What was the most important financial event of the last 40 years? That was the question Howard Marks posed at John Mauldin’s 2023 Strategic Investment Conference in May.

Mr. Marks speculated that most people would say the 2008 Global Financial Crisis or the bankruptcy of Lehman Brothers, maybe the 1987 Black Monday crash, the 1999/2000 technology boom and bust, or perhaps the COVID-19 pandemic. Declaring all of those answers wrong, he proclaimed the most important financial event was the prolonged decline in interest rates from 1981 to 2022. The fed funds rate, the short-term interest rate set by the U.S. Federal Reserve and the building block for all other interest rates, fell from 20% to zero over that roughly 40-year period. In Canada, the drop to zero started from a slightly higher administered interest rate of 21% in 1981.

This 40-year decline in interest rates had a profound, positive effect on economic growth, asset prices and wealth creation. But, because the positive influence accrued gradually over such a long period of time, Mr. Marks believes most people didn’t notice. He likened the situation to walking on a moving sidewalk at the airport. While it’s true that you are moving faster, you take the increased speed for granted because you are not gaining ground relative to others on the same conveyor belt.

Mr. Marks is co-founder and co-chairman of Oaktree Capital, one of the world’s largest distressed debt investors, and he is greatly admired for his thoughtful and insightful investment memos. Late last year, he wrote a memo titled “Sea Change,” in which he pointed to the re-emergence of meaningful inflation and one of the quickest rate-hiking cycles as the triggers for a major transformation in investor attitudes.

The first sea change Mr. Marks experienced in his career, which began in 1969, involved the adoption of a new investor mentality toward risk and return in the mid-1970s. He describes how “Michael Milken and a few others had the idea that it should be possible to issue non-investment grade bonds – and to invest in them prudently – if the bonds offered enough interest to compensate for the risk of default.” Prior to this, only investment grade bonds were considered prudent. When Mr. Marks started very successfully investing in U.S. high-yield bonds in 1978, the universe amounted to merely $2 billion – today, it’s roughly $1.2 trillion. This first major shift in thinking fueled the growth of leveraged buyouts and what’s now called the private equity industry.

The second profound change in attitudes followed the inflationary 1970s, which was a tough period for investors. Higher inflation undermined the economy and put significant upward pressure on interest rates. That put downward pressure on the valuations of stocks and bonds and made investors much more risk averse. Commodities and real estate did well for a while, but ultimately their values crashed too. Fortunately, that difficult era came to an end in the early 1980s, after then Fed Chairman Paul Volcker raised the fed funds rate to 20% and broke the upward inflation spiral.

Mr. Volcker’s actions ended a brutal inflationary period and set the stage for a declining interest rate environment that prevailed for the better part of four decades. It’s helpful to think of interest rates and asset prices on the opposite ends of the valuation teeter-totter. As interest rates decline, valuation multiples increase, and vice versa. The S&P 500 Total Return Index compounded at an impressive 12.34% between 1981 and the end of 2021, helped by the price-earnings multiple increasing from less than 10x to roughly 20x.

Investors who used leverage over the 40-year stretch of falling interest rates did even better. Their returns were magnified by the fact that the cost of borrowing was dependably lower than the rate of asset appreciation. Returns were supercharged even more because investors were also able to refinance their leveraged investments at lower and lower interest rates over time. It’s the same reason people have accrued significant equity in their homes.

Indeed, it was a virtuous, self-fulfilling cycle for borrowers and investors, with the increase in leverage driving stronger economic growth, fewer defaults and bankruptcies, and greater returns.

Globalization and technology also played a big role in keeping inflation low over the four decades. Cheaper labour and advancements in productivity allowed the U.S. Federal Reserve and other central banks to support the economy with accommodative monetary policies. More importantly, the absence of meaningful inflationary pressures allowed the authorities to aggressively lower interest rates and print money in the face of economic weakness and/or crises without fear of igniting inflation.

This ideal economic and financial backdrop encouraged complacency and a relaxed attitude toward risk. As borrowers got bolder, paying higher prices for assets and using more leverage, lenders demanded lower interest rates and fewer or less strenuous protective covenants.

They say, “nothing lasts forever” and the good times came to a halt in 2022, with the fastest rise in inflation since the early 1980s, precipitating the need for the authorities to aggressively raise interest rates.

Now, for the first time in years, Mr. Marks is excited about investing in distressed debt. His company is making senior loans to quality companies at yields of 11-13%. Compared to the 2009 to 2021 period, the economic backdrop and the “mood” of the market have changed dramatically. Investors are no longer optimistic and are instead guarded. The fear of losses or of a recession has replaced the fear of missing out. Credit has gone from being cheap and abundant to expensive and scarce. In Mr. Marks’s opinion, prospective returns (for lenders) have inflected from the lowest ever to more than ample.

The intense tightening in credit conditions and the shift in attitudes about risk have implications for equity investors too. A business’s worth is derived from the discounted value of future cash flows. That discount rate has increased alongside interest rates, which has naturally lowered the present value of future cash flows. And we’re back to the teeter-totter: valuation multiples contract when inflation and interest rates increase.

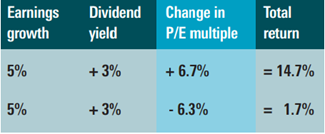

The total return investors achieve from owning a stock is the sum of three things: earnings growth, the dividend yield and the change in valuation multiple.

For example, consider a business that grows its earnings by 5%, pays a 3% dividend and experiences a 6.7% increase in its price-to-earnings valuation multiple from 15x to 16x. In simple terms, the total return is 14.7% (i.e., 5% + 3% + 6.7%). Now imagine the same set of facts, except the valuation multiple falls from 16x to 15x, which is a 6.3% decline. The total return drops to an uninspiring 1.7% (i.e., 5% + 3% - 6.3%).

For example, consider a business that grows its earnings by 5%, pays a 3% dividend and experiences a 6.7% increase in its price-to-earnings valuation multiple from 15x to 16x. In simple terms, the total return is 14.7% (i.e., 5% + 3% + 6.7%). Now imagine the same set of facts, except the valuation multiple falls from 16x to 15x, which is a 6.3% decline. The total return drops to an uninspiring 1.7% (i.e., 5% + 3% - 6.3%).

The struggle experienced by many stocks recently is a direct result of investors using higher discount rates in their valuation models, and in some cases the weakness in share prices has also been influenced by worries about earnings growth.

While there are reasons to believe there will be a cyclical drop in inflation and interest rates as economic growth slows, there are also reasons to expect greater structural inflation over the next 10 years than we have experienced over the last decade. If that is the case, the sea change in attitudes and opportunities that Mr. Marks anticipates will likely become a lasting reality.

In that environment, the price investors pay for owning shares in a business will be as important, if not more so, as the underlying quality of that business. We want to own companies with growth attributes and pricing power, but we have to be careful not to pay too much. Patience and a long-term orientation are characteristics we believe will be considerably more valuable in the era ahead.

Please read our Odlum Brown Limited Disclaimer and Disclosure - It is important!

Odlum Brown Limited is an independent, full-service investment firm focused on providing professional investment advice and objective research. We respect your right to be informed of relationships with the issuers or strategies referred to in this report which might reasonably be expected to indicate potential conflicts of interest with respect to the securities or any investment strategies discussed or recommended in this report. We do not act as a market maker in any securities and do not provide investment banking or advisory services to, or hold positions in, the issuers covered by our research. Analysts and their associates may, from time to time, hold securities of issuers discussed or recommended in this report because they personally have the conviction to follow their own research, but we have implemented internal policies that impose restrictions on when and how an Analyst may buy or sell securities they cover and any such interest will be disclosed in our report in accordance with regulatory policy. Our Analysts receive no direct compensation based on revenue from investment banking services. We describe our research policies in greater detail, including a description of our rating system and how we disseminate our research here.

This report has been prepared by Odlum Brown Limited and is intended only for persons resident and located in all the provinces and territories of Canada, where Odlum Brown Limited's services and products may lawfully be offered for sale, and therein only to clients of Odlum Brown Limited. This report is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Odlum Brown Limited to any registration requirement within such jurisdiction or country. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this report, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed or recommended in this report.

This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information's accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice.

Please note that, as at the date of this report, the Research Analyst responsible for the recommendations herein, associates of such Analyst and/or other individuals directly involved in the preparation of this report hold securities of some of the issuer(s) referred to directly or through derivatives.

No part of this publication may be reproduced without the express written consent of Odlum Brown Limited. Odlum Brown Limited is a Member-Canadian Investor Protection Fund.