At our Annual Address in early 2019, we highlighted seven stocks in the Odlum Brown Model Portfolio* that had performed especially poorly the year before: Coty, ING Groep NV, Tri Pointe Homes, Weyerhaeuser, Cenovus, Peyto and Colfax (which subsequently changed its name to Enovis and spun out ESAB Corporation).

Investing is a humbling affair, and it’s wise to learn from errors, but that wasn’t why we highlighted our dogs that year. Rather, it was to demonstrate that selling poor performers when they are depressed can exacerbate the situation. It’s natural to have doubts when investments disappoint. However, doubt can damage a portfolio if it provokes one to sell at an inopportune time.

Patience is a virtue, and in our May 2019 Odlum Brown Report, “Every Dog Has Its Day,” we reported that our seven dogs had produced a total return of 31% for the year through to mid-April, roughly double the return from the S&P/TSX Composite and S&P 500 Indexes, and meaningfully better than the average return of 13% from our top-10 performing stocks in 2018.

While we ultimately moved on from these seven stocks, those “dogs” have continued to run, with an average Canadian dollar total return of 130% from 2018 to mid-March 2024. That’s better than the 80% and 122% gains in the respective Canadian and U.S. benchmarks over the same period. The best performer, Tri Pointe Homes, has more than tripled in value. The laggard in the group, Enovis, has appreciated by 65%, which doesn’t include the 142% return from ESAB since it was spun out in April 2022.

But poor performers don’t always recover. Sometimes a company’s competitive position deteriorates beyond repair or industry dynamics take a sustained turn for the worse.

We did add Cenovus back in 2021 and Enovis in 2022. In other cases, we switched to better-performing stocks, while in others, we regret moving on. Hindsight is always 20/20. What matters most is that we learn from our mistakes, and that we have conviction in the businesses we continue to hold.

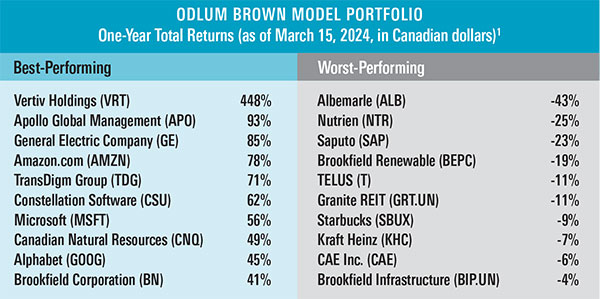

With that in mind, let’s turn to the Model’s current holdings and the stocks presently trying our patience. The below table highlights the 10 best and worst performers for the 12 months ended March 15, 2024. Except for a few noted exceptions, we have owned all these stocks over that full period.

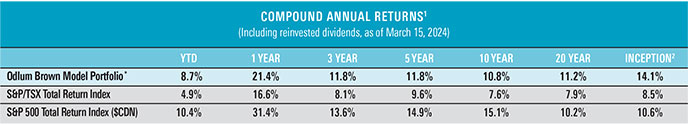

Before we address the laggards, it’s useful to appreciate the general economic context. As of mid-March, the S&P/TSX Composite and S&P 500 were up 16.6% and 31.4%, respectively, from a year ago. Sentiment is buoyant, with investors anticipating a Goldilocks scenario whereby the economy and corporate profits continue to expand, annual inflation recedes to 2% and central banks lower interest rates later this year. Large growth stocks have been the winners in this environment, led by technology firms that are expected to benefit from the revolution in artificial intelligence (AI).

Indeed, our best-performing stock, Vertiv, is riding the AI wave. Vertiv provides critical power and cooling systems for data centres. Over the last 12 months, the stock has returned 448%, considerably more than the 261% gain in Nvidia, the AI darling. Not long ago, Vertiv was in the doghouse. In 2022, shares were down more than 60% from our purchase price after management disclosed that cost inflation was severely depressing margins. They’d made a huge mistake in not including inflation escalators in their customer contracts. Fortunately, we trusted management’s claim that they could fix it, and they did.

Our worst-performing stocks fall into three broad categories: (1) capital-intensive businesses with meaningful debt and hefty dividends; (2) consumer-oriented businesses adversely impacted by COVID-19 and associated inflationary pressures; (3) cyclical resource companies.

Shares of Utilities, Communication Services and Pipelines experienced considerable selling pressure as inflation and interest rates increased. Such factors influence these capital-intensive enterprises in three ways. First, their dividends are relatively less attractive compared to bonds. Second, the debt that supports them is more costly in a higher interest rate environment. Third, investors worry that regulators won’t let them pass on higher costs to consumers. However, if the economy slows and interest rates decline as we expect, the factors presently weighing on these stocks will become tailwinds. Moreover, we believe these businesses provide an important hedge against recession, a risk that the more popular stocks don’t seem to be discounting.

In the consumer space, Kraft Heinz and Saputo are turnaround examples where valuations remain low despite fundamental improvements in the companies. Starbucks is down due to depressed consumer sentiment toward the company, labour issues and exposure to China. While the concerns are valid, we feel they are adequately factored into the share price. Apple is vulnerable to the Chinese market as well, and it is expected to grow its earnings to a much lesser degree than Starbucks over the next three years, yet Apple’s stock commands a 50% higher price-to-earnings multiple.

Our two worst-performing stocks are lithium producer Albemarle and fertilizer producer Nutrien. In both cases, we didn’t anticipate the meaningful price declines in the underlying commodities. The price of lithium significantly corrected as growth in electric vehicle (EV) demand slowed and lithium supply increased. While we regret not selling more before the share price dropped, we have traded the stock reasonably well. We sold 64% of our position on the way up for a weighted-average gain of 125%, recouping 140% of our initial investment. Our remaining shares are still roughly 50% higher than our purchase price. Longer term, ongoing growth in demand for lithium-powered EVs should propel greater profits and a higher share price.

Regarding Nutrien, we believed sanctions would keep meaningful amounts of Russian fertilizer off the global market. That didn’t happen. Consequently, the war-driven surge in fertilizer prices and Nutrien’s share price reversed. Nonetheless, we still see a positive cycle ahead; it’s just going to take more patience.

It’s only natural to want more of the stocks that are rising and fewer laggards, yet our experience has taught us the importance of balance; today’s stragglers are often tomorrow’s leaders.

Contrarian investing has generally not worked well in recent years; it has been more profitable to ride the winners. That might seem intuitive, but it isn’t always the case. In the Model’s first 10 years, we regularly collected profits from our winners and reinvested them into the losers. This strategy produced a compound annual return of 20% between 1994 and 2005, the best 10-year stretch in the Model’s nearly 30-year history.

Today, with the best businesses well appreciated by investors, we believe it’s increasingly important to own less-popular stocks. They provide important diversification and potential for market-beating returns in the long run.

Please read our Odlum Brown Limited Disclaimer and Disclosure - It is important!

*The Odlum Brown Model Portfolio is an all-equity portfolio that was established by the Odlum Brown Equity Research Department on December 15, 1994, with a hypothetical investment of $250,000. It showcases how we believe individual security recommendations may be used within the context of a client portfolio. The Model also provides a basis with which to measure the quality of our advice and the effectiveness of our disciplined investment strategy. Trades are made using the closing price on the day a change is announced. Performance figures do not include any allowance for fees. Past performance is not indicative of future performance.

Odlum Brown Limited is an independent, full-service investment firm focused on providing professional investment advice and objective research. We respect your right to be informed of relationships with the issuers or strategies referred to in this report which might reasonably be expected to indicate potential conflicts of interest with respect to the securities or any investment strategies discussed or recommended in this report. We do not act as a market maker in any securities and do not provide investment banking or advisory services to, or hold positions in, the issuers covered by our research. Analysts and their associates may, from time to time, hold securities of issuers discussed or recommended in this report because they personally have the conviction to follow their own research, but we have implemented internal policies that impose restrictions on when and how an Analyst may buy or sell securities they cover and any such interest will be disclosed in our report in accordance with regulatory policy. Our Analysts receive no direct compensation based on revenue from investment banking services. We describe our research policies in greater detail, including a description of our rating system and how we disseminate our research here.

This report has been prepared by Odlum Brown Limited and is intended only for persons resident and located in all the provinces and territories of Canada, where Odlum Brown Limited's services and products may lawfully be offered for sale, and therein only to clients of Odlum Brown Limited. This report is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Odlum Brown Limited to any registration requirement within such jurisdiction or country. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this report, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed or recommended in this report.

This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information's accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice.

Please note that, as at the date of this report, the Research Analyst responsible for the recommendations herein, associates of such Analyst and/or other individuals directly involved in the preparation of this report hold securities of some of the issuer(s) referred to directly or through derivatives.

No part of this publication may be reproduced without the express written consent of Odlum Brown Limited. Odlum Brown Limited is a Member-Canadian Investor Protection Fund.