At Odlum Brown’s Annual Address in early March, we observed that the bond market was pricing in a “Goldilocks” economic scenario whereby modest increases in interest rates would temper economic growth enough to settle inflation, but not so much that there would be a recession. We had doubts about this “just right” fairy-tale ending, and hedged portfolios for either the possibility that economic growth and inflation would be hotter or colder than anticipated.

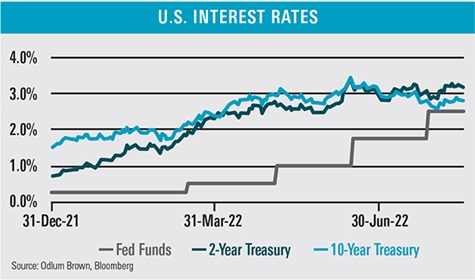

At the time, the annual U.S. inflation rate was almost 8%, up from less than 2% a year earlier, and the U.S. Federal Reserve had yet to raise interest rates. The federal funds rate was an ultra-low 0.25%, where it had been anchored since the beginning of the pandemic. The first 25-basis-point1 increase in this administered short-term rate, which influences all other interest rates, would not happen until late March 2022. Moreover, investors expected this important interest rate would only need to be gradually increased by 25-basis-point increments, to a peak of around 2%, in order to precipitate a modest economic slowdown and bring inflation back to a 2% target.

As we feared, the Goldilocks scenario didn’t pan out. The economy ran hotter than hoped, and inflation accelerated. The Federal Reserve had to get much more aggressive, and hiked its rate by 50 basis points in May, and an unusually large 75 basis points at each of its June and July meetings, bringing it to a range of 2.25-2.50%. The Bank of Canada raised its key interest rate in similar fashion.

As the pace of rate increases accelerated, stocks headed south. In fact, in June, the widely followed S&P 500 Index entered an official bear market, defined as a decline of more than 20%. Canada’s main equity benchmark, the S&P/TSX Composite Index, held up better, falling roughly half as much, as strength in commodity prices buoyed resource stocks.

What is interesting and noteworthy is that longer-term interest rates peaked and stocks bottomed within a day of the Fed’s supersized rate hike on June 15. The day before, U.S. and Canadian 10-year government bond yields peaked around 3.5% and 3.6%, respectively, and have since trended down to 2.7% and 2.8%. Those are big declines!

Since North American 10-year bond yields peaked, and through to mid-August, the S&P 500 Index produced an impressive total return of almost 15%,2 reducing its year-to-date (YTD) loss to 7.2%. Over the same period, the Canadian equity benchmark rallied less than 4%, leaving its YTD decline at 3.2%.

The wide differential in the performance of these two stock markets can be explained by the differences in their composition. The American market has a much higher concentration of growth-type stocks, in sectors like Information Technology and Consumer Discretionary, which are more sensitive to changes in interest rates. The Canadian market is more geared toward value-type businesses, like those operating in Energy and Financial Services, which are more sensitive to changes in the economic outlook.

With long-term bond rates falling over the last two months due to increasing fears of recession, growth stocks have performed much better than value stocks, which explains why the S&P 500 Index rose much faster than the S&P/TSX Composite Index.

The hypothetical, all-equity Odlum Brown Model Portfolio3 is balanced roughly 60/40 between Canadian and American-listed stocks, and has been less volatile than the benchmarks. Moreover, our security and sector selections have added value, such that the Model is back to even since the beginning of the year.

While the odds of a recession have increased, investors are once again discounting a Goldilocks scenario, believing that central banks can tame inflation with only another 125 basis points of rate increases and not much economic damage. In fact, the federal fund futures market is pointing to a peak in the U.S. federal funds rate of 3.6% in March 2023, and lower administered interest rates thereafter.

Normally, the interest rate on long-term bonds is higher than short-term bonds, but that relationship has reversed recently. The two-year U.S. Treasury yield (3.3%) is currently higher than the yield on the 10-year Treasury (2.8%). Such an inversion almost always foreshadows an economic recession.

The recent performance of corporate bonds suggests that a recession, if it occurs, will be very mild. Not only have the yields on investment-grade and riskier high-yield corporate bonds fallen in sync with the drop in long-term government bond yields, but yield spreads have narrowed considerably as well. Expectations for corporate profits have also been fairly resilient.

Both Canadian and U.S. consumer price inflation moderated slightly from very high levels in July, which is an encouraging development. Nonetheless, we worry that inflation may be stubborn, and that central banks will have to tighten monetary policy by raising rates for longer, and more aggressively, than investors currently expect.

Because labour markets remain robust, some are optimistic that inflation can be tempered without much damage to employment levels and the overall economy. Sadly, we fear that is unrealistic. In the short run, it’s unlikely that there will be a fairy-tale trade-off between economic growth and inflation. Either the economy remains buoyant and inflation persists, necessitating tighter-than-expected monetary policy, or economic growth, employment and corporate profits weaken and inflation abates.

Regardless of the near-term path for inflation, monetary policy and the economy, we are optimistic about the longer-term prospects for stocks. That is because we believe the inflation challenges of late will end a long period of monetary mismanagement.

In our view, central banks have been short-sighted, ignoring the negative and unintended consequences of overly accommodative monetary policies in the pursuit of maximizing short-term economic growth. For the better part of the last 30 years, cheap and easy money policies have encouraged excessive risk-taking and the buildup of debt, kept marginal businesses afloat and fueled income inequality through asset inflation. While asset inflation has been of great benefit to client portfolios, the accumulation of all these negative consequences over so many years has undermined the productivity, financial stability and social fabric of our society. These policies were never sustainable in the long run.

Consumers, businesses and politicians all understand and appreciate the destabilizing consequences of inflation fueled by overly accommodative monetary policies. As such, odds are good that monetary management will be more sensible and balanced in the future. That should create a stronger economic foundation and brighten the prospects for the businesses we own.

1 A basis point is 1/100th of a percent.

2 Measured in Canadian dollars and including reinvested dividends.

3 The Odlum Brown Model Portfolio was established on December 15, 1994 with a hypothetical investment of $250,000. The Model provides a basis with which to measure the quality of our advice. It also facilitates an understanding of how we believe individual security recommendations could be used within the context of a client portfolio. Trades are made using the closing price on the day a change is announced. Performance figures do not include any allowance for fees. Past performance is not indicative of future performance.

Please read our Odlum Brown Limited Disclaimer and Disclosure - It is important!

Odlum Brown Limited is an independent, full-service investment firm focused on providing professional investment advice and objective research. We respect your right to be informed of relationships with the issuers or strategies referred to in this report which might reasonably be expected to indicate potential conflicts of interest with respect to the securities or any investment strategies discussed or recommended in this report. We do not act as a market maker in any securities and do not provide investment banking or advisory services to, or hold positions in, the issuers covered by our research. Analysts and their associates may, from time to time, hold securities of issuers discussed or recommended in this report because they personally have the conviction to follow their own research, but we have implemented internal policies that impose restrictions on when and how an Analyst may buy or sell securities they cover and any such interest will be disclosed in our report in accordance with regulatory policy. Our Analysts receive no direct compensation based on revenue from investment banking services. We describe our research policies in greater detail, including a description of our rating system and how we disseminate our research here.

This report has been prepared by Odlum Brown Limited and is intended only for persons resident and located in all the provinces and territories of Canada, where Odlum Brown Limited's services and products may lawfully be offered for sale, and therein only to clients of Odlum Brown Limited. This report is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Odlum Brown Limited to any registration requirement within such jurisdiction or country. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this report, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed or recommended in this report.

This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information's accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice.

Please note that, as at the date of this report, the Research Analyst responsible for the recommendations herein, associates of such Analyst and/or other individuals directly involved in the preparation of this report hold securities of some of the issuer(s) referred to directly or through derivatives.

No part of this publication may be reproduced without the express written consent of Odlum Brown Limited. Odlum Brown Limited is a Member-Canadian Investor Protection Fund.