Staying Ahead of Property and Related Taxes

By Heather Rivers, BA, CFP®, FMA, CPCA®

Communications and Education Specialist,

Odlum Brown Financial Services Limited

In addition to paying your basic annual property taxes each year, have you checked whether you need to make additional tax filings or pay further taxes?

Whether you own a principal residence, a recreational property, a rental property, a property left vacant for part or all of the year, or a property outside of BC, it can be daunting to stay on top of all of the tax filings and deadlines which may impact you.

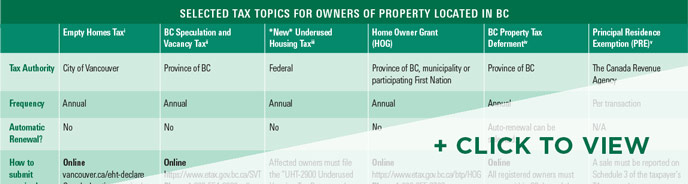

The following table highlights some common property-related tax topics to be aware of:

Tax Relief

While tax relief may be available through exemptions or reduction, these can vary widely between each tax program. For example, while the exemption for a principal residence under the Empty Homes Tax is determined per property, exemptions for the BC Speculation and Vacancy Tax or for the Underused Housing Tax are determined per owner, so any non-exempt co-owners pay these taxes based on their percentage ownership. In addition, life changes such as a medical event, work relocation or death impacting one or more property owners may also alter the tax exposure for the property. The links in the endnotes can be used to access more details for each program.

Reserve or Treaty Lands: Holding a rental, speculation or vacation property on reserve or treaty lands may be more tax-effective since these are not included in the taxable regions for the Vancouver Empty Homes Tax, BC Speculation and Vacancy Tax, or federal Underused Housing Tax.

Rental Homes: Owners who do not live in a home as their principal residence but rent part or all of it out at least six months per year in periods of one month or longer may be exempted from the City of Vancouver Empty Homes Tax, BC Speculation and Vacancy Tax, and federal Underused Housing Tax (check tenancy requirements with each program).

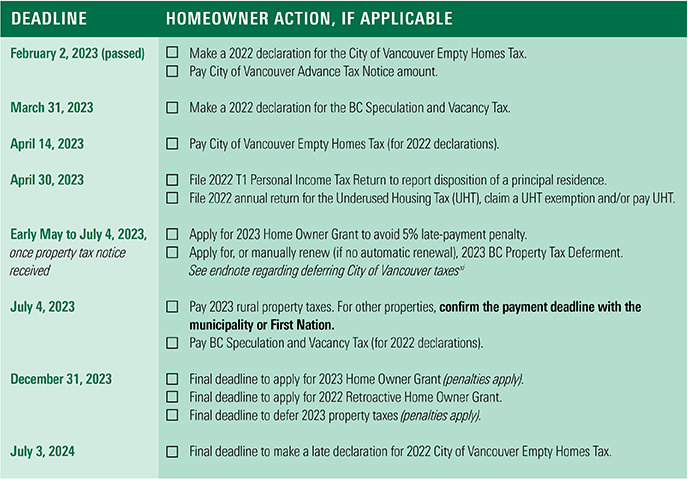

Since significant penalties can result from failing to comply with tax and declaration requirements, consider seeking professional tax advice to manage your tax exposure. For more information, please contact your Odlum Brown Investment Advisor or Portfolio Manager.

i vancouver.ca/home-property-development/empty-homes-tax.aspx

ii gov.bc.ca/gov/content/taxes/speculation-vacancy-tax/faq-speculation-and-vacancy-tax

iii canada.ca/en/services/taxes/excise-taxes-duties-and-levies/underused-housing-tax.html

iv gov.bc.ca/gov/content/taxes/property-taxes/annual-property-tax/defer-taxes

v canada.ca/en/revenue-agency/services/tax/technical-information/income-tax/income-tax-folios-index/series-1-individuals/folio-3-family-unit-issues/income-tax-folio-s1-f3-c2-principal-residence.html. Ask your Odlum Brown Investment Advisor or Portfolio Manager or visit our Client Centre for a copy of our article, “The Principal Residence Exemption.”

vi For 2022 declarations (due March 31, 2023), impacted regions were generally: Capital Regional District; Metro Vancouver Regional District; Districts of Lantzville and Mission; Cities of Abbotsford, Chilliwack, Kelowna, West Kelowna and Nanaimo; and UBC and the University Endowment Lands, with exemptions for islands accessible only by air or water such as Salt Spring Island, Juan de Fuca Electoral Area, Southern Gulf Islands and Bowen Island, per the following: https://www2.gov.bc.ca/gov/content/taxes/speculation-vacancy-tax/how-tax-works/taxable-regions. The geographic regions subject to the BC Speculation and Vacancy Tax in 2023 for declarations due by March 31, 2024, are expanding to include North Cowichan, Duncan, Ladysmith, Lake Cowichan, Lions Bay and Squamish, per https://news.gov.bc.ca/releases/2022FIN0028-001137.

vii https://www2.gov.bc.ca/gov/content/taxes/speculation-vacancy-tax/how-tax-works/terms-definitions#untaxed-worldwide-earner

viii A credit up to $2,000 is available for Canadian residents; foreign owners/satellite families may reduce their 2% rate to as low as 0.5% through a 20% credit on BC income.

ix The ‘1+’ in the calculation allows a property to be covered for one extra year when there is overlap with another eligible property but isn’t available if the taxpayer was a non-resident of Canada in the year of purchase.

x grantthornton.ca/insights/flipping-a-house-your-gain-could-be-fully-taxable-under-proposed-new-rule

xi City of Vancouver residents with advance and main property tax payment deadlines should pay the advance notice amount to avoid the 5% late-filing fee, then defer the main notice amount. In subsequent years, the advance notice amount will be $0.

Odlum Brown Financial Services Limited is a wholly owned subsidiary of Odlum Brown Limited, offering life insurance products, retirement, estate and financial planning exclusively to Odlum Brown clients.