Protecting Retirement Income with Permanent Life Insurance

By Rita Ager, CFP®, CLU, CHS, CPCA®, FEA

Insurance Specialist, Odlum Brown Financial Services Limited

While purchasing permanent life insurance when younger can support your planning goals throughout your lifetime, it also offers ongoing value as you approach retirement. For example, by retaining a permanent policy into retirement, the policy death benefits could be used to fill income gaps for your beneficiaries should any retirement income reduce or stop after your death. By discussing your potential needs with an insurance specialist early in life, an effective plan can be put in place when premiums are more affordable and when the policy has a longer runway to accumulate potential enhancements.

Why is replacing retirement income an important consideration?

Many individuals view government benefits such as the Canada Pension Plan (CPP) and Old Age Security (OAS) as a “base” of guaranteed retirement income. For some retirees, this guaranteed income may be supplemented by income from employer-sponsored pension plans. Whether these sources will be an important cornerstone of your overall retirement income planning, or a small but steady source of funds to supplement accumulated investments, they can accumulate to meaningful amounts over the course of retirement.

When planning as a couple, it can be helpful to consider not only your individual income sources and expenses while you are both alive, but also what changes could occur when one of you predeceases the other. In particular, if your spouse were to die prematurely, how secure would your financial future look? Would your remaining sources of retirement income be sufficient for your ongoing needs?

It can, for example, be difficult to re-enter the workplace after a period of retirement. While it may be an option to liquidate assets to make up for any lost income, withdrawing larger amounts earlier than planned in retirement may jeopardize the sustainability of your lifestyle.

Example for Peter and Grace

Consider a 65-year-old couple who recently retired. Peter and Grace each receive the maximum available CPP and OAS benefits. Peter also receives a joint life pension from his previous employer, with a 60% income continuance to Grace if he predeceases her. While his pension offered other choices, including 100% income continuance to Grace after his death, that option would have resulted in approximately $200 less in initial monthly income. They decided to take the higher initial income and hope that their current good health and strong family longevity would result in a long and healthy retirement together. Once selected, their pension choice could not be altered.

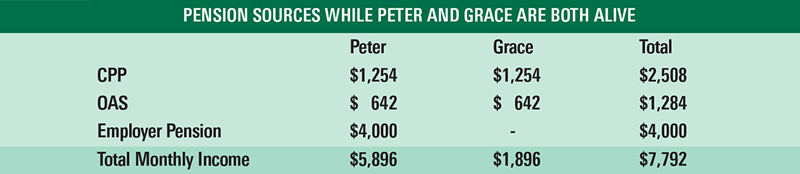

The table below summarizes Peter and Grace’s pension income sources, while they are both alive:

In addition to these pensions, Peter and Grace plan to draw enough income and capital each year from their registered and non-registered accounts to enjoy an annual retirement lifestyle spending of approximately $150,000 (before tax). Since OAS can be clawed back at higher individual income levels, they plan to split their eligible pension income, such as Peter’s employer pension and their RRIF withdrawals, on their annual income tax returns.i

What would happen to Peter and Grace’s income should either of them pass away?

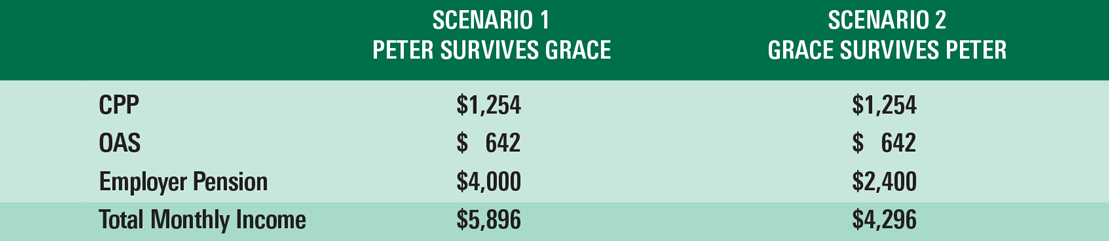

- Their household income from government benefits would decline by 50%. CPP and OAS benefits cease once a recipient passes away. While survivor benefits are sometimes available from OAS, Peter or Grace’s income would be too high to qualify for these. In addition, although Peter or Grace could apply for a CPP survivor benefit, their CPP income would not meaningfully increase since the maximum total combined CPP survivor and retirement benefit is approximately equal to the benefit they each already collect.ii

- The income from Peter’s employer pension would be reduced by 40% following Peter’s death, if Grace outlives Peter.iii After Peter’s death, Grace would continue receiving just 60% of Peter’s monthly pension ($2,400 per month, plus indexing if applicable). This reduction could significantly impact Grace’s retirement income and lifestyle, especially if Peter’s lifespan ends very prematurely.

As shown in the table below, a 25-45% decline in “core” income could be the cumulative result of these two changes following death. If Peter outlives Grace, the loss of Grace’s government benefits will reduce Peter’s core income to $5,896 per month, while if Grace outlives Peter, her income after Peter’s passing would be $4,296 per month, after the loss of his CPP, OAS and 40% of his employer pension.

- OAS may be clawed back. Although not illustrated in the table, any OAS clawback could erode Peter or Grace’s OAS income shown above. Currently, Peter and Grace enjoy full OAS benefits. However, after either of them passes away, not only are their financial assets likely to be concentrated in just one name (if they leave their estate to each other), but they will no longer be able to income split with each other on their tax returns. The resulting net income for either Peter or Grace might be enough to trigger partial or even full OAS clawback.i

Income replacement opportunities for Peter and Grace

If Grace or Peter wanted to replace just 15 years of the $22,750 per year of fully indexed income (the annual equivalent from CPP and OAS in these scenarios), they would need to withdraw an additional $201,000 (today’s dollars) from their non-registered savings. If they instead draw upon registered investments, they would need $288,000.iv

Another solution to guarantee funds after death is having permanent life insurance in place, either as individual policies, or a joint policy that would pay benefits upon the first of these spouses’ deaths. Exploring the different life insurance options available with your insurance specialist is the best way to determine which options could best fit your needs and circumstances today and into the future.

If you would like more information on the insurance options available through Odlum Brown Financial Services Limited, contact us through your Odlum Brown Investment Advisor or Portfolio Manager.

i OAS clawback begins when individual net income exceeds $81,761 in 2022 (indexed for future years); the clawback rate is $0.15 of OAS repayment per dollar of individual net income above this threshold. Pension income splitting allows up to 50% of each spouse’s eligible “pension” income to be allocated to the other spouse, when filing their annual tax returns.

ii Although a surviving spouse should apply for a CPP survivor benefit, the resulting combined CPP retirement/survivor monthly benefit is subject to a maximum amount. In our example, since both Peter and Grace already qualify for the maximum monthly CPP retirement benefit, which is nearly equal to the maximum CPP survivor/retirement benefit, any CPP increase would be negligible. To apply online, visit canada.ca/en/services/benefits/publicpensions/cpp/cpp-survivor-pension.html.

iii Although rare, some pension plans may reduce monthly benefits if a spouse pre-deceases the pensioner. This can be confirmed by contacting the pension plan administrator before selecting a pension income option.

iv Based on a 2% annual indexing assumption, 4% annual rate of return, 15-year duration and 30% marginal income tax rate on interest income earned in a non-registered account.

Odlum Brown Financial Services Limited (OBFSL) is a wholly owned subsidiary of Odlum Brown Limited offering life insurance products, retirement, estate and financial planning exclusively to Odlum Brown clients. OBFSL offers a variety of coverage options from many of Canada’s top insurance companies tailored to suit clients’ individual needs. Our licensed professionals are here to help you assess your position and then implement customized recommendations to meet your individual circumstances and needs. For more information, please contact your Odlum Brown Investment Advisor or Portfolio Manager.