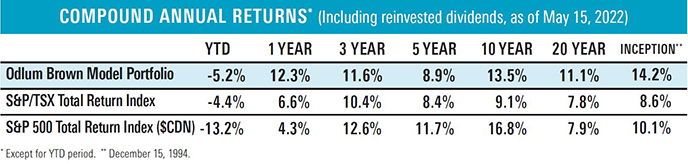

The drawdown in global equities this year has impacted the Odlum Brown Model Portfolio, although we are thus far weathering the storm relatively well. As of mid-May, the Model was down 5.2% year to date versus losses of 4.4% and 13.2% for the respective Canadian and U.S. equity benchmarks. Over the last 12 months, the Model’s gain of 12.3% compares quite favourably to the 6.6% return from the S&P/TSX Total Return Index and the 4.3% advance in the S&P 500 Total Return Index ($CDN).

While we have experienced stomach-turning losses on several stocks, including Netflix, LendingTree and Vertiv Holdings, our general focus on quality businesses trading at reasonable prices has kept us out of some of the hardest-hit areas of the market. Diversification in the cyclical Energy and Materials sectors and defensive Utilities, Consumer Staples, Communication Services and Health Care sectors has also helped buoy results. Over the last year, Canadian Natural Resources, Tourmaline Oil Corporation and Cenovus Energy have produced total returns, including dividends, of 97%, 162% and 169%, respectively. Those impressive results came after a devastating multi-year bear market for traditional energy businesses and highlight the benefit of both diversification and patience.

The U.S. market has performed worse than the Canadian market, largely because it is geared more to growth-type stocks, which are proving to be the most sensitive to the increase in inflation and interest rates. Not only does the Model have considerably less exposure to those types of stocks than the S&P 500 Index, but our overall U.S. exposure has declined to 43% from 50% at the beginning of the year.

Given the heightened level of uncertainty and wide range of possible economic outcomes, we believe diversification is essential. As such, we own many high-quality businesses operating in a broad cross-section of industries and geographies. They likely won’t all move up and down in unison, and that is by design. Our goal, as always, is to do better than our benchmarks in the long run by losing less during the tough times.

The Odlum Brown Model Portfolio is an all-equity portfolio that was established by the Odlum Brown Equity Research Department on December 15, 1994, with a hypothetical investment of $250,000. It showcases how we believe individual security recommendations may be used within the context of a client portfolio. The Model also provides a basis with which to measure the quality of our advice and the effectiveness of our disciplined investment strategy. Trades are made using the closing price on the day a change is announced. Performance figures do not include any allowance for fees. Past performance is not indicative of future performance.