With a new year upon us, here are some strategies to minimize your tax bill in 2021.

Maximize contributions to registered plans

The earlier you contribute to a registered plan, the more time you have to benefit from tax-sheltered income and growth.

Registered Retirement Savings Plan (RRSP)

For 2021, you can contribute up to 18% of your 2020 earned income, up to $27,830 if you earned more than $154,611. If you have not yet maximized your 2020 contribution (up to $27,230), you have until March 1, 2021, to do so. For more information, ask your Odlum Brown Investment Advisor or Portfolio Manager for our article, “How to Interpret Your 2020 RRSP Deduction Limit Statement.”

For 2021, you can contribute up to 18% of your 2020 earned income, up to $27,830 if you earned more than $154,611. If you have not yet maximized your 2020 contribution (up to $27,230), you have until March 1, 2021, to do so. For more information, ask your Odlum Brown Investment Advisor or Portfolio Manager for our article, “How to Interpret Your 2020 RRSP Deduction Limit Statement.”

Tax-Free Savings Account (TFSA)

The annual contribution limit for 2021 is once again $6,000. TFSA room starts to accrue the year you turn 18, and you can open a TFSA once you reach the age of majority (19 in BC). If you were TFSA eligible every year since 2009 but have never contributed to a TFSA, in 2021 you could contribute $75,500.

The annual contribution limit for 2021 is once again $6,000. TFSA room starts to accrue the year you turn 18, and you can open a TFSA once you reach the age of majority (19 in BC). If you were TFSA eligible every year since 2009 but have never contributed to a TFSA, in 2021 you could contribute $75,500.

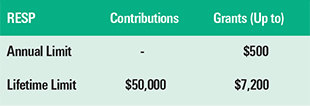

Registered Education Savings Plan (RESP)

If you have children that may pursue post-secondary education, consider contributing at least $2,500 annually to each child’s RESP to receive a 20% Canada Education Savings Grant (CESG) of up to $500 annually ($1,000 annually on up to $5,000 of contributions, if catching-up past unused CESG room).

If you have children that may pursue post-secondary education, consider contributing at least $2,500 annually to each child’s RESP to receive a 20% Canada Education Savings Grant (CESG) of up to $500 annually ($1,000 annually on up to $5,000 of contributions, if catching-up past unused CESG room).

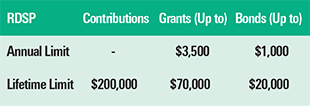

Registered Disability Savings Plan (RDSP)

RDSPs are tax-deferred plans to provide long-term savings for a beneficiary who is eligible for the disability tax credit. Depending on the age of the beneficiary and their family income, annual contributions of $1,500 up to age 49 can attract Canada Disability Savings Grants of up to $3,500 and Canada Disability Savings Bonds of $1,000 annually (higher, if there is unused past room). Lifetime contributions of up to $200,000 can be made until the beneficiary turns 59.

RDSPs are tax-deferred plans to provide long-term savings for a beneficiary who is eligible for the disability tax credit. Depending on the age of the beneficiary and their family income, annual contributions of $1,500 up to age 49 can attract Canada Disability Savings Grants of up to $3,500 and Canada Disability Savings Bonds of $1,000 annually (higher, if there is unused past room). Lifetime contributions of up to $200,000 can be made until the beneficiary turns 59.

Make your interest tax-deductible

Unless you generate rental income, the interest you pay on your home mortgage is not tax-deductible. Interest you pay on funds borrowed to earn business or investment income, on the other hand, is generally deductible. So how can you convert non-deductible interest to being tax-deductible?

The most common strategy is a debt swap. If you have a portfolio of non-registered investments, you could sell sufficient investments to pay down your non-deductible mortgage debt and then re-borrow the funds for investment purposes. For the investment loan to be tax-deductible, you must have a reasonable expectation of income, such as interest or dividends. Capital gains are not considered income for this purpose.

A few things to keep in mind before pursuing a debt swap strategy:

- Half of any accrued capital gains realized upon selling investments are taxable.

- If you plan on repurchasing any investments sold at a loss, wait 30 days from settlement date before repurchasing so that the loss isn’t denied under the superficial loss rules.

- To ensure that interest remains deductible, do not co-mingle funds from the investment loan with personal use funds.

- Consult your tax advisor.

- Verify with your lender whether any mortgage prepayment penalties will be assessed and what financing options (i.e., secured line of credit) are available for the investment loan.

Our 2021 Tax Facts and Figures information sheet will be available shortly. Use it to find:

Ask your Odlum Brown Investment Advisor or Portfolio Manager for a copy.