What Are Pension Buybacks?

By Heather Rivers, BA, CFP®, FMA, CPCA®

Manager, Financial Planning and Education,

Odlum Brown Financial Services Limited

A purchase of past service in a pension, or “pension buyback” as it is commonly called, allows individuals who are part of a defined benefit pension plan to increase their pensionable service and thus their future income benefits. For example, past service for a maternity leave or for a period prior to joining the pension plan may be offered for purchase.

Paying for a buyback

Buyback costs are calculated by a pension actuary. The exact cost depends on facts including your age, salary, which years of service you will purchase, and on actuarial assumptions for future uncertainties, such as future pension indexing (if applicable), future investment rates of return and average mortality of the plan members. Generally, the cost increases over time since the pension will have less time to invest before providing benefits to you.

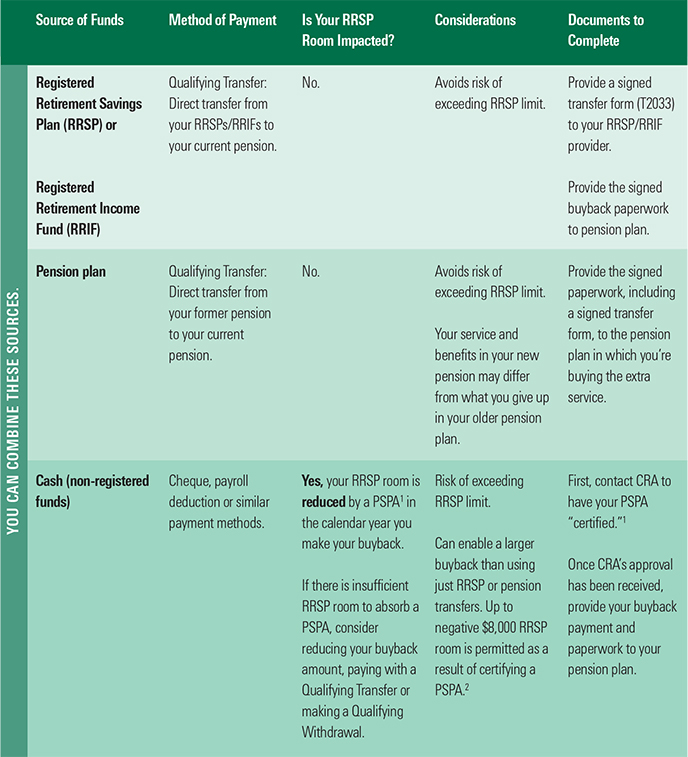

When it comes to paying for a buyback, you may have up to three options:

Other considerations

There are other potential factors to weigh when deciding whether to purchase past service. These are more fully described in our article “Pension Buyback Considerations,” available from your Odlum Brown Investment Advisor or Portfolio Manager. Here is a list of key factors to consider:

- Future employment – E.g., will your salary and service increase after a buyback?

- Cost-sharing – Is your employer sharing the buyback cost?

- Estate planning and decision-making flexibility – Are you aware of the different estate planning options between defined benefit pensions and registered accounts (i.e., RRSPs and RRIFs)?

- Life expectancy – The longer you and/or your spouse3 expect to live, the more you could collect as future pension benefits.

- Timing – A buyback opportunity is time-sensitive: when does the opportunity expire?

- Income flexibility – Is the pension income’s structure too rigid for your future needs?

- Inflation – Does the plan offer any guaranteed or ad-hoc cost-of-living increases over time?

- Solvency – How healthy is this pension?

Tax considerations

Review tax and RRSP planning considerations associated with a buyback. For example:

Past service pension adjustment (PSPA) – Since your buyback generates a PSPA, which reduces your RRSP room in the same calendar year as the buyback occurs, review your RRSP contributions before committing to a buyback. You may need to pause further contributions until you have completed the buyback and received a new post-buyback RRSP Limit Statement from the Canada Revenue Agency (CRA), to help avoid overcontributing.1,2

Tax deductions – While “cash” used for pension buybacks can generally be claimed as a tax deduction, you cannot carry-forward any undeducted pension contributions to deduct them in future years as you can with RRSP contributions. In some cases, it may be better to contribute to your RRSP before transferring RRSPs to your pension for a buyback. Your advisor and tax professional can help review your payment options and personal circumstances, particularly for large buyback amounts.

For more detailed information about pensions and pension buybacks, consult your pension plan, a pension actuary and/or tax professional. For further information about investing for retirement and the products and services offered by Odlum Brown Financial Services Limited, please contact your Odlum Brown Investment Advisor or Portfolio Manager.

1 A past service pension adjustment, or PSPA, is calculated when buying back past pension service. If you don’t ask the CRA to “certify” your PSPA before paying with non-registered funds, you risk incurring penalties and interest for excess RRSP contributions, risk having your buyback cancelled or having to request RRSP or RRIF Qualifying Withdrawals.

2 When the CRA certifies your PSPA, it will permit you to have up to $8,000 of negative RRSP room resulting from the buyback, without requiring RRSP withdrawals. In such situations, you cannot make additional RRSP contributions until your RRSP room becomes positive.

3 If you select a joint-life income option, some or all of the pension would continue to be paid to your spouse after your death.

Odlum Brown Financial Services Limited is a wholly owned subsidiary of Odlum Brown Limited offering life insurance products, retirement, estate and financial planning exclusively to Odlum Brown clients. The information contained herein is for general information purposes only and is not intended to provide financial, legal, accounting or tax advice and should not be relied upon in that regard. Many factors unknown to Odlum Brown Limited may affect the applicability of any matter discussed herein to your particular circumstances. You should consult directly with your professional advisor before acting on any matter discussed herein. Individual situations may vary.