Governments and central banks did a remarkable job of avoiding a depression when economies locked down due to COVID-19. By providing individuals, businesses and governments with enormous and unprecedented financial support, the world experienced the shortest economic recession and fastest recovery on record.

Unfortunately, the success also fuelled a surge in inflation, which is currently running at rates last seen in the early 1980s. While the war in Ukraine has definitely added pressure, hugely expansionary fiscal and monetary policies were the primary fuels for rising prices. Authorities simply stimulated too much demand for goods and services at a time when the world was struggling with supply. It is elementary economics: prices rise when demand is greater than supply.

Inflation is universally disliked. When the cost of living rises faster than incomes, individuals struggle to make ends meet. Business leaders see profit margins squeezed when they can’t find workers and/or raise prices faster than costs. Investors become nervous and fearful because asset prices fall when inflation is out of control. Politicians naturally get blamed and risk losing their jobs. Central bankers face the unpleasant task of fixing inflation by raising interest rates.

Naturally, everyone would like to believe that inflation will abate without too much economic pain. Optimists point to significant drops in the price of things like gasoline, lumber and used cars as reasons to believe the authorities are winning the war against inflation. They are right, to a degree. However, realists appreciate that it’s the price of services – not goods – fuelling consumer price inflation today. The service sector is much larger than the goods sector, and there is a wage-price dynamic causing inflation to accelerate. Because the unemployment rate is low and job openings are plentiful, workers are getting significant pay increases. With those, workers can afford to pay more for goods and services, and companies are able to pass on higher costs. If jobs remain plentiful and pay raises continue, the cycle repeats. It’s hard to believe inflation will drop in such a scenario.

In the late 1970s and early 1980s, authorities were slow to appreciate the wage-price dynamic, and it got out of control. Inflation accelerated to very high levels, and the U.S. Federal Reserve ultimately had to raise administered interest rates to 20% to break the wage-price spiral and subdue inflation, causing nasty back-to-back recessions in 1980 and 1981.

Unfortunately, higher unemployment and an economic recession are likely the necessary evils needed to reduce inflation and put the world on healthier ground. The U.S. Federal Reserve and other central banks are aiming to bring demand and supply back into balance by increasing interest rates. Individuals and businesses borrow and spend less when interest rates rise, which ultimately results in people losing their jobs. Putting people out of work is harsh medicine indeed, but the alternative of letting high inflation persist would ultimately produce worse economic outcomes for everyone.

While investors fret about how much more central banks will increase rates and the dismal near-term outlook for the economy, we see several reasons to be optimistic about the long term.

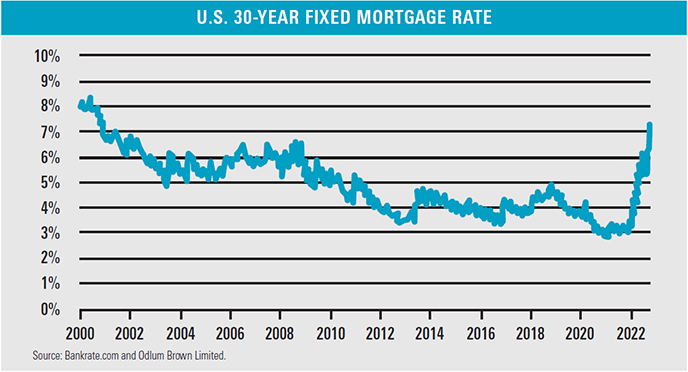

First, we believe interest rates have already increased to levels that should produce a meaningful economic contraction and enough weakness in labour markets to arrest the wage-price spiral. The administered short-term interest rates, which are controlled by central banks and are the building blocks for all other rates, have increased dramatically. The U.S. Federal Reserve and the Bank of Canada have increased rates sharply from near zero to 3.25% in the U.S. and 3.75% in Canada this year alone. Meanwhile, market-based interest rates, including government and corporate bonds, mortgage rates, credit cards and auto loans, have increased much more. In fact, U.S. government bond yields are back to where they were during the 2008/09 financial crisis. Similarly, investment-grade corporate bond yields are at a 13-year high of 6.25%. High-yield bonds are close to 10%, which is very near the peaks in 2011 and 2016, and not much lower than the highs reached at the start of the pandemic in early 2020. Most extreme of all is the more than 7% interest rate on U.S. 30-year fixed-rate mortgages, the highest since 2000.

There is always a meaningful lag before changes in interest rates have an economic impact, but we believe the necessary and harsh medicine is already in the economic pipeline. Stocks are more sensitive to changes in market interest rates than administered central bank rates, and we doubt market rates will rise much further, if at all. Stocks may be near their bottom, if market interest rates are near their peak.

Stock prices are depressed, and investor sentiment is extremely negative – additional reasons to be constructive. According to the Bank of America’s latest monthly survey of global fund managers, professional investors are more bearish about stocks than at any time in the last two decades. Fund managers viewed the world as relatively safe at the beginning of the year, but now they see risks as elevated as they were in 2008. Sentiment regarding the outlook for corporate earnings is as negative as it has been since the survey started.

Negative sentiment is a positive from a contrarian perspective. The odds of generating attractive returns over a three to five-year horizon are always better when sentiment is gloomy and valuations are depressed, rather than when investors are optimistic and stock prices are near their highs.

While it might seem counterintuitive to invest when there is so much to worry about, it’s important to appreciate that the market is forward looking. Stocks, bonds and other assets have performed very poorly this year because investors know that getting inflation down requires tough economic action. They know conditions will get worse before they get better, and they have marked down stock prices accordingly.

In time, and perhaps soon, investors will come to realize that the medicine is working. By the time unemployment is rising and inflation is falling, the market will probably be anticipating a healthier economy, better corporate profits and higher stock prices.

Please read our Odlum Brown Limited Disclaimer and Disclosure - It is important!

Odlum Brown Limited is an independent, full-service investment firm focused on providing professional investment advice and objective research. We respect your right to be informed of relationships with the issuers or strategies referred to in this report which might reasonably be expected to indicate potential conflicts of interest with respect to the securities or any investment strategies discussed or recommended in this report. We do not act as a market maker in any securities and do not provide investment banking or advisory services to, or hold positions in, the issuers covered by our research. Analysts and their associates may, from time to time, hold securities of issuers discussed or recommended in this report because they personally have the conviction to follow their own research, but we have implemented internal policies that impose restrictions on when and how an Analyst may buy or sell securities they cover and any such interest will be disclosed in our report in accordance with regulatory policy. Our Analysts receive no direct compensation based on revenue from investment banking services. We describe our research policies in greater detail, including a description of our rating system and how we disseminate our research here.

This report has been prepared by Odlum Brown Limited and is intended only for persons resident and located in all the provinces and territories of Canada, where Odlum Brown Limited's services and products may lawfully be offered for sale, and therein only to clients of Odlum Brown Limited. This report is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Odlum Brown Limited to any registration requirement within such jurisdiction or country. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this report, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed or recommended in this report.

This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information's accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice.

Please note that, as at the date of this report, the Research Analyst responsible for the recommendations herein, associates of such Analyst and/or other individuals directly involved in the preparation of this report hold securities of some of the issuer(s) referred to directly or through derivatives.

No part of this publication may be reproduced without the express written consent of Odlum Brown Limited. Odlum Brown Limited is a Member-Canadian Investor Protection Fund.