Pension Income Splitting

By

Michael Erez,

CPA, CGA, CFP®

Vice President, Director,

Odlum Brown Financial Services Limited

By Heather Rivers, BA, CFP®, FMA

Communications and Education Specialist,

Odlum Brown Financial Services Limited

When tax season arrives, one of the easiest ways to reduce your family’s tax bill is through pension income splitting, whereby spouses (including common-law partners) may split up to 50% of qualifying pension income when filing their income tax returns.

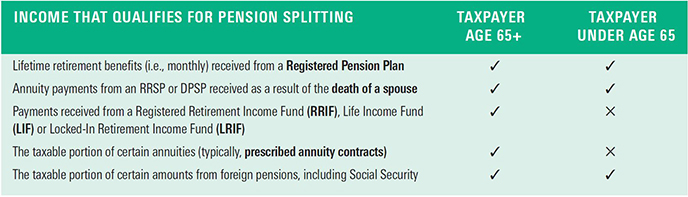

What type of income qualifies for pension splitting?1

Eligible income is not limited to traditional “pensions.” Any income that qualifies for the pension income credit qualifies for pension income splitting. While a taxpayer’s (pensioner’s) age is relevant, their spouse’s age is not.2

Lump-sum withdrawals from RRSPs do not qualify for income splitting, nor do benefits from the Canada Pension Plan (CPP) or Old Age Security (OAS). 3

Creating Qualifying Pension Income

Opportunities to create or increase income to split with your spouse may include:

- Creating or increasing withdrawals from your existing RRIFs

- Transferring all or a portion of your RRSPs to a RRIF

- Transferring all or a portion of your RRSPs to a registered annuity

- Initiating income from a registered pension plan

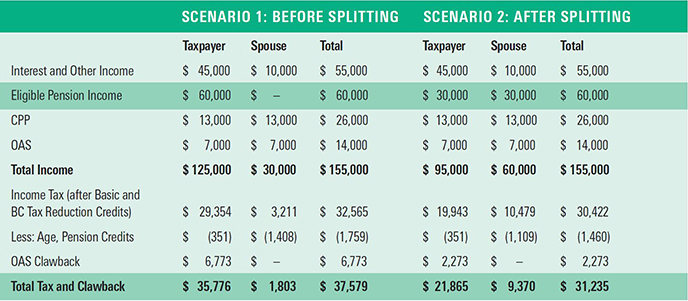

In the example below, a couple who are both aged 65 could potentially save $6,344 in income taxes and Old Age Security by splitting $30,000 (50% of the taxpayer’s eligible pension income) and both spouses claiming the pension income tax credit, based on combined 2021 Federal and BC tax rates.

How to Elect to Split Pension Income When Filing Tax Returns

To split income, you must both file Form T1032 (Joint Election to Split Pension Income). The spouse wishing to reduce their taxable income claims a deduction on Line 21000 (Deduction for elected split-pension amount) of their income tax return for up to 50% of their eligible pension income, and the other spouse must include the same amount on Line 11600 (Elected split-pension amount). How much income is split (if any) can be changed each year to suit your evolving tax situation. When deciding how to allocate income between spouses, be sure to incorporate any negative tax consequences into your analysis, such as losing OAS benefits, medical expense tax credits, age credits or child tax benefits.

If you are interested in learning more about pension income splitting, or about the products and services available through Odlum Brown Financial Services Limited, contact us through your Odlum Brown Investment Advisor or Portfolio Manager.

1 Qualifying income before age 65 is detailed here: canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/line-31400-pension-income-amount/which-pension-annuity-income-qualifies-pension-income-amount.html.

2 While a taxpayer can split eligible pension income with a spouse of any age, their spouse’s age is relevant to claim a Pension Income Credit on the spouse’s income tax return.

3 CPP ‘sharing’ is possible under separate legislation, by applying to Service Canada once both spouses have applied for CPP retirement benefits.

Odlum Brown Financial Services Limited is a wholly owned subsidiary of Odlum Brown Limited offering life insurance products, retirement, estate and financial planning exclusively to Odlum Brown clients.