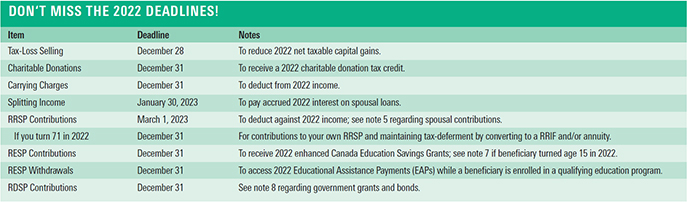

With December upon us, here are a number of tax considerations and deadlines to remember for the 2022 tax year. Please note that December 31 is a Saturday this year. Plan your contributions and withdrawals accordingly.

Payments, Expenses and Other Transactions

1. Tax-Loss Selling – Selling non-registered investments with unrealized capital losses before year-end can offset capital gains realized in 2022. While this strategy may offer tax advantages, ensure that it also makes sense from an investment perspective. Trades must be placed on Canadian securities exchanges no later than December 28 to settle in time to report in the 2022 tax year. Foreign exchanges may have different deadlines. Losses unused in 2022 can be carried back to offset capital gains from the three preceding years (2021, 2020 and 2019) or carried forward to claim in any future year.

Beware of “superficial loss” rules which deny a capital loss if you or your spouse buys an identical investment within 30 days before or after the settlement date, including in an RRSP, RRIF, TFSA or a company controlled by you or your spouse. Denied losses generally increase the adjusted cost base of the purchased identical investment, which may reduce future capital gains.

2. Charitable Donations – The first $200 of annual donations are eligible for a 15% federal tax credit plus the applicable provincial credit (5.06% in BC). Donations in excess of $200 are eligible for higher combined credits (up to 53.5% in BC). Donating eligible securities “in kind” results in no taxable capital gain while receiving a donation tax credit for the donated securities.

3. Carrying Charges – Investment-related fees, charges and interest paid on money borrowed for most investment purposes (other than in registered accounts) must be paid by December 31 to be deductible in 2022.

4. Splitting Income – The deadline to pay 2022 interest on spousal loans is January 30, 2023. Contrast this with pension income splitting rules, which allow you to allocate to your spouse or partner up to 50% of your eligible pension income by filing an election with your 2022 income tax returns. Eligible pension income includes your RRIF and LIF payments if you are at least age 65 at the end of 2022, and life annuity payments from a registered pension plan at any age.

Contributions to Registered Plans

5. Registered Retirement Savings Plans (RRSPs) – You can use your unused RRSP contribution room to contribute to your own RRSP until December 31 of the year in which you turn 71, or to a spousal RRSP until December 31 of the year in which they turn 71. Contributing to a spousal RRSP in 2022 reduces the income attribution period by one calendar year compared to a contribution made in 2023. If you have a considerable amount of contribution room, consider maximizing your contributions now, but deducting your contributions over multiple years, depending on your current and expected future taxable income and credits.

6. Tax-Free Savings Accounts (TFSAs) – There is no deadline for TFSA contributions. Unused contribution room is carried forward to be used in future years. If you plan to withdraw from TFSAs in the near future, consider making the withdrawal in December 2022, rather than in 2023. This can enable earlier re-contributions (as early as January 1, 2023), since TFSA withdrawals increase your contribution room the following calendar year.

7. Registered Education Savings Plans (RESPs) – If an RESP beneficiary is enrolled in a qualifying post-secondary educational program, December 31 is the deadline to withdraw an Educational Assistance Payment (EAP) for 2022, taxable to the student. If your child turned 15 in 2022, December 31 is also the last chance to ensure future CESG eligibility at ages 16 and 17 (in 2023 and 2024), by satisfying minimum RESP contributions.

8. Registered Disability Savings Plans (RDSPs) – RDSPs are tax-deferred long-term savings plans for an individual who is eligible for the disability tax credit. Lifetime contributions of up to $200,000 can be made by anyone until the beneficiary turns 59, and can create access to federal government assistance in the form of Canada Disability Savings Grants (CDSGs) and Bonds (CDSBs) for up to 10 previous calendar years, until December 31 of the year in which the beneficiary turns 49. RDSP contributions are not tax-deductible.

Odlum Brown Financial Services Limited (OBFSL) is a wholly owned subsidiary of Odlum Brown Limited offering life insurance products, retirement, estate and financial planning exclusively to Odlum Brown clients.