enhance your estate for future generations, or fund charitable bequests.

What is the best type of coverage to purchase?

There are two main types of coverage: term life insurance and permanent life insurance.

Term insurance is initially more affordable and can be automatically renewed at guaranteed rates, without additional medical questions, but coverage typically ends by around age 80 with premiums becoming much higher at each renewal.

Permanent life insurance is intended to stay in place until the death of the person(s) insured.

In deciding on the type and amount of coverage that is right for you and your family, you will want to consider variables including your age, health, budget, existing coverage and obligations, as well as your short and long-term goals.

Who should consider term life insurance?

This type of coverage is often well suited to individuals or young families when:

- More coverage is needed now at the most affordable price.

- The insurable need is expected to diminish over time. For example, after 10, 15 or 25 years, or once a mortgage, business loan or other debt is repaid.

- The term policy’s conversion options to permanent insurance (at a higher rate) would be adequate, if a more enduring need for insurance develops.

Since term insurance becomes increasingly expensive at pre-set term renewal dates, using some permanent life insurance may be more appropriate to meet certain objectives, as described below.

Who should consider permanent life insurance?

This type of coverage can be for any permanent need, such as for individuals or families who:

- Want to have the security of lifetime coverage without escalating premium costs.

- Plan to make intergenerational wealth transfers or charitable bequests, or to equalize their distribution of family or business assets.

- Plan to maximize initial income from pensions or retirement plans, using insurance to meet the needs of surviving family members.

- Want to have funds available for final expenses, probate and income taxes.

- Want the flexibility to increase their policy cash value and coverage amount through deposits that can be invested and tax-sheltered.

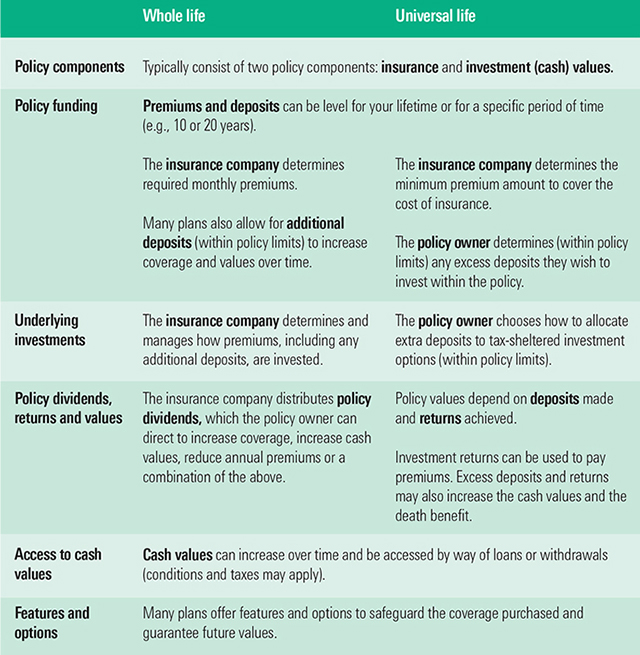

Under the umbrella of permanent life insurance, there are plans available for a wide range of insurance uses. Although product names vary, they generally fall into these two main types: whole life and universal life.

A few key commonalities and differences between these policy types follow:

When it comes to life insurance, there is no one-size-fits-all solution. To better understand your risks, clarify your objectives and explore which options best fit your needs, we invite you to consult with one of our Odlum Brown Financial Services Limited (OBFSL) insurance professionals, accessible through your Odlum Brown Investment Advisor or Portfolio Manager. As your needs or objectives change, we will be here to serve you and your family, for generations.

Odlum Brown Financial Services Limited (OBFSL) is a wholly owned subsidiary of Odlum Brown Limited offering life insurance products, retirement, estate and financial planning exclusively to Odlum Brown clients. OBFSL offers a variety of coverage options from many of Canada’s top insurance companies tailored to suit clients’ individual needs. Our licensed professionals are here to help you assess your position and then implement customized recommendations to meet your individual circumstances and needs. For more information, please contact your Odlum Brown Investment Advisor or Portfolio Manager.