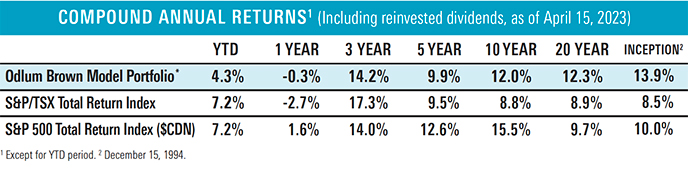

Stocks have recovered impressively following the downdraft in the wake of the recent U.S. bank failures. As of mid-April, the Canadian and U.S. equity benchmarks were both up 7.2%, year to date. The Odlum Brown Model Portfolio gained 4.3% over the same period.

While we are always disappointed when we don’t keep pace with the general market, it’s not unusual for our Model to underperform in a fast-rising market. In fact, we have outperformed the benchmarks over the long term by modestly underperforming in rising markets and losing meaningfully less during the inevitable corrections. By preserving capital in the tough times, we have more money to compound during the good times.

Last year, our Model was down 4.5 percentage points less than the average decline in the Canadian and U.S. benchmarks. This year, we have given back 2.9 percentage points of that advantage.

Our job is to both protect and grow wealth, and we are currently focused on the protection aspect of that equation. The Model is purposely positioned defensively relative to the general market, and we believe that posture will ultimately produce market-beating results.

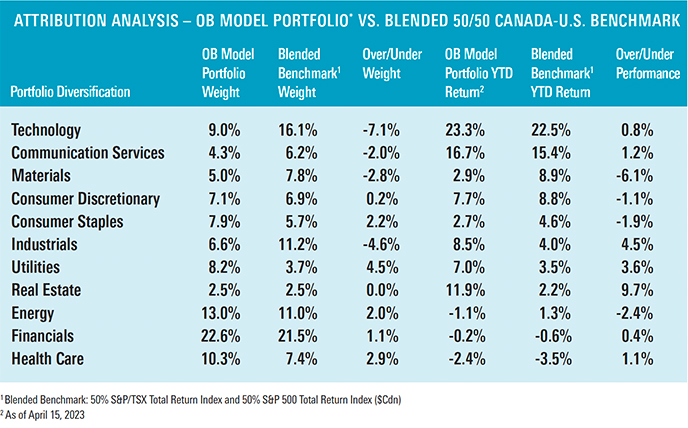

The accompanying attribution table highlights our sector weights and year-to-date returns and compares them to a blended 50/50 Canada-U.S. benchmark. Our comparatively weak performance this year is a consequence of being underweight the best-performing sectors and overweight those that haven’t performed as well. Our stock-picking batting average has been reasonably good, with better-than-benchmark performance in seven of the 11 sectors.

The table is sorted by the year-to-date sector returns for the blended benchmark. Notably, we have less exposure to the three best-performing sectors: Technology, Communication Services and Materials. The first two have performed particularly well, with gains of 22.5% and 15.4%, respectively, because they contain a lot of growth stocks that investors believe will do well if the economy slows and central banks lower interest rates. We are not convinced that will hold true, as growth stock earnings may suffer more than expected if we have a recession. The strong performance in the Materials sector has been fueled by sizable gains in gold company stocks.

We own high-quality businesses, and we have greater-than-market exposure to defensive sectors like Health Care, Utilities and Consumer Staples. Most of those businesses are less economically sensitive, and many have above-average dividend yields. We believe investors will value these attributes more dearly as the economy slows.

The authorities handled the bank failures well, and fears of a systemic banking crisis have appropriately passed. Still, the sudden demise of a few banks is a reminder that there are negative consequences of a long period of cheap and easy money.

As we discussed at our Annual Address earlier this year, ultra-low interest rates encourage excessive risk taking and debt leverage. While the drama and details surrounding the failure of Silicon Valley Bank and others may have been shocking, it’s not surprising that there were some poorly managed banks that made bad investments and loans.

As Warren Buffett said in a recent CNBC interview, “It gets back to that old story,… when the tide goes out you learn who’s been swimming naked.” It’s what usually happens after central banks take away the proverbial punch bowl following a long period of stimulative monetary policy.

Taming inflation requires extinguishing the excesses that fueled higher prices. Bank failures and business and consumer bankruptcies are necessary and inevitable parts of the process.

U.S. bank-lending standards had already tightened meaningfully prior to the bank failures, and we have little doubt that they will tighten further. The U.S. regional banks, in particular, will need to dial back lending to enhance their financial strength, which will take a toll on consumers and businesses. Canadian banks are similarly becoming more conservative. The least credit-worthy borrowers will be unable to refinance loans. There will be more casualties, as that’s what happens when credit conditions tighten.

While the process is unpleasant, and the possibility of recession is real, unfortunately it’s necessary to arrest inflationary pressures, put the economy on a healthier footing and set the stage for the next expansion.

There are reasons to believe that an economic setback, if indeed one arrives, will be relatively mild. The overall banking system, in North America and globally, is considerably better capitalized than it was prior to the 2008 financial crisis. Back then, it was low-quality, sub-prime mortgages that caused the crisis. Today, it’s high-quality government bonds and agency mortgage-backed securities that are the problem. The former fell in value as the 2008 crisis unfolded, fueling a vicious self-feeding cycle. The latter securities have risen in price this time around, as longer-term interest rates have trended down on the expectation that the U.S. Federal Reserve will lower administered, short-term interest rates later this year in reaction to a weaker economy.

The U.S. is the most important consumer cohort in the world, and, as a group, they are in much better financial shape than they were prior to the 2008 crisis. They have learnt important lessons from that era and have reduced their collective debt leverage considerably in the ensuing years. Moreover, they’ve developed a strong preference for fixed-rate 30-year mortgages after getting burned by variable-rate mortgages the last time the central bank raised interest rates meaningfully. That, together with savings accumulated during the pandemic and a strong job market, makes U.S. consumers better positioned to weather higher interest rates and economic turbulence.

The possibility of a recession has been widely telegraphed by the media and investment pundits, and, because of that, we believe much of the risk is already discounted in stock prices. That doesn’t mean we don’t expect volatility – we do – but it also implies that we are constructive regarding the prospects for pleasing returns over the next few years.

We own businesses that have strong competitive advantages and the financial wherewithal to survive. In other words, they aren’t “swimming naked” and at risk of being exposed as the tide goes out. On the contrary, they have the strength to invest in the face of adversity, gain market share and ultimately thrive. Their share prices may fluctuate as we navigate these uncertain times. But, like Warren Buffett’s attitude towards Berkshire Hathaway, we will be more enthusiastic if share prices temporarily go on sale.

Please read our Odlum Brown Limited Disclaimer and Disclosure - It is important!

Odlum Brown Limited is an independent, full-service investment firm focused on providing professional investment advice and objective research. We respect your right to be informed of relationships with the issuers or strategies referred to in this report which might reasonably be expected to indicate potential conflicts of interest with respect to the securities or any investment strategies discussed or recommended in this report. We do not act as a market maker in any securities and do not provide investment banking or advisory services to, or hold positions in, the issuers covered by our research. Analysts and their associates may, from time to time, hold securities of issuers discussed or recommended in this report because they personally have the conviction to follow their own research, but we have implemented internal policies that impose restrictions on when and how an Analyst may buy or sell securities they cover and any such interest will be disclosed in our report in accordance with regulatory policy. Our Analysts receive no direct compensation based on revenue from investment banking services. We describe our research policies in greater detail, including a description of our rating system and how we disseminate our research here.

This report has been prepared by Odlum Brown Limited and is intended only for persons resident and located in all the provinces and territories of Canada, where Odlum Brown Limited's services and products may lawfully be offered for sale, and therein only to clients of Odlum Brown Limited. This report is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Odlum Brown Limited to any registration requirement within such jurisdiction or country. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this report, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed or recommended in this report.

This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information's accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice.

Please note that, as at the date of this report, the Research Analyst responsible for the recommendations herein, associates of such Analyst and/or other individuals directly involved in the preparation of this report hold securities of some of the issuer(s) referred to directly or through derivatives.

No part of this publication may be reproduced without the express written consent of Odlum Brown Limited. Odlum Brown Limited is a Member-Canadian Investor Protection Fund.