Patience Remains a Virtue

Wednesday, July 13, 2022

On June 13, 2022, the S&P 500 Index entered bear market territory, defined as a decline of at least 20%. As of today, the index is still down 20% from its peak on January 3. As with all bear markets, there are plenty of bleak headlines foretelling further doom and gloom.

We don’t know when or at what level the S&P 500 will bottom. However, some recent research by Miller Value Partners is an encouraging reminder that patience is a virtue when it comes to owning stocks.

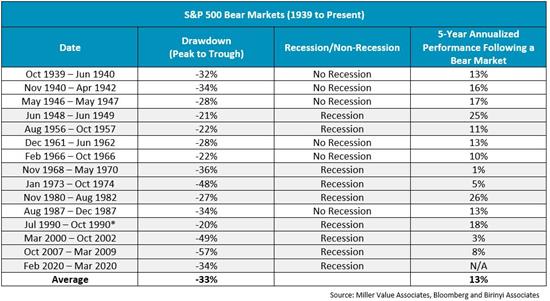

Bear markets are a natural – and necessary – part of investing. The table above shows all the bear markets for the S&P 500 and its predecessor index since 1939. The peak-to-trough declines ranged from 20% to 57%, with an average decline of 33%. Some of these coincided with a recession, but not all. Most interesting, every single five-year period subsequent to the 20% drawdown experienced a positive annual total return, at an average of 13%.

There is no guarantee that this encouraging history will repeat itself. And, there are legitimate concerns on investors’ minds, including inflation, recession and European war. Furthermore, if inflation persists, it would eat away at the real return stocks generate. Nevertheless, past bear markets were also accompanied by significant concerns: a world war in the early 1940s, high inflation and a Presidential resignation in the 1970s, and a collapse in housing prices in 2008/2009. Yet, stocks ultimately delivered a positive return. Studies like these may not carry the same punch as negative headlines, but they can help investors conjure the patience required to ride out uncomfortable bear markets.

*The 1990 bear market depicted in the table fell 19.9% versus the typical definition of a 20% drawdown.