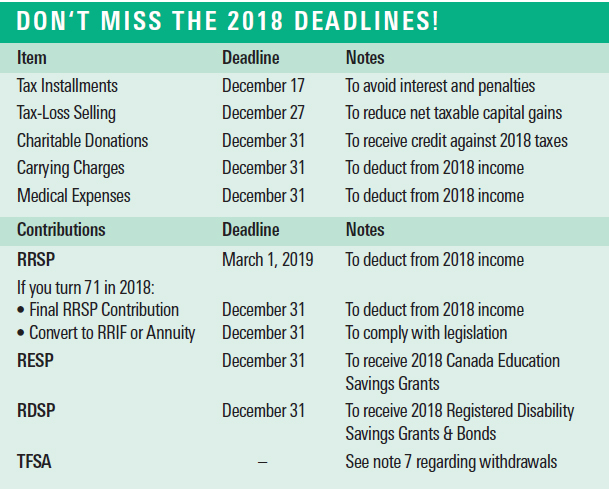

With December upon us, here are a number of tax considerations and deadlines to remember for the 2018 tax year. Please note that December 31 is a Monday this year.

Payments, Expenses and Other Transactions

1. Tax-Loss Selling

Tax-loss selling entails selling investments with unrealized capital losses before yearend to offset capital gains realized during the year. Any remaining unused capital losses can be carried over to offset capital gains from the three preceding years or in any future year. While this strategy may be advantageous from a tax perspective, ensure that tax-loss selling makes sense from an investment perspective as well.

To ensure that your capital losses can be reported in the 2018 tax year, trades on Canadian securities exchanges must be placed no later than December 27, 2018, as trades typically take two business days to settle. Different dates may apply to foreign exchanges.

Beware of "superficial loss" rules. The capital loss on an investment will be denied if you buy an identical investment during the period that begins 30 days before and ends 30 days after the sale settlement date and you still own that investment at the end of the period. These rules also apply if the identical investment is purchased by or transferred to your RRSP, RRIF, TFSA, spouse or a company controlled by you or your spouse.

If you are caught by the superficial loss rules, the denied loss amount is generally added to the adjusted cost base of the identical investment purchased, in essence deferring the loss until the ultimate year of disposition.

2. Carrying Charges

Investment-related expenses, such as fees to manage non-registered accounts and charges and interest paid on money borrowed for most investment purposes (other than in registered accounts) must be paid by December 31 to be deductible in 2018.

Contributions to Registered Plans

3. Registered Retirement Savings Plans (RRSPs)

The maximum RRSP contribution limit for 2018 is $26,230. To view your 2018 RRSP contribution room, you can check your 2017 CRA Notice of Assessment, call the CRA's personal telephone services, or log into the CRA's My Account online. If you have a considerable amount of contribution room or if you expect to be in a higher tax bracket in the near future, consider making the maximum contribution this year, but claim the deduction over multiple years, depending on your expected taxable income.

4. RRSP Contributions After Age 71

Although you can no longer contribute to your own RRSP after December 31 of the year in which you turn 71, you can contribute to a spousal RRSP if you still have contribution room and your spouse or common-law partner is not older than 71 in the year of contribution.

5. Registered Education Savings Plans (RESPs)

The federal government provides annual Canada Education Savings Grants (CESGs) of up to $500 with a lifetime CESG limit of $7,200 per beneficiary. Subject to the restriction outlined in the following paragraph, beneficiaries aged 17 or younger who have unused CESG carry-forward room may receive up to a maximum annual CESG of $1,000 if the account subscriber contributes $5,000 per year or more.

If your child turned 15 in 2018 and you have not contributed a minimum of $2,000 or at least $100 per year in any four years to date, December 31 is your last chance to contribute $2,000 or more to an RESP in order to be eligible for the CESG in 2018 through 2020 (ages 15-17).

6. Registered Disability Savings Plans (RDSPs)

RDSPs are tax-deferred savings plans to help provide long-term savings for individuals who are eligible for the disability tax credit. Lifetime contributions of up to $200,000 can be made until the beneficiary turns 59. There are no annual contribution limits and the contributions are not tax deductible.

The federal government provides assistance in the form of Canada Disability Savings Grants (CDSGs) and Bonds (CDSBs) until the beneficiary turns 49:

- CDSGs of up to $3,500 per year with a lifetime limit of $70,000 are provided on a matching basis, based on the contribution amount and the beneficiary's family income.

- CDSBs of up to $1,000 per year with a lifetime limit of $20,000 are provided to low-income beneficiaries. No contributions are required to receive the bond.

RDSP holders may wish to contribute to an RDSP by December 31 to receive government assistance for the current year. Any unused CDSG and CDSB room, however, can be carried forward for up to 10 years.

7. Tax-Free Savings Accounts (TFSAs)

There is no deadline for TFSA contributions as any unused contribution room is carried forward from one year to the next. However, withdrawals in any given year do not increase TFSA contribution room until the following calendar year. Therefore, if you are planning to make a withdrawal in the near future, consider making it by December 31 to be able to re-contribute the withdrawn amount in 2019.

When TFSAs were introduced in 2009, the annual contribution limit was set at $5,000, indexed to inflation in $500 increments. In 2013, the annual limit increased to $5,500 and was further increased to $10,000 in 2015. For 2016 and 2017, the annual limit has reverted to $5,500. Therefore, if you have not made any TFSA contributions to date, you could contribute up to a maximum of $57,500 in 2018.