Choosing a Pension Income Option

By Heather Rivers, BA, CFP®, FMA

Communications and Education Specialist,

Odlum Brown Financial Services Limited

Individuals with a defined benefit pension plan face an important decision when they retire: which lifetime monthly pension income option to choose. It is important to understand each choice and to consider what is important to you and your family for this next phase of life. After all, your choice will have far-reaching impacts for you, your spouse or common-law partner, and potentially other beneficiaries.

What options are offered?

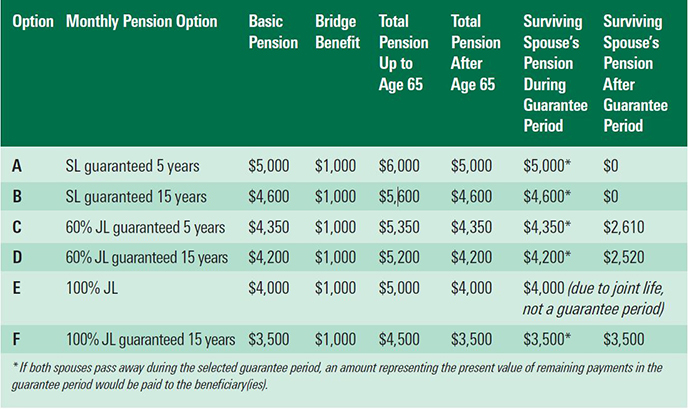

The options offered upon retirement will depend on your pension plan but typically include single life (SL) or joint life (JL) options (if you have a spouse or common-law partner), various guarantee periods, and, if retiring before turning age 65, bridging benefits and possibly supplementary temporary annuity (TA) options. Some examples are illustrated in the table below.

Single life – This monthly pension continues for your lifetime only. You can choose it only if you are single or your spouse waives their right to the minimum 60% JL pension. SL pensions offer higher monthly income than joint life options because they are based on only one life.

Joint life – This type of monthly pension continues for your and your spouse’s lifetime. If you die first, your spouse continues to receive all or a portion of your monthly pension for their lifetime, based on the percentage you selected. You must choose a minimum 60% JL pension unless your spouse waives their right to this minimum.

Guarantee period – A guarantee period determines if your beneficiary (or beneficiaries) will receive any amount from your pension after you die or, in the case of a JL pension, if both you and your spouse die within the guarantee period. The amount paid to your beneficiary would be the present value equivalent to the remaining monthly payments in the guarantee period. Choosing a short (or no) guarantee period increases your monthly pension while you are alive. After the guarantee period ends, nothing would be paid to beneficiaries.

Temporary annuity and/or bridge benefit – If you retire before age 65, your pension typically includes a bridge benefit and may also offer you the option to select a TA. Both of these are temporary benefits which stop at age 65 or upon your death, whichever happens first. As a result, your pension income declines at age 65, as illustrated above. Income from the Canada Pension Plan and/or Old Age Security often partly or fully offsets the decline.

Considerations

Each choice is actuarially equivalent, meaning that each would provide equivalent lifetime income, if certain behind-the-scenes assumptions being made by the pension perfectly match the future – for example, that you pass away on the date predicted by the pension’s average life expectancy assumption. In reality, however, your ‘best’ pension choice is an educated but imperfect guess based on the information you have at the time of selection. Here are several factors to weigh when choosing your pension option:

- Estate planning. If you have a spouse or common-law partner, generally the pension plan will consider them to be your plan beneficiary. However, your spouse can waive this right so that you can appoint other beneficiaries (such as your children from a previous relationship). If you want to ensure that some of your pension value could be passed to a beneficiary who is not your spouse, consider selecting a longer guarantee period.

- Early flexibility or lifetime security. If you retire before age 65 and a TA is available, consider whether the benefit of additional monthly income early in retirement outweighs the reduced income after you turn age 65. For example, you may want to use additional funds early in retirement for paying off a mortgage, travelling or hobbies, or to reduce your taxable income later in retirement (e.g., if you expect an inheritance or larger RRIF withdrawals). If you worry about having insufficient income later in life, you might instead prefer not selecting from TA options.

- Life expectancy. It’s worth considering SL options if your spouse’s life expectancy is meaningfully shorter than yours and they will have sufficient income from other sources if you predecease them. On the other hand, if your spouse is more likely to outlive you and has insufficient income from other sources, selecting a JL pension with a higher percentage of income continuance can better protect their retirement security.

Your income is not the only thing likely to change when you retire. In most cases, group benefits through your employer will cease. Some pensions may offer retirees an option to buy extended health, dental and/or insurance benefits through the pension plan. Before declining such coverage, be sure to review your insurance needs with an insurance specialist.

For more information about your pension and retirement income options, contact your pension plan. To discuss your retirement planning and the products and services offered by Odlum Brown Financial Services Limited, please contact us through your Odlum Brown Investment Advisor or Portfolio Manager.

Odlum Brown Financial Services Limited is a wholly owned subsidiary of Odlum Brown Limited, offering life insurance products, retirement, estate and financial planning exclusively to Odlum Brown clients.