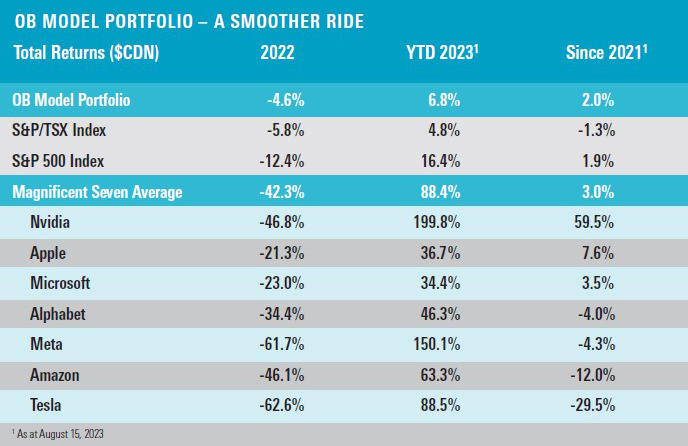

For the year through to August 15, 2023, the Odlum Brown Model Portfolio* appreciated 6.8%. While that was better than the 4.8% gain in the Canadian S&P/TSX Total Return Index, it was considerably less than the 16.4% advance in the S&P 500 Total Return Index. Understandably, investors are envious and wish we had more exposure to the American market.

U.S. stocks have performed exceptionally well this year, yet it is important to appreciate that the impressive showing followed a very poor result in 2022, when that market was down 12.4%. Since the end of 2021, U.S. stocks are up 1.9%. Over the same period, Canadian stocks declined 1.3% and our Model rose 2.0%.

This year’s surge in the S&P 500 has been driven by a relatively small group of very large stocks popularly referred to as the “Magnificent Seven”: Nvidia, Apple, Microsoft, Alphabet, Meta, Amazon and Tesla. Collectively, these seven companies account for roughly 30% of the index, and on average they produced a total return (in Canadian dollars) of 88% for the year through to mid-August. While that’s remarkable, the same stocks were among the heaviest burdens on the benchmark last year, losing an average of 42%. Since the end of 2021, the Magnificent Seven have generated an average Canadian dollar total return of just 3%.

The foregoing figure might seem incorrect given that the percentage recovery in 2023 is so much bigger than the percentage loss in 2022, but that’s the way the math works: it takes a 100% gain to recover from a 50% loss.

What’s noteworthy about the Magnificent Seven’s impressive rally is that it happened despite central banks tightening monetary policy more than expected and bond yields rising further than feared. Higher interest rates typically put downward pressure on stock multiples because investors use higher discount rates in their valuation models. Moreover, high-growth businesses like the Magnificent Seven are theoretically more sensitive to changes in interest rates because they are expected to produce greater earnings further into the future than slower-growth firms. Theory and reality have clearly diverged in 2023.

It’s never a simple story, and there are plenty of plot twists to consider. Lots of other factors influence stock prices. Things like the economic outlook, technological developments and investor sentiment also play a role.

Despite widespread fears of recession, the dreaded economic slowdown has not transpired. The global and North American economies have remained resilient despite the bite from higher interest rates, and inflation has moderated meaningfully. That’s a “Goldilocks” scenario, and shareholders have celebrated accordingly. With a more constructive outlook for the economy and corporate profits, it’s understandable that investors have bid stock prices higher.

The impressive developments in Artificial Intelligence (AI) have no doubt added to the optimism, too. Most pundits believe the Magnificent Seven will benefit from the exciting technology, and we agree.

We took a closer look at the evolution of consensus 2024 earnings per share (EPS) estimates for the Magnificent Seven to see if the optimism toward the economy and AI had translated into brighter forecasts. While there was significant improvement in the outlook for Nvidia and Meta this year, estimates are generally down from where they were at the end of 2021. On average, they fell 13% in 2022 and rose 18% in 2023, which nets out to a 4% decline over both periods. Exclude the extraordinary 63% increase in the 2024 EPS expectation for Nvidia over the full period, and the average decline is 15%, with estimates for Amazon, Meta, Alphabet and Microsoft, in particular, down significantly.

As is often the case, valuation multiples contracted and expanded in sync with the trends in earnings estimates, magnifying the losses in 2022 and augmenting the gains in 2023. Today, four of the seven are more expensive from a price-to-earnings (P/E) perspective than they were at the start of 2022. Nvidia and Tesla had the highest multiples, and those metrics have declined modestly, while Apple’s valuation is roughly the same.

Improved investor sentiment has clearly been an important tailwind for the Magnificent Seven, but we don’t consider it a case of hype trumping substance. The popular moniker is not hollow; the seven companies are truly magnificent businesses with deep competitive advantages, tremendous profitability and ample growth potential.

Most of the time, great businesses are great stocks. The caveat is that too high a price can render even a fantastic business a poor investment. That was the case with technology stocks around the turn of the century. From its peak in 2000 to its low in 2002, the S&P 500 Information Technology subindex dropped more than 80% and didn’t recover until 2017.

In 2000, we had strong conviction that the euphoria toward technology stocks was misplaced. Valuations were sky high and untethered from business fundamentals. That’s not the case today.

On balance, the valuations of the Magnificent Seven seem reasonable relative to their profitability and growth prospects. One way to support this view is to consider the PEG ratio, a valuation metric for determining the trade-off between the stock price, EPS and the company’s expected growth rate. For each company, we calculated the P/E based on consensus EPS estimates for the next fiscal year, the expected two-year compound annual growth in EPS, and the ratio between the two figures (PEG = P/E divided by growth rate).

With an average P/E of 29x and growth rate of 23%, the group’s PEG ratio is 1.3x. That is reasonable relative to other growth stocks and is far from the levels technology stocks reached in the late 1990s and early 2000s. It doesn’t guarantee pleasant returns, as changes in interest rates, the economic outlook, earnings expectations and investor sentiment could undermine performance, but it does moderate the downside risk.

We own four of the Magnificent Seven in the Model: Apple, Microsoft, Alphabet and Amazon, and we are glad we do. Owning them has contributed to this year’s gains. But because our weightings in these gems are less than the benchmark, our Model has not kept pace with the U.S. market this year. For the same reason, our results didn’t suffer nearly as much last year. Being more diversified than the benchmark has helped reduce the volatility of our portfolio. We also believe the posture will help us achieve market-beating performance over the long term and cushion the downside during the inevitable market drawdowns.

Please read our Odlum Brown Limited Disclaimer and Disclosure - It is important!

The Odlum Brown Model Portfolio was established on December 15, 1994, with a hypothetical investment of $250,000. The Model provides a basis with which to measure the quality of our advice. It also facilitates an understanding of how we believe individual security recommendations could be used within the context of a client portfolio. Trades are made using the closing price on the day a change is announced. Performance figures do not include any allowance for fees. Past performance is not indicative of future performance.

Odlum Brown Limited is an independent, full-service investment firm focused on providing professional investment advice and objective research. We respect your right to be informed of relationships with the issuers or strategies referred to in this report which might reasonably be expected to indicate potential conflicts of interest with respect to the securities or any investment strategies discussed or recommended in this report. We do not act as a market maker in any securities and do not provide investment banking or advisory services to, or hold positions in, the issuers covered by our research. Analysts and their associates may, from time to time, hold securities of issuers discussed or recommended in this report because they personally have the conviction to follow their own research, but we have implemented internal policies that impose restrictions on when and how an Analyst may buy or sell securities they cover and any such interest will be disclosed in our report in accordance with regulatory policy. Our Analysts receive no direct compensation based on revenue from investment banking services. We describe our research policies in greater detail, including a description of our rating system and how we disseminate our research here.

This report has been prepared by Odlum Brown Limited and is intended only for persons resident and located in all the provinces and territories of Canada, where Odlum Brown Limited's services and products may lawfully be offered for sale, and therein only to clients of Odlum Brown Limited. This report is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Odlum Brown Limited to any registration requirement within such jurisdiction or country. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this report, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed or recommended in this report.

This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information's accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice.

Please note that, as at the date of this report, the Research Analyst responsible for the recommendations herein, associates of such Analyst and/or other individuals directly involved in the preparation of this report hold securities of some of the issuer(s) referred to directly or through derivatives.

No part of this publication may be reproduced without the express written consent of Odlum Brown Limited. Odlum Brown Limited is a Member-Canadian Investor Protection Fund.