On March 28, 2023, Canadian Deputy Prime Minister and Minister of Finance Chrystia Freeland delivered the government’s 2023 federal budget, anticipating a deficit of $43 billion for 2022-231 and forecasting deficits of $40.1 billion for 2023-24 and $35 billion for 2024-25. Here is a brief overview of some notable proposals affecting individuals and business owners.

No changes are proposed to personal or corporate tax rates nor to the capital gains inclusion rate or principal residence exemption. However, the budget proposes to make changes to the Alternative Minimum Tax (AMT) calculation to further focus on high-income taxpayers.

Individuals

Registered Accounts

Tax-Free First Home Savings Account (FHSA)

Budget 2022 introduced the First Home Savings Account (FHSA), a registered plan that allows individuals to make tax-deductible contributions, earn investment income tax-free and make withdrawals tax-free for the purchase of a first home.2 Eligible individuals can contribute up to $8,000 annually, up to $40,000 over their lifetime.

Budget 2023 confirmed the legislation’s effective date of April 1, 2023. Most financial institutions are working toward launching the FHSA in late 2023.

Registered Education Savings Plan (RESP)

When a child withdraws funds for post-secondary education, the return of contributions is tax-free, whereas CESGs and investment income and growth withdrawn are taxable to the child. This taxable income is known as an Educational Assistance Payment (EAP).

To address the increasing cost of education, the budget proposes that, effective March 28, 2023, EAP withdrawals during the first 13-week period of post-secondary education be increased to:

- $8,000 (up from $5,000) for beneficiaries enrolled in full-time programs, and

- $4,000 (up from $2,500) for beneficiaries enrolled in part-time programs.

Effective immediately, the budget proposes to allow divorced or separated parents to open joint RESPs for one or more of their children, or to transfer an existing joint RESP to another financial institution.

Registered Disability Savings Plan (RDSP)

A Registered Disability Savings Plan (RDSP) is a savings plan designed to help family members prepare for the long-term financial security of a person with a severe and prolonged mental or physical impairment.

A lifetime maximum of $200,000 can be contributed to an RDSP.

Temporary rules, set to expire December 31, 2023, allow a “qualifying family member” (QFM) to open an RDSP and be the holder if no qualifying person is authorized to act on behalf of an adult beneficiary and the opinion of the RDSP issuer is that the beneficiary’s contractual competency is in doubt. A QFM includes the individual’s parent and spouse or common-law partner (unless living apart due to a breakdown in their marriage or partnership).

Budget 2023 proposes to broaden the definition of QFM to include a sibling of the beneficiary who is 18 years of age or older. The proposed expansion of the QFM definition will apply as of royal assent of the legislation and be in effect until December 31, 2026. A sibling who becomes a QFM and plan holder before the end of 2026 can remain the plan holder after 2026.

Other

Alternative Minimum Tax (AMT)

The Alternative Minimum Tax (AMT) is a parallel tax calculation that establishes a minimum level of tax for taxpayers who would otherwise pay little or no tax by claiming certain tax deductions and credits. The AMT is based on an “adjusted taxable income” calculation that allows fewer deductions, exemptions and credits than under the regular income tax calculation. Taxpayers pay the AMT or their regular tax liability, whichever is highest. Additional tax paid as a result of the AMT can generally be carried forward for seven years and credited against future personal tax liabilities to the extent it exceeds AMT in those years.

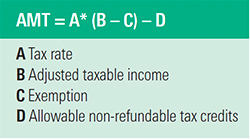

The current AMT calculation applies a flat 15% tax rate (A) to adjusted taxable income (B) that exceeds a $40,000 exemption (C). The AMT is then reduced by a number of allowable non-refundable tax credits (D).

3

To better target the AMT to high-income individuals, Budget 2023 proposes several changes to its calculation, including broadening the AMT base by further limiting tax preferences (i.e., exemptions, deductions and credits), increasing the AMT exemption and raising the AMT tax rate.

Broadening the AMT Base

Capital Gains and Stock Options

Under the regular tax calculation, 50% of capital gains are taxable. The government has not proposed any changes to the regular capital gains inclusion rate. Under the AMT calculation, the capital gains inclusion rate is 80%. The budget proposes an increase to the AMT capital gains rate to 100% while keeping capital loss carry-forwards and allowable business investment losses to be deductible at 50% in the AMT calculation. The budget also proposes that 100% of the benefit associated with employee stock options be included in the AMT base.

Lifetime Capital Gains Exemption

Under current rules, 30% of capital gains eligible for the lifetime capital gains exemption are included in the AMT base. The government proposes to maintain this treatment.

Donations of Publicly Listed Securities

In addition to receiving a tax receipt for the value of the donation, capital gains that would otherwise be taxable on disposing of securities can be eliminated when donating publicly listed securities in kind. For AMT purposes, the government proposes to include 30% of capital gains on donations of publicly listed securities in the AMT base, mirroring the AMT treatment of capital gains eligible for the lifetime capital gains exemption.

Deductions and Expenses

Under the proposed rules, the AMT base would be broadened by limiting a number of deductions by 50%, including employment expenses (other than those to earn commission income), moving expenses, childcare expenses, interest and carrying charges incurred to earn income from property, deduction for limited partnership losses of other years, and non-capital loss carryovers.

Non-Refundable Credits

Currently, most non-refundable tax credits can be credited against the AMT. The government proposes that only 50% of non-refundable tax credits would be allowed to reduce the AMT, subject to a few exceptions.

The proposed AMT would continue to use the cash (not grossed-up) value of Canadian dividends and fully disallow the dividend tax credit.

Raising the AMT Exemption

The government proposes to increase the exemption from $40,000 to the start of the fourth federal tax bracket. Based on expected indexation for the 2024 taxation year, this would be increased to approximately $173,000. The exemption amount would be indexed annually to inflation.

Increasing the AMT Rate

The government proposes to increase the AMT rate to 20.5% (from 15%), corresponding to the rates applicable to the second federal income tax bracket.

The proposed changes would come into effect beginning in 2024. Additional details will be released later this year.

The Grocery Rebate

To address the increasing cost of living, the budget proposes to enhance the existing GST credit by offering Canadians with low-to-modest incomes a one-time grocery rebate of up to $225 for seniors, $153 per adult and $81 per child. Single adults may be eligible to receive an additional $81 supplement.

Automatic Tax Filing

To ensure more low-income Canadians can quickly and easily auto-file their tax returns, Budget 2023 announces the government’s plan to increase the number of eligible Canadians for File My Return to two million by 2025.

Corporations

Intergenerational Share Transfers

Budget 2023 proposes to close certain loopholes in Bill C-208 relating to corporate surplus stripping transactions. A surplus strip generally involves disposing of the shares of a corporation to a non-arm’s-length (NAL) corporation, resulting in a capital gain rather than the shareholder extracting the value of the first corporation as a dividend. Where the lifetime capital gains exemption can be claimed on the disposition, the shareholder can further reduce or eliminate the tax arising from the transaction.

In 1985, the government instituted an anti-avoidance provision known as Section 84.1 which, where specific criteria are met, recharacterizes the capital gain as a deemed dividend.

The Budget 2023 proposals will require that the purchasing family member (or other NAL entity) continues to be actively engaged on a regular and continuous basis in the business, and that they retain legal control over the corporation for a period not less than 36 months. Additional criteria have been outlined in the budget.

These measures would apply to transactions occurring on or after January 1, 2024.

Budget 2023 can be viewed online in its entirety on the Department of Finance Canada’s website and is subject to parliamentary approval.

For more information, please contact your Odlum Brown Investment Advisor or Portfolio Manager.

1 Ending March 31, 2023.

2 For the purpose of opening an FHSA, you will be considered a first-time home buyer if, at any time in the calendar year before the account is opened or at any time in the preceding four calendar years, you did not live in a qualifying home as your principal residence that either you owned, or your spouse or common-law partner owned.

3 For the full AMT calculation, see CRA Form T691.

Odlum Brown Financial Services Limited (OBFSL) is a wholly owned subsidiary of Odlum Brown Limited offering life insurance products, retirement, estate and financial planning exclusively to Odlum Brown clients.