Twenty-seven years ago, on December 15, 1994, our Research Department launched the Odlum Brown Model Portfolio with an initial investment of $250,000. The purpose of this hypothetical, all-equity Model was, and still is, to showcase how we believe stock recommendations may be used in client portfolios, and to measure the quality of our advice and the effectiveness of our disciplined investment strategy.

The objective of the Model is to achieve better performance than the Canadian equity benchmark, the S&P/TSX Composite Total Return Index, while limiting risk and preserving capital. Typically, the Model holds 40-45 stocks. It is well diversified across economic sectors, with an emphasis on high-quality companies with sustainable competitive advantages, conservative financial leverage and strong management. In recent years, we have felt that foreign diversification is both prudent and essential to achieving good long-term returns. The Canadian market lacks diversity and has a limited number of world-class businesses. Thus, roughly half of the portfolio is currently invested in U.S. securities.

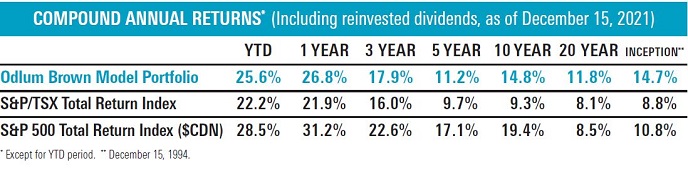

In November 2021, the value of the Model breached $10 million, marking a 40-fold increase since inception. That represents a compound annual return of 14.7%.

While we are proud of the achievement, credit for the pace by which we reached this milestone this past year really belongs to the governments and central banks that super-charged the economic recovery with unprecedented amounts of fiscal and monetary stimulus. For the year through to mid-December, the Model appreciated by 25.6%, roughly in line with a blended 50/50 Canada-U.S. equity benchmark.

The question on everyone’s mind is, “Can the good times continue?” From an economic perspective, there are reasons to believe global growth will slow materially from the impressive rate achieved in 2021. While stocks still have good long-term prospects, increased volatility and lower returns are likely in 2022.

As of writing, it appears that the Omicron variant may accelerate the already established winter-wave of COVID-19 cases and undermine economic activity. Although there are indications that Omicron is less deadly than the Delta variant, it’s proving to spread much faster. Travel restrictions and lockdowns are becoming common once again, and this time they are happening as extraordinary government support programs are ending and central banks are starting to dial back cheap and easy monetary policies.

Investors are obsessed with inflation, and for good reason. It is running at its highest level in decades, and that is creating hardship for individuals and businesses alike. Many companies are struggling with supply chain issues and labour shortages, and the lack of investment in the traditional energy sector has caused energy prices to rise meaningfully in parts of the world.

Nonetheless, we don’t fear an economic recession in the near term because there is so much fiscal and monetary stimulus in the economic pipeline. It normally takes 12-18 months for stimulus to work its way through the system, and it’s more likely that economic growth will merely revert to the slow, muddle-through pace that existed prior to the pandemic.

Social unrest due to rising wealth and income inequality has long been a major concern, and the U.S. Federal Reserve and other central banks have exacerbated the worrisome trends by buying bonds and maintaining interest rates at such low levels. While these stimulative activities were absolutely necessary in reviving the economy, they also served to inflate the value of financial assets, thereby increasing income inequality given these assets are disproportionately owned by the wealthy.

Wages are rising at a decent rate, but unfortunately they are not keeping pace with consumer price inflation. From a purchasing power perspective, the average worker’s inflation-adjusted income is falling. That likely explains why consumer confidence is extremely depressed.

While some businesses have been hurt by the pandemic and its effect on supply chains, labour availability and prices, most of the big companies that dominate the equity market benchmarks have been helped by inflationary trends. They have been able to raise prices at a faster rate than their costs have increased, which has fueled record profit margins and outstanding profit growth. The Canadian and U.S. equity benchmarks were up 22.2% and 28.5%, respectively, in 2021 (as of December 15) because the growth in earnings overwhelmingly offset a modest contraction in valuation multiples. What’s unclear is whether corporations will be able to maintain these sizeable profit margins in 2022.

There is a risk that the monetary authorities will take the proverbial punch bowl away just as the economy is slowing, which could put pressure on corporate profit margins and undermine the overall demand for stocks.

High prices are already starting to take a toll on demand for homes, automobiles and other high-priced items, and central banks have started the process of reducing monetary accommodation to tame inflationary pressures. In particular, the U.S. Federal Reserve is expected to unwind its $120 billion monthly bond-buying program over the next few months and start raising interest rates. That means there will be less liquidity in the market – that is, money looking for investments. In other words, there won’t be a liquidity-driven rising tide lifting all investment boats.

The big companies that dominate the major North American stock market averages are generally holding their own, yet that masks the fact that many stocks are not doing well. Many of the more exciting, faster-growing businesses – those that benefited from the pandemic, and also those with the most extreme valuations – have seen very significant corrections in their share prices (as of December 15, 2021). For example, the share price of the popular video conferencing company Zoom is down 67% from its high. It’s an awesome business and platform, but it’s also a very expensive stock. Peloton’s exercise bikes are similarly impressive, but its stock is down 77% from its high. Shares of DocuSign, whose product has been invaluable in helping us get paperwork completed while working remotely, are trading at a 51% discount to their peak valuation.

Investors are learning that price matters. Shares of unprofitable businesses, or those whose share prices are hard to justify based on underlying fundamentals, have performed poorly lately. Large companies have fared better than small, and developed markets have outpaced those that are still developing. These patterns typically unfold when monetary policy becomes tighter or less accommodative, which seems likely in 2022.

It’s quite possible that markets will be volatile in the near term as investors fret over the fallout from the Omicron variant and the extent to which central bankers will tighten monetary policy. Still, we have been humbled and surprised, both positively and negatively, too many times to make bold predictions about the economy or the stock market over the next six to 12 months. While a meaningful market correction is certainly possible, it’s also conceivable that the authorities will reverse course and crank up monetary accommodation, as they did in 2019.

Our focus is always three to five years out, and over that horizon we expect economic growth and inflation to moderate. Against that backdrop, we believe we own a great complement of businesses with meaningful potential to be bigger, stronger and more valuable.

We are managing the heightened near-term uncertainty of COVID-19, inflation and the general economic outlook by ensuring our Model Portfolio is well diversified, and that we own reasonably priced, high-quality businesses with the ability to grow and raise prices to offset inflationary pressures.

alumni UBC Volunteers

Vancouver, BC

Throughout 2022

Odlum Brown is proud to be the Presenting Sponsor of alumni UBC Volunteers. Through this program each year, thousands of generous UBC alumni and other volunteers share their time, knowledge and experience to build an exceptional UBC and a better world.

Recent initiatives include THE A PROJECT, developed to support community organizations focused on protecting the environment, food security, and access to education and resources. As part of this program, Odlum Brown team members wrote and sent holiday cards to local seniors, bringing cheer and encouragement to those who may be facing isolation.

For more information on the many alumni UBC Volunteers initiatives we support throughout the year, visit alumni.ubc.ca/volunteer

Please read our Odlum Brown Limited Disclaimer and Disclosure - It is important!

The Odlum Brown Model Portfolio is an all-equity portfolio that was established by the Odlum Brown Equity Research

Department on December 15, 1994, with a hypothetical investment of $250,000. It showcases how we believe individual

security recommendations may be used within the context of a client portfolio. The Model also provides a basis with which to

measure the quality of our advice and the effectiveness of our disciplined investment strategy. Trades are made using the

closing price on the day a change is announced. Performance figures do not include any allowance for fees. Past performance

is not indicative of future performance.

Odlum Brown Limited is an independent, full-service investment firm focused on providing professional investment advice and objective research. We respect your right to be informed of relationships with the issuers or strategies referred to in this report which might reasonably be expected to indicate potential conflicts of interest with respect to the securities or any investment strategies discussed or recommended in this report. We do not act as a market maker in any securities and do not provide investment banking or advisory services to, or hold positions in, the issuers covered by our research. Analysts and their associates may, from time to time, hold securities of issuers discussed or recommended in this report because they personally have the conviction to follow their own research, but we have implemented internal policies that impose restrictions on when and how an Analyst may buy or sell securities they cover and any such interest will be disclosed in our report in accordance with regulatory policy. Our Analysts receive no direct compensation based on revenue from investment banking services. We describe our research policies in greater detail, including a description of our rating system and how we disseminate our research here.

This report has been prepared by Odlum Brown Limited and is intended only for persons resident and located in all the provinces and territories of Canada, where Odlum Brown Limited's services and products may lawfully be offered for sale, and therein only to clients of Odlum Brown Limited. This report is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Odlum Brown Limited to any registration requirement within such jurisdiction or country. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this report, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed or recommended in this report.

This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information's accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice.

Please note that, as at the date of this report, the Research Analyst responsible for the recommendations herein, associates of such Analyst and/or other individuals directly involved in the preparation of this report hold securities of some of the issuer(s) referred to directly or through derivatives.

No part of this publication may be reproduced without the express written consent of Odlum Brown Limited. Odlum Brown Limited is a Member-Canadian Investor Protection Fund.