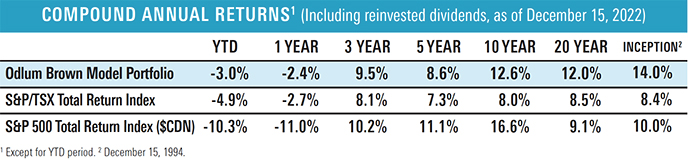

A year ago, we celebrated the Odlum Brown Model Portfolio’s* 27th anniversary and a valuation of $10 million. That marked a 40-fold gain from the initial investment of $250,000 in our hypothetical portfolio in 1994. We credited governments and central banks, and the unprecedented levels of fiscal and monetary stimulus they unleashed to supercharge the economic recovery, for the pace by which we breached the $10 million milestone. In 2021, the Model appreciated by 26%. This past year, the Model was down 3.0% as of mid-December, a meaningful recovery from a year-to-date loss of nearly 10% in mid-July.

We are grateful that our Model has held up as well as it has, considering the unexpected persistence of high inflation and the dramatic rate by which central banks have raised interest rates to get it under control. Indeed, the Bank of Canada and the U.S. Federal Reserve increased administered short-term interest rates seven times during 2022, from an upper bound of 0.25% in early March to 4.25% and 4.5%, respectively, by the end of the year. It was the fastest and most aggressive tightening of monetary policy since the early 1980s.

A year ago, we did not foresee a recession on the horizon as there was too much fiscal and monetary stimulus in the economic pipeline. It usually takes 12 to 18 months for stimulus to have an impact on the economy, so we expected growth to revert to the slow, muddle-through state that existed prior to the pandemic. And growth did reduce: according to the latest estimate from the International Monetary Fund, global growth slowed from 6.0% in 2021 to 3.2% in 2022.

The economic outlook for 2023 is uninspiring. The fiscal and monetary restraint implemented in 2022 will have a meaningful dampening effect as it works its way through the economic system. Government deficits declined significantly last year, as extraordinary assistance programs ended, and there is little support for big government spending in the near term, given the inflationary pressures in the economy. Interest rates on mortgages, corporate loans and government bonds increased considerably in lockstep with changes in administered interest rates. Moreover, the money supply began to shrink in the latter part of 2022, as central banks’ quantitative easing was replaced by quantitative tightening. In other words, central banks started selling some of the bonds and mortgage-backed securities they had bought during the pandemic.

The dour economic outlook no doubt makes it hard to be excited about the stock market, yet it’s important to remember that markets are forward looking. Investors, corporate leaders and consumers expect tougher times, and much of that pessimism is already discounted in share prices. That’s positive from a contrarian perspective. While the exact timing and level of a market bottom is impossible to predict, the stock market has always resumed its upward march well before the trough in the economy.

The bond market is sending a strong indication that a recession and lower inflation and interest rates are on the horizon. The yield on long-term government bonds is currently lower than the yield on short-term government bonds. This has created what pundits refer to as an inverted yield curve. It’s an unusual condition that typically happens before a recession. Under normal and healthy conditions, investors are rewarded with higher yields on longer-term bonds to compensate for greater risk.

We view the inversion of the yield curve positively. As we explained in our November 2022 Odlum Brown Report, "Harsh Medicine for a Healthier Future," higher unemployment and an economic recession are likely the necessary evils we need to put the world on healthier ground and arrest crippling inflation.

In fact, our hope is that the battle to extinguish inflation will end an era of monetary mismanagement and set the stage for a reversal of several of the negative unintended consequences of overly accommodative monetary policies.

Central banks reduce interest rates during a recession or economic crisis to stimulate the economy and create jobs. Lower interest rates have three distinctly positive influences on the economy: (1) they encourage consumers to borrow and spend; (2) they motivate entrepreneurs and business leaders to expand existing businesses or create new ones; and (3) they inflate asset values and make people feel richer, which in turn fuels greater spending.

While we are grateful that central banks ease monetary conditions to moderate the pain that comes with economic setbacks, we feel they have lost their way in recent decades and overplayed their role. They have forgotten that the economic cycle serves an important, cleansing purpose, which fortifies society’s economic foundation. Cheap and easy money policies have very real and negative consequences that undermine our financial stability, productivity and social fabric.

For each of the positive influences, lower interest rates have three distinctly damaging effects over the long term: (1) they encourage excessive risk taking and debt leverage; (2) they lead to a misallocation of resources toward unproductive or less productive activities; and (3) they fuel inequality, as wealthy people own a disproportionate amount of the assets that get inflated by low interest rates.

The buildup of these consequences has been considerable since the 2008 financial crisis, as the Bank of Canada and U.S. Federal Reserve kept administered interest rates near zero for nine of the last 14 years. Global debt leverage is at an unprecedented level, productivity is depressed and social unrest is the worst we have seen in decades. The good news is that the normalization of interest rates will help reverse some of that. Consumers, businesses and governments will be motivated to reduce leverage. Unprofitable and unproductive businesses will go bankrupt or be scaled back, freeing up much-needed labour and resources in short supply elsewhere in the economy. The downward revaluation of assets will also help narrow the divide between the haves and the have-nots.

The recklessness and possible fraud that has become apparent in the crypto industry is a great example of all three damaging consequences and their reversal. Greed and the promise of easy money caused investors to take excessive risks. Fortunes were made and lost, and now investors are being more cautious. Unproductive jobs are being eliminated, and businesses elsewhere in the economy are finding it easier to attract good employees. The bursting of the crypto bubble has thus far destroyed more than $2 trillion of value.

Considerable wealth and froth have been expunged from other formerly popular and speculative areas of the market, including non-profitable technology businesses, initial public offerings, meme stocks (like GameStop) and special purpose acquisition companies (SPACs). Even the formidable FAANGM equities – Meta (formerly Facebook), Apple, Amazon, Netflix, Alphabet (Google) and Microsoft – saw their Canadian dollar values decline an average of 37% in 2022.* Home prices inflated substantially during the pandemic, and they too are starting to come down in the face of higher mortgage rates.

While nobody likes seeing values decline, the asset inflation we’ve experienced in recent years has created significant inequality, which in turn has fueled disturbing social unrest. We believe the unwinding of speculative excesses will go a long way to creating a better environment for investing in the long run.

In order to ensure inflation remains under control, central banks are not likely to revert to ultra-low interest rates and abundant financial liquidity. Investment discipline will be much more important over the next 10 years than it has been over the past decade. Owning high-quality businesses with competitive advantages, solid profit margins, high returns on capital and strong balance sheets will matter much more, as will the price one pays for these businesses.

We are confident that our well-diversified portfolio of high-quality, reasonably priced businesses will serve us well in both the near term and the long run.

*As of December 15, 2022

Please read our Odlum Brown Limited Disclaimer and Disclosure - It is important!

The Odlum Brown Model Portfolio is an all-equity portfolio that was established by the Odlum Brown Equity Research Department on December 15, 1994, with a hypothetical investment of $250,000. It showcases how we believe individual security recommendations may be used within the context of a client portfolio. The Model also provides a basis with which to measure the quality of our advice and the effectiveness of our disciplined investment strategy. Trades are made using the closing price on the day a change is announced. Performance figures do not include any allowance for fees. Past performance is not indicative of future performance.

Odlum Brown Limited is an independent, full-service investment firm focused on providing professional investment advice and objective research. We respect your right to be informed of relationships with the issuers or strategies referred to in this report which might reasonably be expected to indicate potential conflicts of interest with respect to the securities or any investment strategies discussed or recommended in this report. We do not act as a market maker in any securities and do not provide investment banking or advisory services to, or hold positions in, the issuers covered by our research. Analysts and their associates may, from time to time, hold securities of issuers discussed or recommended in this report because they personally have the conviction to follow their own research, but we have implemented internal policies that impose restrictions on when and how an Analyst may buy or sell securities they cover and any such interest will be disclosed in our report in accordance with regulatory policy. Our Analysts receive no direct compensation based on revenue from investment banking services. We describe our research policies in greater detail, including a description of our rating system and how we disseminate our research here.

This report has been prepared by Odlum Brown Limited and is intended only for persons resident and located in all the provinces and territories of Canada, where Odlum Brown Limited's services and products may lawfully be offered for sale, and therein only to clients of Odlum Brown Limited. This report is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Odlum Brown Limited to any registration requirement within such jurisdiction or country. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this report, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed or recommended in this report.

This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information's accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice.

Please note that, as at the date of this report, the Research Analyst responsible for the recommendations herein, associates of such Analyst and/or other individuals directly involved in the preparation of this report hold securities of some of the issuer(s) referred to directly or through derivatives.

No part of this publication may be reproduced without the express written consent of Odlum Brown Limited. Odlum Brown Limited is a Member-Canadian Investor Protection Fund.